This Week: Inflation In Focus For USD Index

Image Source: Pixabay

The debate around Fed rate hikes will be further guided by the latest US CPI data released on Wednesday, in a week that also features these potential market-moving events:

Monday, April 10

- IMF/World Bank spring meetings

- USD: Speech by New York Fed President John Williams

- Markets closed in the UK, Europe, Hong Kong, and Australia

Tuesday, April 11

- AUD: Australia March business confidence, April consumer confidence

- CNH: China March CPI and PPI

- EUR: Eurozone February retail sales

- USD: Fed Speak - speeches by Chicago Fed President Austan Goolsbee, Philadelphia Fed President Patrick Harker, and Minneapolis Fed President Neel Kashkari

Wednesday, April 12

- CAD: Bank of Canada rate decision

- USD: US March CPI, FOMC meeting minutes, speech by Richmond Fed President Thomas Barkin

Thursday, April 13

- AUD: Australia March unemployment, April inflation expectations

- CNH: China March external trade

- EUR: Eurozone February industrial production; Germany March CPI (final)

- GBP: UK February GDP, industrial production, trade balance; BOE chief economist Huw Pill speech

- USD: US weekly initial jobless claims; March PPI

Friday, April 14

- SPX500_m: US earnings season kicks off with Wall Street banks

- USD: US March retail sales, industrial production; April consumer sentiment

Back to the tier-1 event of the week, the US consumer price index (CPI) for March is forecasted to have grown by 5.1% compared to March 2022 (year-on-year).

If so, the headline number would have slowed for 9 straight months since the peak of 9.1% back in June 2022.

But the month-on-month core CPI number, which excludes food and energy prices which are more volatile, will be key.

Economists reckon the forecasted 0.4% remains more than double the rate required overtime to bring inflation back to the Fed’s 2% target.

Wednesday also sees the release of the Fed minutes from the meeting which saw a 25bp rate hike but was widely viewed as dovish.

However, the dot plot for this year indicated a more hawkish sentiment among officials.

With the banking turmoil now easing, there could be the risk of a greater focus on continued high inflationary pressures. This would certainly help the beleaguered dollar which is off over 3% since its highs a month ago in early March.

Other G10 central banks in focus: Bank of Canada

Markets have been a lot more sensitive to soft data recently as growth and recession concerns have increased.

Most central banks around the globe are either pausing their rate hike cycle (RBA, BoC) or getting close to the end (FOMC, RBNZ).

But those banks like the ECB and BoE who have signaled a readiness to continue have seen their currencies make solid year-to-date gains. This is highlighted by crosses like EUR/AUD and GBP/AUD which pushed to new cycle highs last week.

Focus will turn to the Bank of Canada meeting on Wednesday where policymakers are expected to stand pat.

Elevated wage data will likely bother the BoC who have noted previously that high earnings growth is inconsistent with regaining control of inflation.

But the downside risks to global growth after the banking stress mean rate cuts could be on the horizon.

In fact, markets are currently pricing in up to 50 basis points in cuts by the BoC before 2023 is over.

Guidance around that banking turmoil could inform on the BoC’s next move.

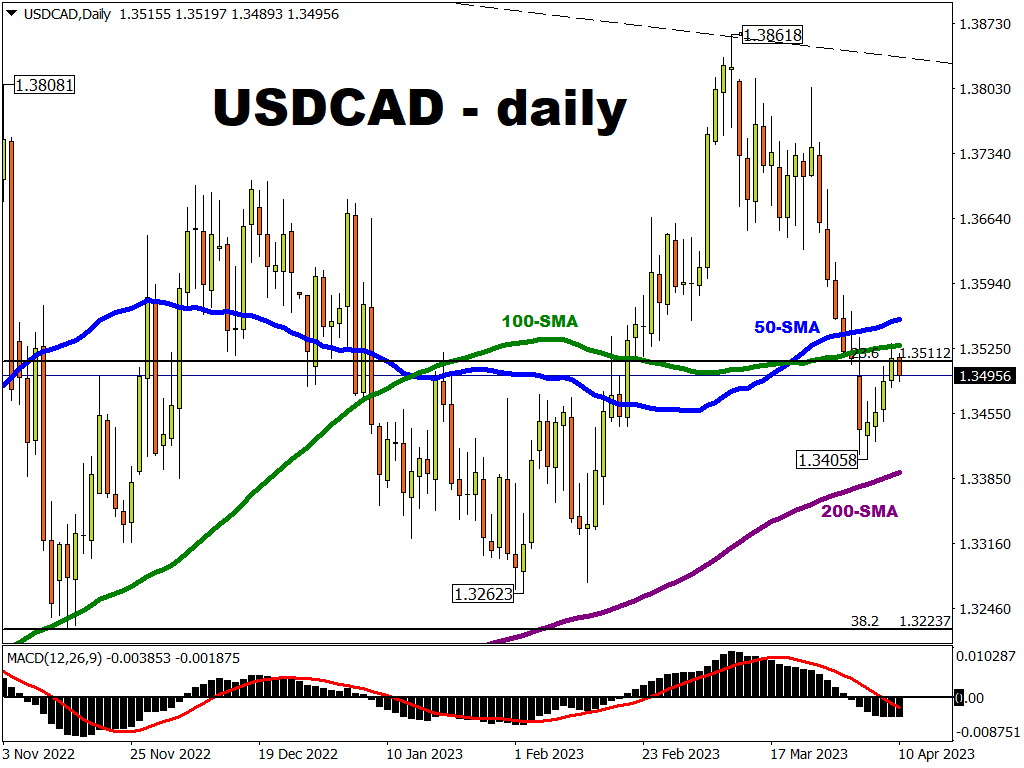

The recent drop in USD/CAD stalled around key trend support in the low 1.34s. Immediate resistance sits around its 100-day simple moving average (SMA), with its 50-day counterpart potentially offering stronger resistance slightly further afield northwards.

More By This Author:

Dollar Struggles To Find Any LoveThis Week: Markets Eye NFP And Tech Gains

Brent Drops Ahead Of US Inflation Data

Disclaimer: Forecasts which are made in the review constitute the personal view of the author. Commentaries made do not constitute trade recommendations or guidance for working on financial ...

more