Two Trades To Watch: EUR/USD, FTSE - Tuesday, Dec. 5

Image Source: Pixabay

EUR/USD falls towards 1.08 ahead of services PMI, PPI figures

- Eurozone services forecast to remain in contraction

- US ISM services is forecast to rise

- EUR/USD tests 200 sma support

EUR/USD is falling, extending losses from the previous session and heading towards 1.08.

The pair trades lower ahead of eurozone services PMI figures, which are expected to show that the dominant sector within the region remained in contraction in November. The services PMI is expected to rise to 48.2, up from 47.8. While this is an improvement, it remains below that key 50 level separating expansion from contraction.

Meanwhile, service sector inflation, which remains a key contributor to inflation, is expected to soften further as the price is paid sub index is forecast to support the view that inflation is cooling.

The data comes after eurozone Q3 GDP contracted 0.1%, and weak data could fuel fears of a prolonged recession.

Also in focus will be the eurozone PPI, which is expected to fall -9.5% YoY after falling 12.4% annually in September. Cooling factory gate inflation bodes well for further easing in consumer prices. CPI cooled to 2.4% YoY in October and is moving closer to the ECB steps and target.

Cooling inflation and slowing growth could boost bets that the ECB will cut rates early next year. The price is the market's pricing in a 25 basis point cut as soon as April.

Meanwhile, the US dollar is finding its footing, stabilizing after heavy losses in recent weeks. The US dollar fell over around 3% in November, booking a steep decline on bets that the Fed could start cutting interest rates next year.

The market is reassessing how far and how fast the US dollar has fallen. Given the speed and acuteness of the decline, a period of consolidation and a reassessment of fundamentals is to be expected. The market rarely falls in a straight line.

Attention now will be on US ISM services PMI, which is expected to tick higher to 52, up from 51.8. JOLTS jobs opening numbers will also be in focus and are expected to ease slightly.

An improvement in services PMI and a slight fall in job openings could see the market push back on rate-cut bets, lifting the dollar.

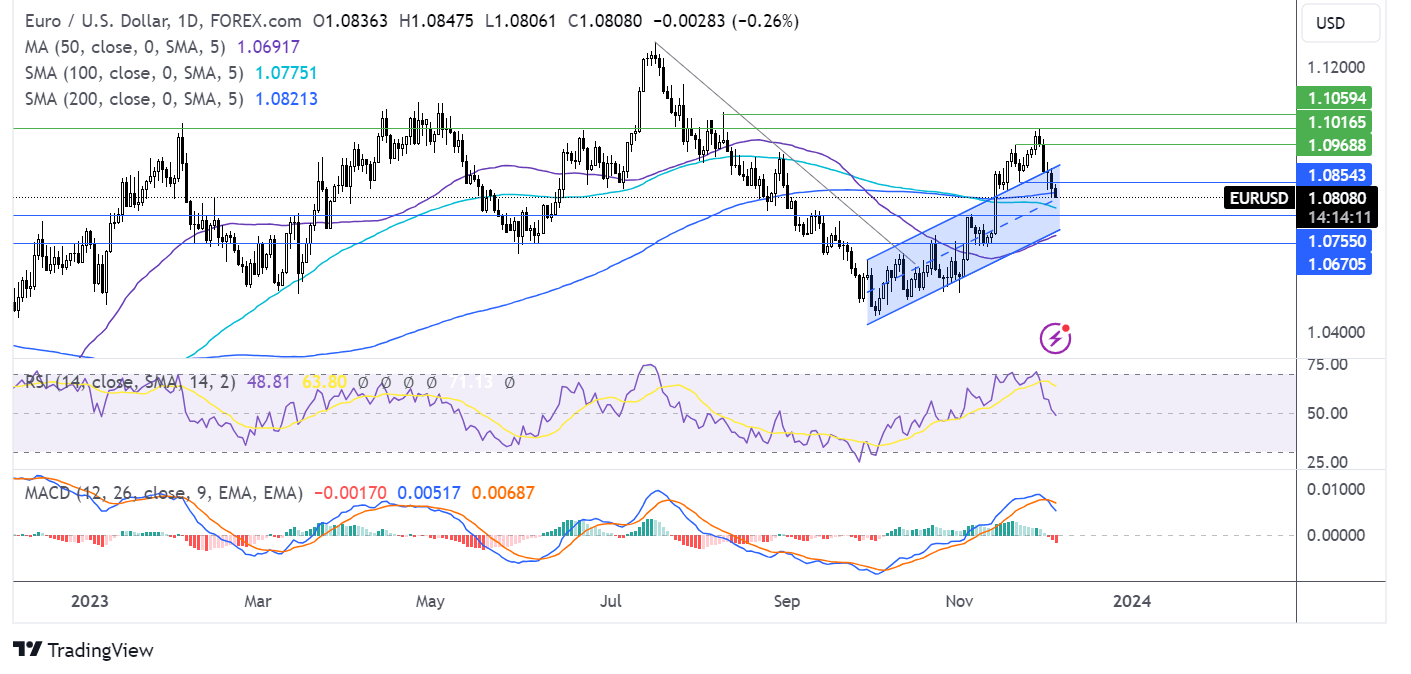

EUR/USD forecast – technical analysis

EUR/USD rebounded lower from the peak of 1.1020, taking out minor support at 1.0850, and is testing the 200 sma support at 1.0820. The bearish crossover on the MACD supports the bearish view.

Should sellers break below the 2000 sma, support at 1.0750, the early November high comes into play ahead of 1.0665.

Should the 200 sma hold, buyers could look to rise back above 1.0850 before 1.10 comes back into target.

