Two Trades To Watch: EUR/USD, USD/JPY - Monday, May 22

Image Source: Pixabay

EUR/USD rises above 1.08 after hawkish ECB chatter, EZ consumer confidence up next. USD/JPY falls after a dovish Powell, debt ceiling talks in focus.

EUR/USD rises above 1.08 after hawkish ECB chatter, EZ consumer confidence up next

- ECB’s Christine Lagarde maintains a hawkish tone

- EZ consumer confidence to improve to -17

- EUR/USD rises above 1.08

EUR/USD is starting the week on the front foot, capitalizing on a weaker USD and finding support from recent ECB hawkish chatter.

ECB President Christine Lagarde what's clear is that the ECB's fight to tame inflation isn't over, and more action is still needed. Her comments come after several ECB officials have warned that the central bank needs to raise interest rates further in order to bring inflation down. After 375 basis points in hikes, expectations are for a further two rate hikes to July. However, risks are rising that the ECB may need to extend rate hikes for longer.

Attention now turns to eurozone consumer confidence which is expected to improve slightly to -17, up from -17.5. However, the high-interest rate and inflation environment could test consumer sentiment; weaker morale could weigh on the EUR. The consumer led-service sector is the dominant driver of economic activity, and the threat of a weaker consumer could fuel recession fears.

Looking ahead, apart from consumer confidence, the economic calendar is quiet. Investors will be monitoring ECB chatter with chief economist Philip Lane and Luis de Guindos in focus.

The USD is under pressure from dovish comments from Fed Chair Powell, and US debt ceiling talks are set to resume after collapsing at the end of last week. There is no high-impacting US data due today. Fed speakers will be in focus.

EUR/USD outlook - technical analysis

EUR/USD trades within a two-week descending channel. The pair has rebounded off 1.0760, last week’s low and is testing resistance of the 100 sma at 1.0810. A rise above here exposes the 50 sma and multi-month rising trendline at 1.0890 and could set the pair on track towards 1.0960 the May 1 low and the 20 sma.

Should sellers successfully defend the 100 sma, a break below 1.0760 is needed to create a lower low and open the door towards 1.0710 the confluence of the falling trendline support and the March 23 low.

(Click on image to enlarge)

USD/JPY falls after a dovish Powell, debt ceiling talks in focus

- Powell said rates may not need to rise as far as expected

- Debt ceiling talks to resume today

- USD/JPY tests rising trendline support

USD/JPY is falling, extending losses from Friday, on the back of dovish comments from Federal Reserve Chair Powell and with debt ceiling talks in focus.

On Friday Fed Chair Powel said that the US central bank may not agree to raise interest rates by as much as expected. He acknowledged that inflation was still too high but said that stresses in the banking system could mean that rates may not need to rise so high.

Over the weekend, Minneapolis Fed President Nell Kashkari said that he could be in favor of pausing rate hikes in the June meeting.

The market is currently pricing in an 87% probability of the Fed keeping rates on hold in June up from 79% last week.

Meanwhile, the yen is shrugging off poor data and benefitting from concerns surrounding the US debt ceiling. Republican negotiators walked out of talks on Friday and House Speaker Kevin McCarthy has said that talks will only restart once President Biden returns. Talks between the two leaders will resume today.

However, nerves are rising as the US slides towards the early June X-date without an agreement to raise the $31.4 trillion debt limit.

Japanese core machine orders came in much lower than expected, dropping by -3.5%, well below the 1.3% rise forecast.

There is no high-impacting US economic data due today. Fed speakers will be in focus with James Bullard, Raphael Bostic, and Thomas Barkin all due to speak. Any comments surrounding inflation or monetary policy could drive USD/JPY.

