Two Trades To Watch: EUR/USD, USD/CAD - Wednesday, March 8

Photo by Michelle Spollen on Unsplash

EUR/USD falls to 2-month low after hawkish Fed Powell. USD/CAD gains for a 3rd day ahead of the BoC rate decision.

EUR/USD falls to 2-month low after hawkish Fed Powell

- Fed expected to hike rates to 6%

- German retail sales unexpectedly fall

- EUR/USD needs to break below 100 sma to extend the selloff

EUR/USD fell to a 2-month low and remains pressured below 1.06 after Fed chair Powell spoke before the Senate banking committee and warned that the central bank could ramp up the pace of rate hikes and could raise interest rates for longer.

The market is now pricing in a 50 basis point rate hike in the March meeting, up from 25 basis points. The terminal rate is now expected to climb to 6%.

The 2 year treasury yield rose to over 5% for the first time since 2007, and the 2 year 10 year bond yield inversion is at its deepest level since the 1980’s raising expectations that the US economy will have a hard landing.

Fed Chair Powell’s tone was significantly more hawkish than at the January meeting when Powell spoke about the disinflation process.

Powell is due to speak again today. US ADP payrolls and JOLTS job openings are also in focus.

Meanwhile, the euro is falling after German retail sales unexpectedly fell -0.3%, after dropping -5.3% in December. Expectations had been for a rebound in sales of 2% MoM.

Eurozone GDP data is due to be released and is expected to confirm 0% growth QoQ down from 0.3% in Q3. This is the 3rd reading, so it is not expected to be market-moving.

ECB President Christine Lagarde is due to speak and could reiterate her comments from last week that interest rates could need to rise further after the March meeting.

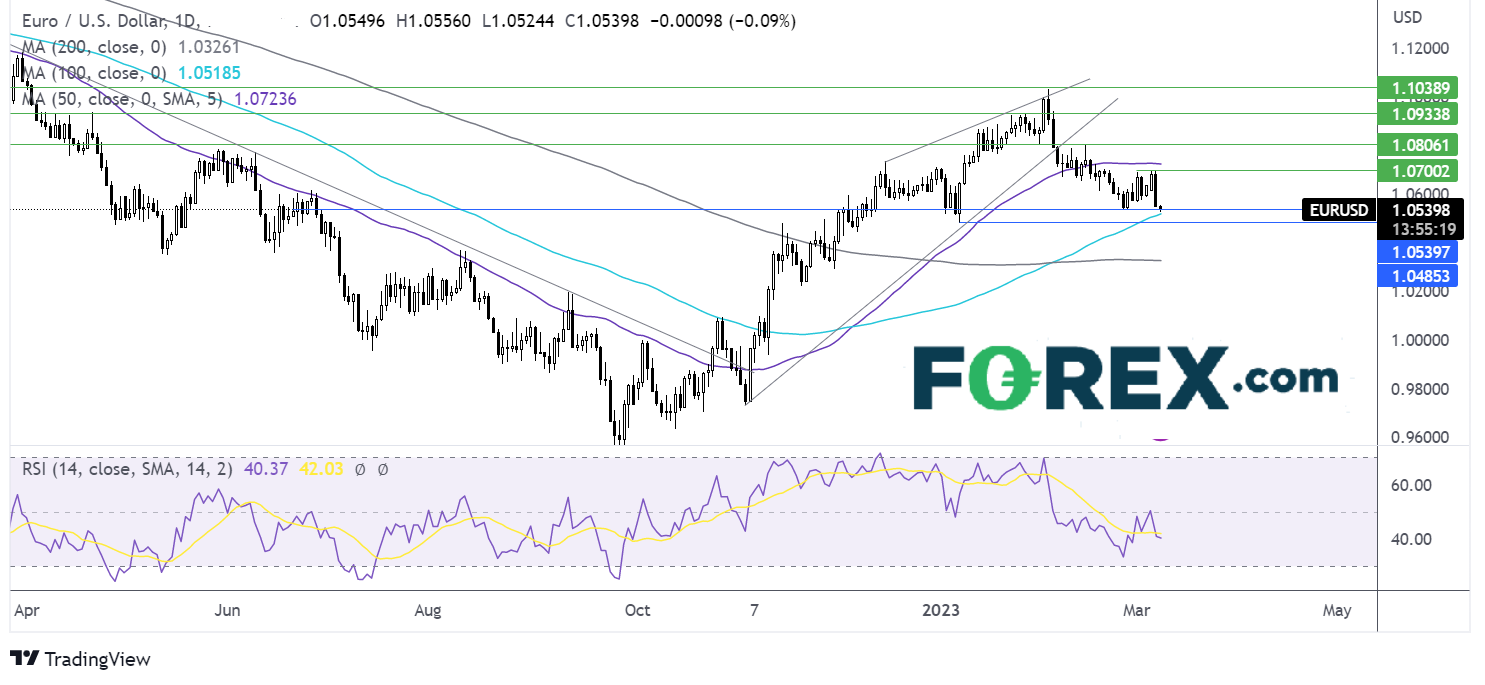

Where next for EUR/USD?

Failure to rise above 1.07 and the bearish engulfing candle, combined with the RSI below 50 keeps sellers hopeful of further downside. Sellers will look for a break below 1.0520 the 100 sma, opening the door to 1.0480 the 2023 low and exposing the 200 sma.

Should buyers successfully defend the 100 sma, buyers could look back up towards 1.07. A rise above here is needed to create a higher high.

(Click on image to enlarge)

USD/CAD gains for a 3rd day ahead of the BoC rate decision

- BoC expected to keep rates on hold

- Fed-BoC divergence growing

- USD/CAD looks towards 1.38

The USD/CAD Is rising for a third straight day on the back of U.S. dollar strength and as investors look ahead to the BoC interest rate decision.

The BoC is expected to keep the overnight rate on hold at 4.5%. In the previous meeting, the Bank of Canada Governor Tiff Macklem said that should inflation cool as predicted, then there would be no need for further rate hikes. For now, the BoC is expected to hold steady and assess the impact of 8 consecutive rate hikes on the economy.

This would, of course, be in contrast to what we heard from Fed Chair Powell in the previous session. The central bank divergence could mean more upside for USD/CAD.

US jobs data will also be under the spotlight ahead of Friday’s non-farm payroll. ADP payrolls are expected to rise by 200k in February up from 106k in January. JOLTS job openings are also likely to fall, given January’s blowout jobs report. Strong jobs data could fuel aggressive Fed bets further and boost the USD.

Where next for USD/CAD?

The meaningful rise above 1.37, the upward sloping 200 sma, and the bullish RSI keep buyers hopeful of further upside.

Bulls are now targeting 1.38 the November high, to extend the upward trend towards 1.3850 the October 21st high.

On the flip side, support can be seen at 1.37, the December high, ahead of 1.3665, the February 24 high. It would take a move below 1.3550 the March low to create a lower low., exposing the 100 sma.

(Click on image to enlarge)

More By This Author:

US Open: Stocks Rise Cautiously With All Eyes On Powell's Testimony

Two Trades To Watch: Gold, DAX - Tuesday, March 7

Two Trades To Watch: EUR/USD, USD/CAD - Monday, March 6

Disclaimer: The information on this web site is not targeted at the general public of any particular country. It is not intended for distribution to residents in any country where such ...

more