Two Trades To Watch: DAX, GBP/USD Forecast - Friday, March 8

Image Source: Unsplash

DAX hovers at all-time highs post-ECB

- ECB lowered inflation & growth forecasts

- ECB President Lagarde hinted to a June rate cut

- EZ GDP & US NFP data due

- DAX rose to an all-time high

The DAX is hovering around all-time highs in quiet trade as investors continue to digest the ECB interest rate decision and look ahead to the US nonfarm payrolls.

As expected, the ECB kept interest rates at 4%. Still, the central bank revised its growth and inflation forecasts downward, suggesting it could be moving closer to cutting interest rates.

ECB president Christine Lagarde hinted at a June rate cut should inflation continue to fall. The news sent the German index to an all-time high.

Today, the DAX has just edged off that high as it looks ahead to more data and digests German industrial production figures, which rebounded in January up 1% after falling 2% in December.

Attention is now turning to Eurozone GDP data, which is expected to show that the Eurozone economy avoided a recession at the end of last year.

In the US session, US non-farm payrolls are expected to be a big driver for sentiment, with a weaker jobs report fueling bets that the Federal Reserve will cut rates sooner rather than later.

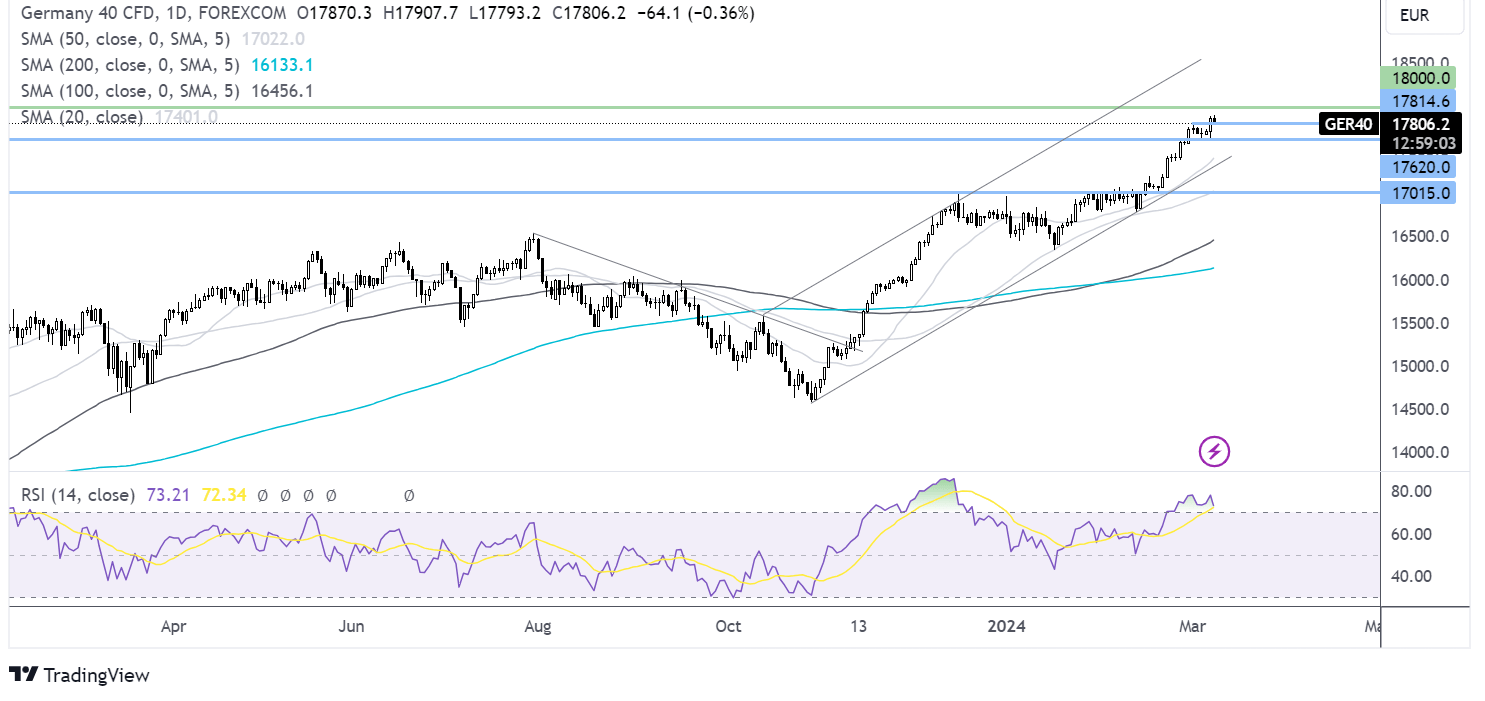

DAX forecast – technical analysis

The DAX powered above 17817, the previous all-time high, hitting a new record level above 17900 as buyers look towards the 18000 round number and 18500, the upper band of the rising trendline.

However, the DAX is experiencing extreme overbought conditions, which could result in a reversal or at least some consolidation.

Sellers will look to take out support at 17600, the weekly low, to extend losses towards 17350, the rising trendline support.