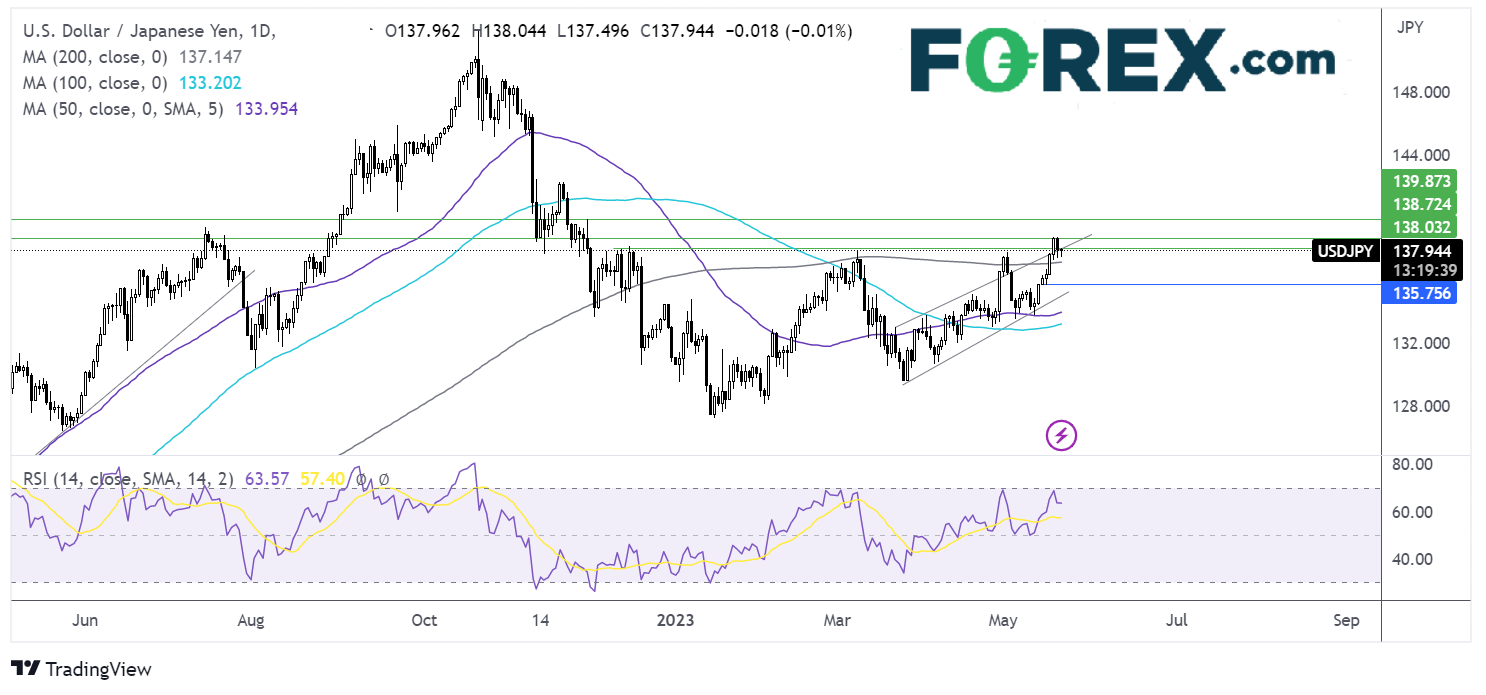

USD/JPY outlook - technical analysis

USD/JPY failed to for a higher high above 138.75, last week’s high, and has fallen back, testing support of the rising trend line and the March high at 137.90.

The long lower wick on today’s candle, combined with the RSI above 50 keeps buyers hopeful of further gains.

Resistance can be seen at 138.75 and 139.90, the 30th November high.

On the flip side, sellers will be looking for a break below 137.50 today’s low to extend the selloff to 137.00 the 200 sma. A break below here brings 135.85, last week’s low into target.

(Click on image to enlarge)

More By This Author:

Dow Jones Outlook: Stocks Edge Higher On Hopes Of A Debt Ceiling Deal

Two Trades To Watch: Oil, EUR/GBP

Two Trades To Watch: GBP/USD, EUR/USD - Tuesday, May 16

Disclaimer: The information on this web site is not targeted at the general public of any particular country. It is not intended for distribution to residents in any country where such ...

more