Two Trades To Watch: FTSE 100, USD/JPY Forecast

Image Source: Unsplash

FTSE rises as cooler than forecast CPI fuels December rate cut expectations

- UK CPI holds at 3.8% YoY vs 4% expected

- December rate cut expectations rise to 70%

- FTSE 100 trades in a rising channel

UK CPI remained unchanged at 3.8% YoY in September, for a third straight month, defying expectations of a rise to 4%. Meanwhile, core CPI unexpectedly fell to 3.5% down from 3.6% in August, and service sector inflation remained unchanged at 4.7%. The data suggests that the peak ion CPI may have been reached.

The data will help ease concerns at the Bank of England about lingering inflation, especially given recent downbeat data on the economy and jobs market. The figures fuel expectations that the Bank of England will cut rates again before Christmas.

The BoE is not expected to cut interest rates in November, given the chancellor's budget; however, expectations for a December rate cut have risen to 70%.

The prospect of a lower interest rate environment is pulling the pound lower whilst lifting the FTSE100 higher. House builders are among those topping the leaderboard with Persimmon trading at +2.3% and Berkeley Group at +2.6% on the prospect of lower interest rates supporting the housing market.

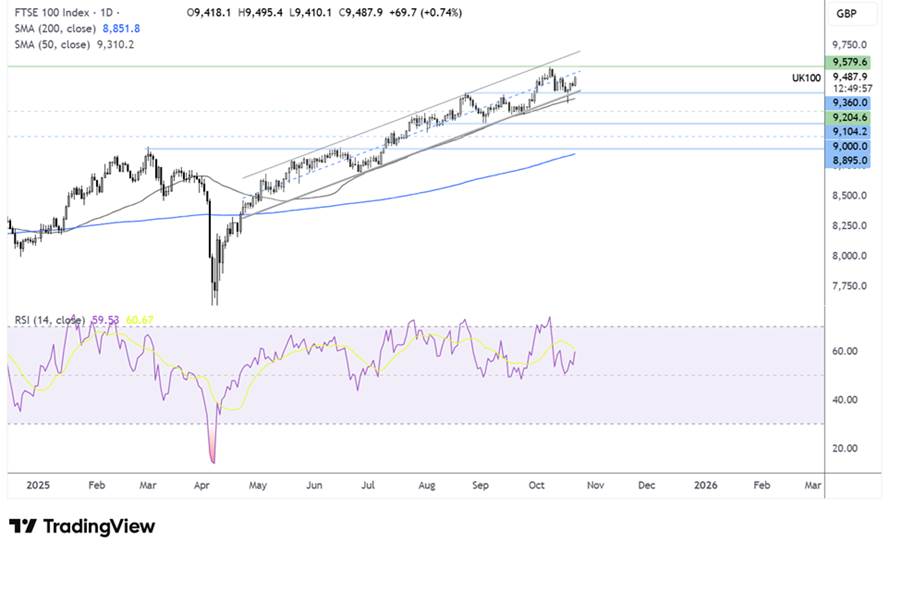

FTSE 100 forecast – technical analysis

The FTSE 100 trades within a rising channel dating back to late April. The price recently recovered from a spike lower to the 50 SMA and is heading towards 9500, the mid-point of the rising channel.

Buyers will look to extend gains above 9578 for fresh record highs. 9600 would be the next logical target ahead of 9700.

Support is seen at 9350, the August high. Break below here exposes the 50 SMA at 9300. Below, 9200 comes into focus ahead of the September low at 9110.

(Click on image to enlarge)

USD/JPY slips, but losses may be limited

- Gold tumbles 5% igniting a safe haven rebalancing

- Sanae Takaichi was elected as PM. The BoJ is expected to push back rate hikes.

- USD/JPY trades in a rising channel

USD/JPY is edging lower as volatility in gold ignites a rebalancing across safe-haven assets. However, gains in the yen may be limited after Sanae Takaichi was elected as the first female Prime Minister in Japan.

Gold prices have seen extreme volatility in recent sessions, dropping from their record high of $4381 and tumbling 5% in their most significant one-day fall since 2020. Gold is currently trading below $4100. The sharp move lower prompted investors to rebalance safe-haven flows and offered support to the yen.

However, gains in the yen could be limited. The yen has been under pressure in recent sessions following the election of Sunae Takaichi as Prime Minister. The new leader is expected to pursue an expansionary fiscal policy, including increased government spending and possible consumption tax cuts. Prime Minister Takaichi is reportedly preparing an economic stimulus package likely to exceed last year's ¥13.9 trillion to help households tackle inflation.

The Bank of Japan is also expected to take a cautious approach to further rate hikes with Takaichi at the helm. Expectations of another rate increase are being pushed back to early next year. The Bank of Japan is scheduled to announce its latest policy decision on October 30, and the market is only pricing in a 20% chance of a 25 basis point hike.

On the data front, Japan unexpectedly recorded a trade surplus in September as exports rose 4.2% and imports climbed 3.3% pointing to some relief from US tariff pressures.

Separately, the US dollar is edging lower against its major peers after a three-day rally. Expectations that the US government shutdown will end soon are fading. An ongoing shutdown complicates the task for the Federal Reserve at its meeting on October 29.

Even so, the market still expects the Fed to cut interest rates by 25 basis points. US inflation data on Friday will be a key focus this week.

USD/JPY forecast - technical analysis

USD/JPY trades within a rising channel dating back to late April, reaching an 8-month high of 153.25 before easing lower to 149.35. The price has recovered from this low, pushing back above 150 to current levels of 151.75 at the time of writing.

Buyers will look to extend the broader uptrend to 153.25. A rise above here creates a higher high and opens the door to 154.90, the 78.6% Fib retracement of the 158.90 high and the 139.90 low.

Support is seen at 151, the July high, and 149.35, the 50% Fib retracement.

(Click on image to enlarge)

More By This Author:

Two Trades To Watch: GBP/USD, DAX Forecast - Thursday, Oct. 16

Two Trades To Watch: EUR/USD, USD/JPY Forecast - Wednesday, Oct. 15

Two Trades To Watch: GBP/USD, DAX Forecast - Tuesday, Oct. 14

Disclaimer: StoneX Financial Ltd (trading as “City Index”) is an execution-only service provider. This material, whether or not it states any opinions, is for general information ...

more