Two Trades To Watch: DAX, GBP/USD - Wednesday, Nov. 29

Photo by Colin Watts on Unsplash

DAX rises ahead of inflation data

- German inflation is expected to cool to 3.5% YoY from 3.8%

- Fed hints at a dovish pivot

- DAX rises above 16000 resistance

The DAX is starting higher, rising above 16000 ahead of key inflation figures.

European stocks have had a very strong November and are on course for one of the best months since the start of this year on bets that the major central banks are at the end of the hiking cycle.

A more dovish-sounding Federal Reserve overnight has been the catalyst to boost the German index above resistance at 16000. Meanwhile, ECB policymakers have been pushing back on bets that the ECB has finished hiking.

Bundesbank chief Joachim Nagel said yesterday that the ECB may need to raise interest rates again if the inflation outlook deteriorates and ECB president Christine Lagarde has been reiterating her views this week that the fight against inflation is not over. Meanwhile, the market is fully pricing in a rate cut by the ECB in June.

Attention will be on eurozone inflation data due tomorrow which could provide further clues surrounding the next steps for the ECB.

Ahead of this, the German inflation figures come out today. Expectations are for CPI to ease to 3.5% YoY, down from 3.8% in October. The most popular state, the north Rhine Westphalia saw consumer prices fall By more than expected, with the annual figure cooling to 3%, down from 4.2%. This bodes well for German inflation figures later today. A sharper-than-expected cooling in inflation could boost bets that the ECB will be the first central bank to cut interest rates, which would support stocks.

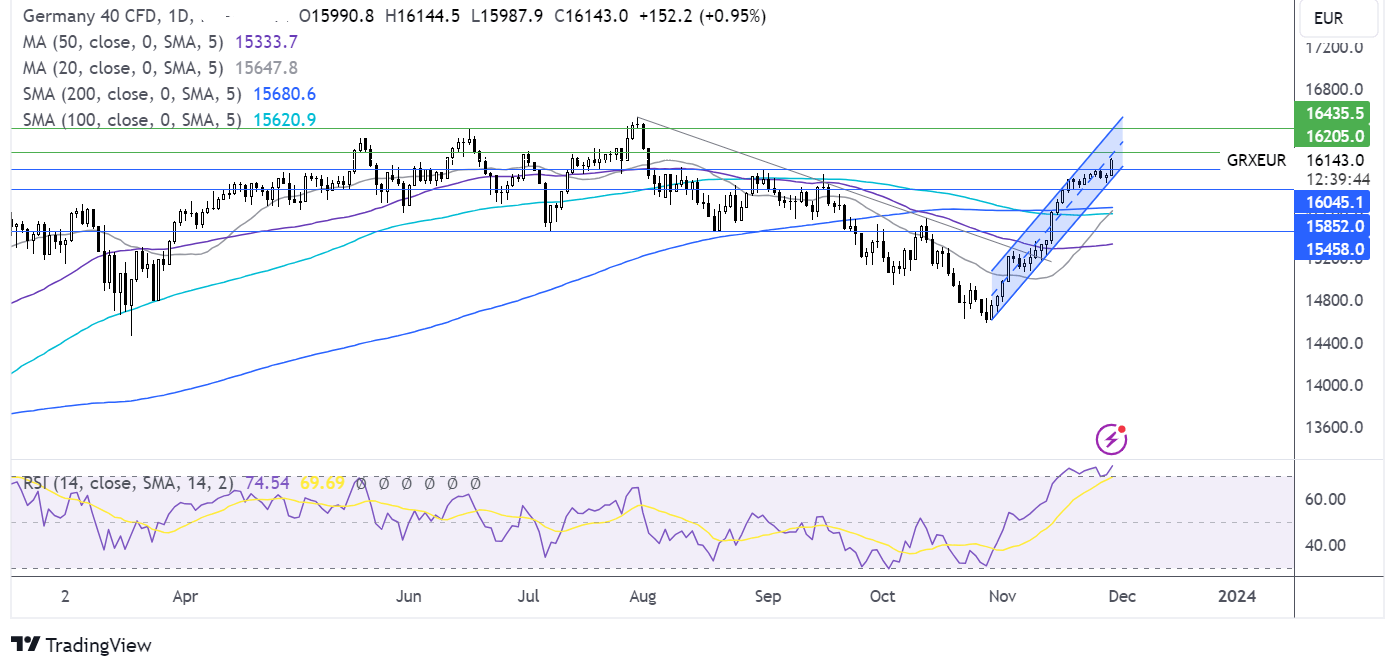

DAX forecast - technical analysis

DAX trades within a rising channel, breaking above 16044 the August and November high to current levels of 16125. The RSI is in overbought territory so buyers should be wary.

Resistance can be seen at 16210 the early July high, with a move above here bringing 16430 the June high into focus.

On the downside, a break below 16044/ 16000 open the door to support at 15850, last week’s low. A break below this level exposes the 200 sma.

(Click on image to enlarge)

GBP/USD rises to 1.27 on divergent central bank chatter

- BoE’s Andrew Bailey vows to keep fighting inflation

- Fed officials hint to a dovish pivot

- GBP/USD rises to a fresh 3 month high

GBP USD has risen to 1.27 its highest level thin since late August, amid a weaker US dollar and after fighting talk from Bank of England governor Andrew Bailey.

The Bank of England chiefs said on Wednesday that the central bank will do “what it takes” to bring inflation back to the 2% target. He added that he had not seen sufficient progress towards the target to be confident of that goal.

His comments sought to push back on market expectations that the BoE might start to cut interest rates from their 15-year high after inflation cooled by more than expected and amid signs of a slowing economy.

The hawkish comments from Bailey are in contrast to recent Federal Reserve comments. Fed officials have adopted a more dovish stance, with Fed governor Christopher Waller, a known hawk, saying that he was comfortable that interest rates at their current level could bring inflation back to the 2% target and added that should inflation keep falling, the Fed could consider cutting interest rates.

His comments fueled bets that the Federal Reserve will cut rates in the first half of next year, with the market now pricing in a 40% probability of a 25 basis point cut as soon as March 2024.

Attention will be on tomorrow’s US core PCE inflation data, the Fed's preferred measure for inflation, for further clues over the future path for rates.

There is no high impacting UK economic data today the focus today will be on USD DP data, the second reading. Expectations are for 3.5% QoQ in Q3 up from 1.7%. The inflation subcomponent will be under the spotlight. More Fed speakers could also drive the pair.

GBP/USD forecast – technical analysis

GBP/USD rose above the rising trendline resistance and 1.268, the May high before running into resistance at 1.2730.

The long upper wick on today’s candle suggests that there was little demand at the high price. This, combined with the RSI being in overbought territory could keep buyers cautious.

Buyers would need to rise above 1.2730 to book a higher high and target 1.2840, the August high.

A break below 1.2640 could see sellers test 1.26 the rising trendline support ahead of 1.2460 the 200 sma. A break below here could see sellers gain momentum.

More By This Author:

Dow Jones Forecast: Stocks Set For A Muted Start Ahead Of Consumer Confidence Data

Two Trades To Watch: DAX, GBP/USD Forecast - Tuesday, Nov. 28

S&P 500 Forecast: Stocks Hover Around A 3-Month High At The Start Of A Busy Week

Disclaimer: StoneX Financial Ltd (trading as “City Index”) is an execution-only service provider. This material, whether or not it states any opinions, is for general information ...

more