(Click on image to enlarge)

GBPUSD rises to 2024 high ahead of US non-farm payroll

- USD weakens after Powell hints at a rate cut soon

- US NFP to show 200k jobs added vs. 353k in January

- GBP/USD test 1.2830 December resistance

GBP/USD has risen as the US dollar weakens following Federal Reserve chair Powell’s testimony before the Senate and ahead of today's non-farm payroll report.

Yesterday, Jerome Powell said that the Federal Reserve was close to cutting interest rates should inflation continue along its cooling trajectory. Following these comments, US yields tumbled lower, as did the US dollar, lifting GBP/USD to the new year-to-date high.

Attention is now firmly on the US non-farm payroll report, which is expected to show 200,000 jobs were added in February, up from 353,000 in January. Meanwhile, unemployment is expected to remain unchanged at 3.7%, and wage growth is expected to ease to 0.3% from 0.6%. The Fed will want to see the labour market ease before cutting rates.

The data comes after ADP payrolls jobless claims and Jolts job openings all came in weaker than expected, as did the ISM services and manufacturing jobs sub-components. This suggests we could see a slightly weaker non-farm payroll report.

Weaker-than-expected jobs data could pull the US dollar lower.

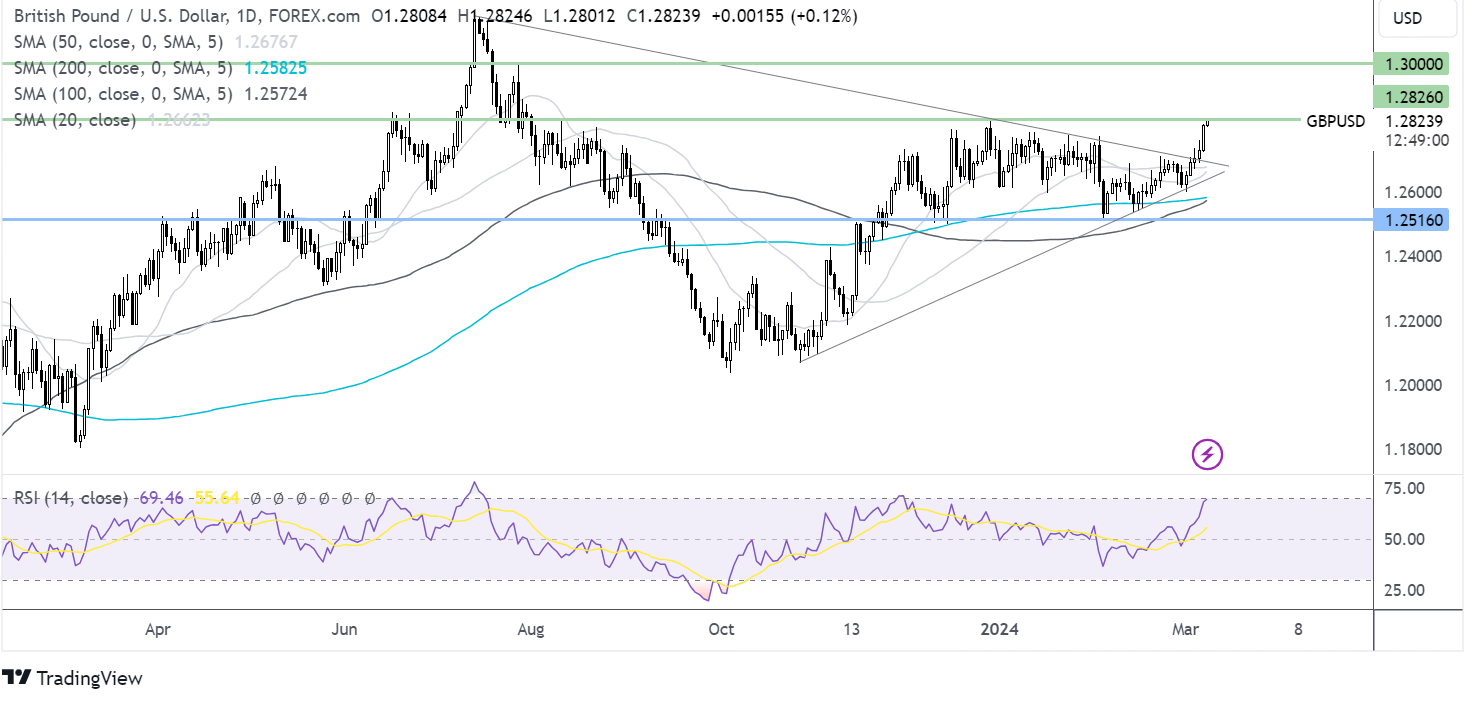

GBP/USD forecast – technical analysis

GBP/USD broke out from its symmetrical triangle, rising above 1.28 to within a breath of 1.2830 the late December high. A close above this level could see GBP/USD extended gains to 1.30.

On the downside, support can be seen at 1.27, the falling trendline support, and below here, 1.26, the March low.

(Click on image to enlarge)

More By This Author:

Two Trades To Watch: EUR/USD, USD/JPY Forecast - Thursday, March 7

Two Trades To Watch: GBP/USD, EUR/USD Forecast - Wednesday, March 6

Two Trades To Watch: DAX, USD/JPY Forecast - Tuesday, March 5

Disclaimer: StoneX Financial Ltd (trading as “City Index”) is an execution-only service provider. This material, whether or not it states any opinions, is for general information ...

more