Two Trades To Watch: DAX, GBP/USD - Tuesday, June 7

Photo by Colin Watts on Unsplash

DAX falls as the market mood sours, and factory orders drop. GBP/USD falls as Bojo holds onto power.

DAX falls as the market mood sours, factory orders drop

After a stronger close yesterday the DAX is heading lower today.

US 10-year treasury yields rising back above 3%, combined with an outsized rate hike by the RBA to tame inflation has made the market nervous.

The ECB will meet on Thursday and fears are rising that they could also point to a steeper path to tightening policy, which could tip the economy into recession.

German factory orders added to the depressed mood. Orders unexpectedly fell by -2.7%, defying expectations of a rise to 0.4%. The fall marks the third straight month of declines and comes as China lockdowns pressure supply chains, which were already reeling from the Ukraine war.

The data comes as Q2 German economic growth forecasts have been slashed owing to supply chain troubles, soaring energy costs, and falling consumer confidence.

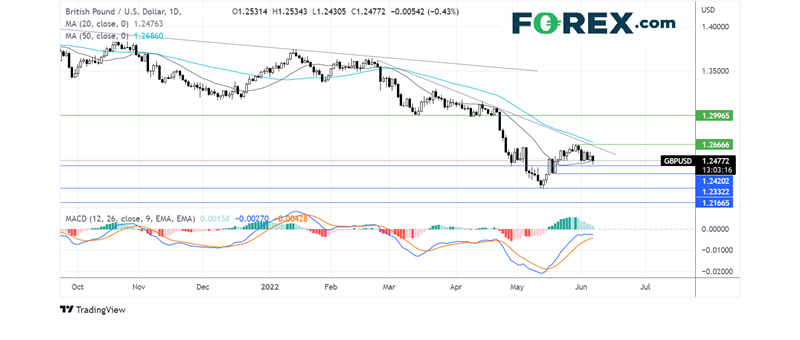

Where next for the DAX?

The DAX extended its rebound from 13280 the May low, rising above the multi-month falling trendline and trading above its month-old rising trendline. The 20 sma is crossing over the 50 sma and the RSI holds in positive territory.

The price has run into resistance at 14700 and is easing lower. Support can be seen at 14280 the May 17 high, with a break below here exposing the 20 sma at 14200. A break below here could negate the near-term uptrend. A move below here opens the door to 13700 the May 19 low.

On the flipside, buyers will be looking for a move over 14700 to extend the uptrend towards 14900 the March high, and 15000 round number.

(Click on image to enlarge)

GBP/USD falls as Bojo holds onto power

The pound trades on the back foot even after Boris Johnson won a vote of no confidence. The PM scraped through with just 59% of the votes, raising doubts over how long he can cling to power.

His performance was worst than that of his predecessor Theresa May, who then resigned 6 months later. Yesterday’s vote, rather than quelling political concerns, has highlighted the extent of division in the party, which Boris Johnson could struggle to overcome. Despite the political drama in Westminster, the result is unlikely to have a big effect on policy, suggesting that the selloff in the pound is more related to concerns over the health of the UK economy.

The pound is fretting over rising inflation and fears that the BoE could tip the UK into recession if it acts aggressively to rein in inflation. Yet with the cost-of-living crisis continuing and business activity slows, the BoE is between a rock and a hard place.

Meanwhile, the USD is benefitting from the soring market mood, lifted by safe-haven flows. In addition to hawkish Fed bets.

Looking ahead the UK service sector PMI is expected to confirm 51.8, a steep slowdown in growth in May, compared to 58.9 in April.

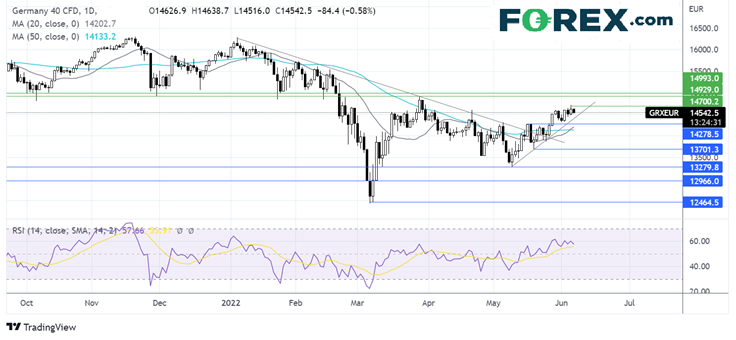

Where next for GBP/USD?

GBP/USD continues to trade below its multi-month falling trendline and its 50 sma. The recent recovery from 1.2150, 2022 low, ran into resistance at 1.2660 and the price is once again heading lower. The receding bullish bias on the MACD supports further downside.

Immediate support can be seen at 1.2475 the 20 sma being tested currently. A break below here and 1.2420, the April low, opens the door to 1.2340 the May 19 low ahead of 1.2150.

On the flip side, should the 20 sma hold, resistance can be seen at 1.2660 the May high. A move above here is needed to create a higher high and bring 1.30 back into play.

(Click on image to enlarge)