Two Trades To Watch: EUR/GBP, S&P 500 - Monday, Oct. 17

Photo by PiggyBank on Unsplash

Pound & bonds rally ahead of Hunt’s fiscal plan. US S&P500 futures rise with earnings in focus.

Pound & bonds rally ahead of Hunt’s fiscal plan

The pound is pushing higher, and the gilt market is showing signs of improvement, with yields falling, as the new Chancellor of the Exchequer takes the reins. Jeremy Hunt will accelerate plans to bring the country’s public finances back in order after the turmoil of the mini-budget.

Hunt has received the support of BoE Governor Andrew Bailey, as they both agree on the importance of fiscal sustainability. In his statement today, Hunt could announce higher taxes and spending cuts, and push back on tax cuts as he aims to raise confidence in the UK economic outlook.

However, his plan would directly undermine PM Liz Truss who appears to be on borrowed time. There are doubts over whether she will last the week. However, the removal of the PM would bring more political uncertainty, the last thing the pound needs right now.

The markets will be judging the Chancellor’s measure; should they not go far enough, investors could once again pull out of UK assets sending gilt yields higher and the pound lower. Should Hunt strike the right tone, some level of order could return to the markets ahead of the full medium-term fiscal plan due on 31st October.

Where next for EUR/GBP?

After running into resistance at 0.8870 last week, EURGBP has fallen below the 50 sma and support at 0.8720 the June high. The price is testing the 20 sma at 0.8650. The RSI is below 50 and supports further downside.

Sellers will look for a move below the 20 sma and 0.8615, last week’s low, to open the door to 0.8575, the September 6 low, and 0.8515, the August 19 high.

Buyers will look for a move back over 0.8715 to expose the 50 sma at 0.8785 ahead of 0.8875, last week’s high.

(Click on image to enlarge)

US S&P500 futures rise with earnings in focus

US stocks fell on Friday in a delayed reaction to Thursday’s hotter-than-expected inflation data and after US retail sales stalled.

Today, futures are rising as investors continue assessing inflation and recession fears and as US Q3 earnings are set to ramp up.

On Friday Wells Fargo, Citigroup, and JP Morgan beat Wall Street’s estimates, while Morgan Stanley was disappointing.

Looking ahead, today sees the release of Goldman Sachs and Bank of America Q3 earnings. The results come as Goldman Sachs announces a huger overhaul to combine its investment banking and trading businesses.

Today there is no high impacting US economic data.

Where next for the S&P500?

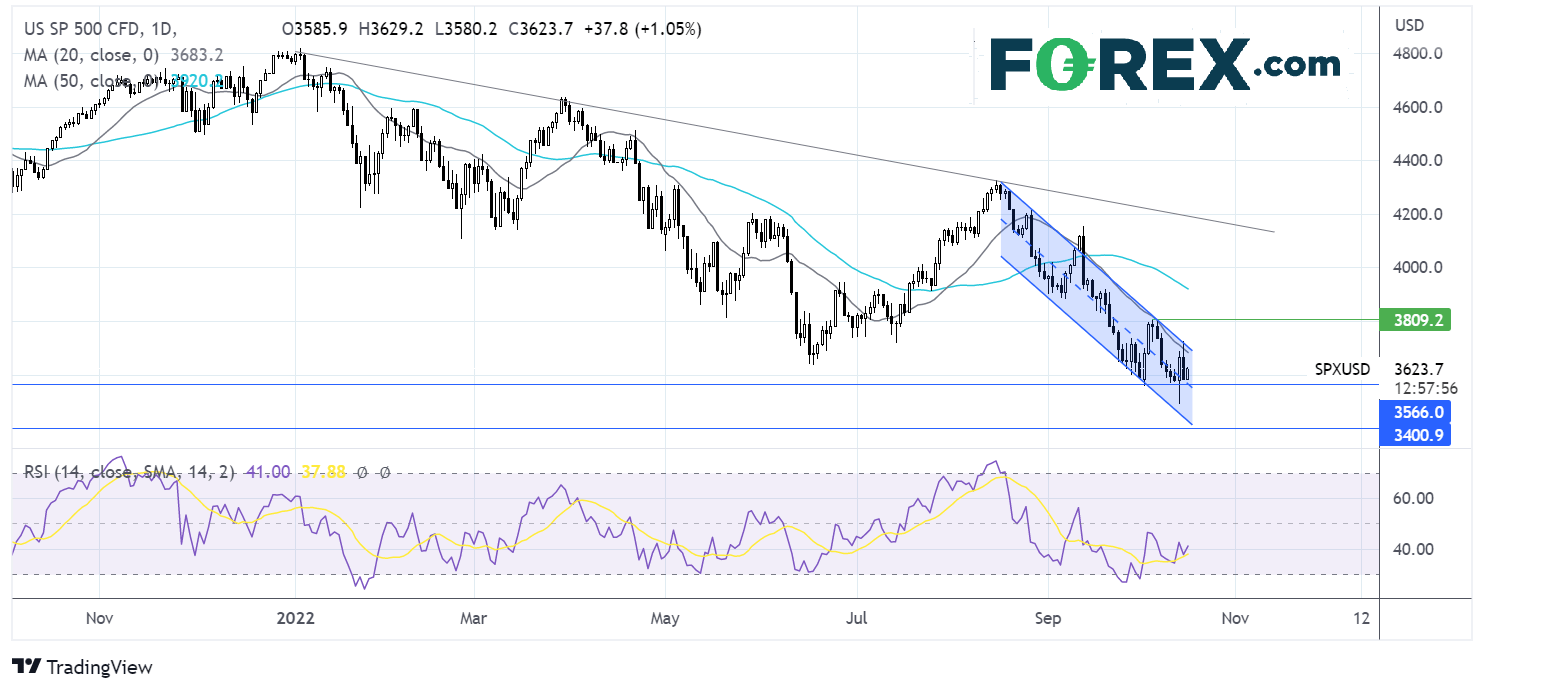

S&P500 futures are rising higher, however, the price continues to trade in the multi-month falling channel.

A floor appears to have formed around 3560, and while the RSI is below 50, it is pointing higher.

Sellers will need to break below 3560 in order to bring 3500 the 2022 low into target.

Buyers will look for a move over the 20 sma and falling trend line resistance at 3685, bringing 3800 into target the October high. A move over here creates a higher high.

(Click on image to enlarge)

More By This Author:

Two Trades To Watch: FTSE, EUR/USD - Friday, Oct. 14

Two Trades To Watch: Gold, DAX - Thursday, Oct. 13

Two Trades To Watch: GBP/EUR, USD/JPY

Disclaimer: The information on this web site is not targeted at the general public of any particular country. It is not intended for distribution to residents in any country where such ...

more