(Click on image to enlarge)

FTSE 100 falls for a second day, miners under pressure

- Moody’s cuts China’s credit rating

- UK services PMI & BRC sales in focus

- FTSE 100 falls from last week’s high

The FTSE 100 along with its European peers is heading for a lower start following on from a weak session on Wall Street and in Asia overnight.

While China’s Caixin PMI rose to a three-month high, this was overshadowed by Moody's rating agency cutting China's credit outlook to negative. The move highlights rising global concerns about debt levels in the world's second-largest economy and could is pulling miners and resource stocks lower.

Investors are also digesting the latest KPMG- British Retail Consortium sales figures which grew by the disappointing amount in November despite retailers ramping up discounts ahead of the Black Friday. Instead, cautious consumers delayed their Christmas shopping, resulting in lackluster sales.

The BRC-KPMG retail sales index for November showed a 2.7% rise in sales which was above the three-month average of 2.6% but below the 12-month average of 4.1%.

Attention will also be on UK services PMI figures which are expected to confirm the preliminary reading of 50.5 for services PMI, a surprise rise back into expansion from 49.5 in October. This is the second reading, so may not be as influential.

On the earnings front, Ashtead posted flat Q2 profits but said that demand in the US remained robust. This comes after the company cut annual profit and revenue forecasts just last month. Ashtead posted a pre-tax profit of $666M, and earnings were up 5% to $1.2 billion.

Looking ahead US economic data could drive sentiment, as investors weigh up Federal Reserve rate cut prospects.

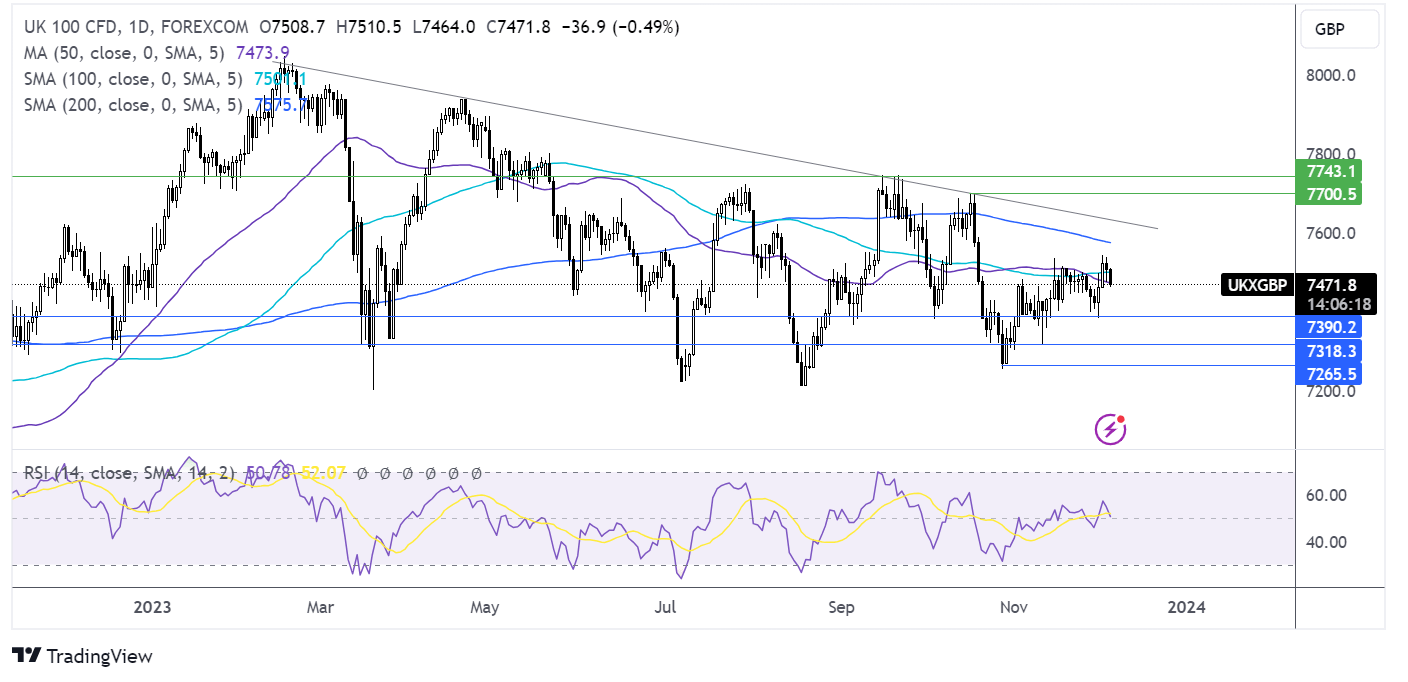

FTSE 100 forecast – technical analysis

The FTSE 100 is falling away from last week’s high of 7540 and is testing support of the 50 sma at 7475. A break below here could see the test of 7460, the December low.

A breakdown of this level could bring 7385, last week’s low into focus, ahead of 7325, the mid-November low.

Meanwhile, should the 50 sma hold, buyers could look to retest 7540, the December high, with a rise above here exposing the 200 sma at 7575 and the falling trendline at 7625.

(Click on image to enlarge)

More By This Author:

S&P 500 Forecast: SPX Looks To Data For Policy Clues As Blackout Period Kicks In

Two Trades To Watch: EUR/USD, USD/JPY - Monday, Dec. 4

Nasdaq 100 Forecast: Stocks Look Cautiously To Fed Chair Powell's Appearance

Disclaimer: StoneX Financial Ltd (trading as “City Index”) is an execution-only service provider. This material, whether or not it states any opinions, is for general information ...

more