Two Trades To Watch: FTSE 100, EUR/USD Forecast - Monday, Sep. 15

Image Source: Unsplash

FTSE 100 struggles after weak China data & ahead of a busy week

- Chinese factory output & retail sales growth slowed

- UK unemployment, CPI retail sales data & BoE rate decision this week

- FTSE climbs in rising chanel

The 50 is trading flat on Monday, lagging its European peers after weak Chinese data, and as investors look ahead to a busy week for UK economic data and the Bank of England rate decision on Thursday.

Miners are a drag on the index after August Chinese data showed that industrial output, consumption, and investment slowed more sharply than expected. Chinese factory output and retail sales reported the weakest growth since last year, raising doubts about China's ability to reach its 5% growth target without Beijing rolling out more stimulus.

Sainsbury's is topping the leader board, rising 4.5% to a four-year high after confirming that talks to sell Argos to JD.com have terminated amid unfavourable terms.

Whilst the UK economic calendar is quiet today, this week is a busy week for data with UK jobs figures and inflation data on Tuesday and Wednesday, followed by the Bank of England rate decision on Thursday and retail sales data on Friday.

Expectations are for inflation to tick higher to 3.9% YoY, which will keep the Bank of England from cutting interest rates anytime soon. With inflation almost double the central bank's target, the Bank of England is unable to support slowing growth. Data at the end of last week showed that GDP stalled at 0% in July.

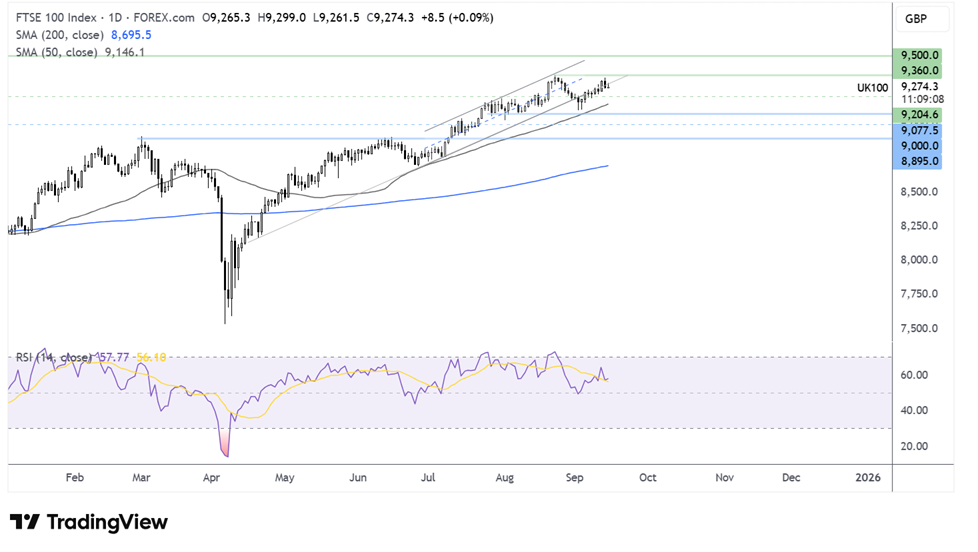

FTSE 100 forecast – technical analysis

The FTSE 100 continues to trade with a multi-month rising channel. The price has extended its recovery from the 9100 September low, rising above to a peak of 9340 last week, just shy of the 9360 record high.

Buyers will need to extend gains above 9360 to head towards 9500 and fresh record highs.

Support is seen at 9200 and 9100, the August low. A break below 8900 negates the longer-term uptrend.

(Click on image to enlarge)

EUR/USD probes 1.1750 despite French credit downgrade

- Fitch downgraded France’s sovereign credit rating

- USD falls ahead of Wednesday’s FOMC rate decision

- EUR/USD trades in a tight range, probing 1.1750

EUR/USD fluctuates in a tight range after ending last week marginally higher. Investors remain on the sidelines ahead of this week's Federal Reserve interest rate decision and despite France's sovereign credit downgrade.

Late on Friday, the credit rating agency Fitch announced that it downgraded France's sovereign credit score to AA+ from AA-, citing concerns over upcoming budget negotiations, which are unlikely to produce a more diluted fiscal package than was initially proposed by the outgoing administration. While these developments are putting the euro lower, they could be limiting the upside.

Meanwhile, ECB governing council member Martin Kocher noted concerns over the appreciation in the euro, which, if it continues, could be problematic for export-oriented industries.

Whilst the eurozone economic calendar is quiet today, the ZEW economic sentiment figures are due tomorrow, along with the final inflation print on Wednesday. Last week, the ECB left interest rates unchanged for a second straight meeting as inflation hovers around the 2% target.

The US dollar is starting the new week on the back foot against its major pairs as investors await Wednesday's FOMC meeting, where the central bank is expected to cut rates by 25 basis points amid signs of the US labour market weakening and despite inflation ticking higher.

EUR/USD forecast – technical analysis

EUR/USD is trading in a tight range above 1.17 as it attempts to break out of the falling trendline resistance.

The price trades above the 20 and 50 SMA, and the RSI is above 50, keeping buyers hopeful of further gains.

Buyers will need to rise above 1.1750 to extend gains towards 1.1830.

Immediate support is seen at 1.17 and the 50 SMA at 1.1650. A break below 1.1580, the August low, creates a lower low.

(Click on image to enlarge)

More By This Author:

Two Trades To Watch: Oil, FTSE Forecast - Wednesday, Sep. 10Two Trades To Watch: GBP/USD, DAX Forecast - Tuesday, Sep. 9

Two Trades To Watch: EUR/USD, Oil Forecast - Monday, Sep. 8

Disclaimer: StoneX Financial Ltd (trading as “City Index”) is an execution-only service provider. This material, whether or not it states any opinions, is for general information ...

more