The Weekender: Stagflation Fears Erode Market Confidence

Image Source: Pixabay

MARKETS

It’s happening again. The cracks in U.S. exceptionalism are widening, and this time, the market isn’t shrugging it off. The S&P 500 is sliding to a one-week low, the Dow is staring at its worst month in recent memory, and investors are finally facing a reality check—a cocktail of slowing growth, sticky inflation, and trade war uncertainty that feels uncomfortably familiar.

The stagflation drumbeat is getting louder. The market has ignored it for months, choosing instead to focus on Trump’s pro-growth agenda and the belief that inflation was yesterday’s problem. But when consumer sentiment collapses, inflation expectations tick higher, and the U.S. services sector—the very heartbeat of American economic dominance—contracts at the steepest pace in two years, the narrative shifts fast.

This week’s data drop was a gut punch to risk appetite:

- Consumer sentiment craters—The University of Michigan survey was slashed to a 15-month low of 64.7, shattering confidence in the so-called resilience of the U.S. consumer.

- The services sector—a cornerstone of growth—flashes a warning—The S&P Global Services PMI tumbled to 49.7, a shock contraction that suggests the engine of the U.S. economy isn’t as bulletproof as many assumed.

- Inflation expectations reawaken—The long-term inflation outlook just spiked to a 29-year high, sending a clear message that the battle is far from over.

- The housing market looks shaky—January existing home sales plunged nearly 5%, evidence that higher-for-longer rates are finally sinking their teeth into demand.

Markets have a way of ignoring problems until they become unavoidable, and right now, stagflation risks—once dismissed as a relic of the 1970s—are creeping back into the conversation. The Bank of America global fund manager survey tells the story: expectations for stagflation over the next year have jumped to a seven-month high.

And yet, not everyone is convinced. The Trump camp argues that tariffs will ultimately drive long-term growth, forcing industry back onshore in a VAT-style reset that will benefit domestic producers. But here’s the problem: stagflation isn’t just about data—it’s about perception. Once inflation fears and slowing growth become embedded in investor psychology, they start feeding on themselves.

Markets are adjusting, but maybe not fast enough:

- Bond traders are already positioning for stagflation—the smart money is piling into the 10-year (a classic recession play). ( I would be selling, not buying 2 years if we move beyond mini stagflation )

- Gold is screaming "danger"—another all-time high, another sign that investors are hedging against fiat devaluation and economic stagnation.

- The yen is catching a bid—the classic safe-haven play is waking up, suggesting risk-off flows are accelerating.

- Liquidity is king—when uncertainty rules the day, cash isn’t just a defensive move—it’s a weapon.

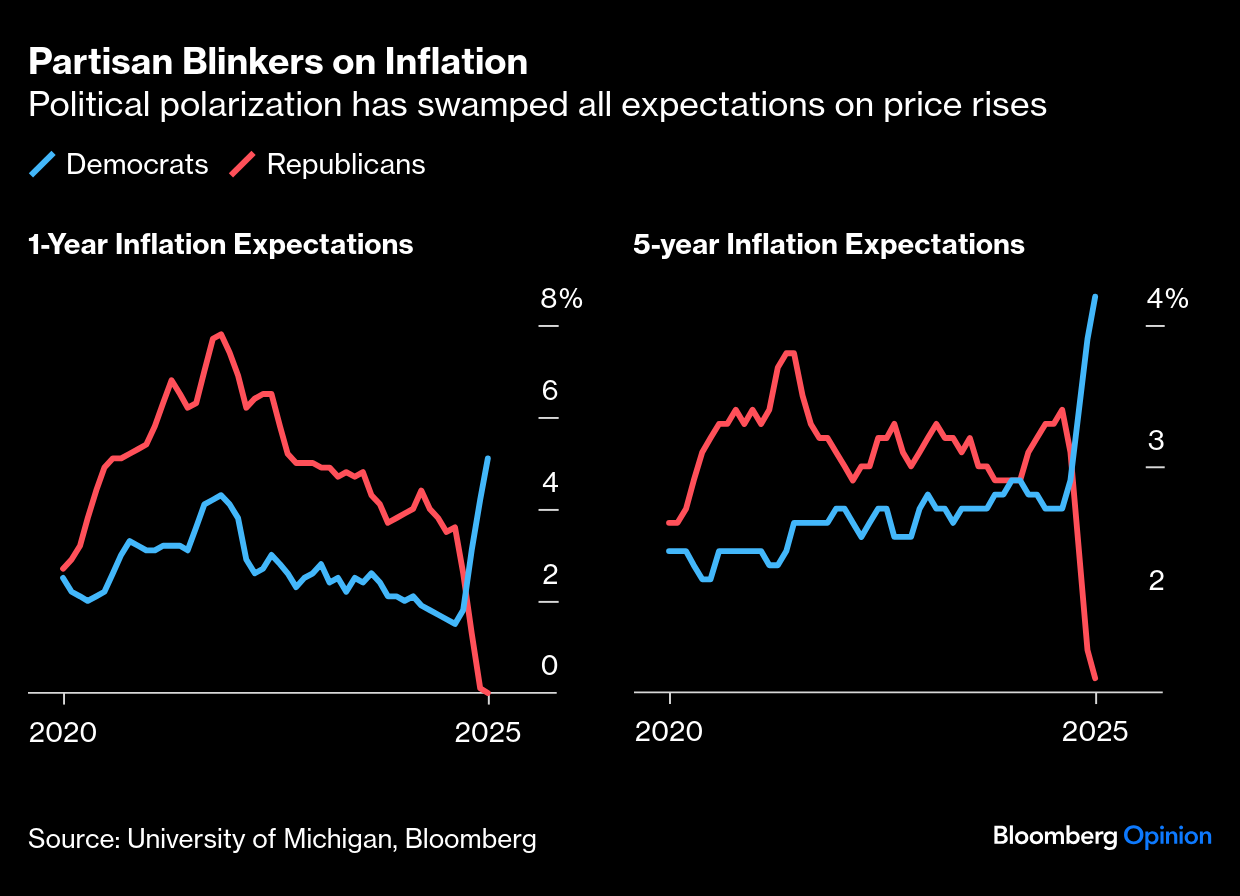

And then there’s the political filter distorting the inflation conversation. The U. Mich survey is heavily skewed by political bias, with Democratic respondents driving the inflation panic—but whether it’s perception or reality, what matters is how markets react. Inflation is sticky, and if the genie gets loose again, the Fed won’t hesitate to keep the screws tight.

(Click on image to enlarge)

For months, markets have been blissfully complacent, assuming that Trump’s pro-growth policies would keep the game alive. But this week’s data shows that the cracks in the façade are deepening, and the market’s stagflation nightmare is no longer just a tail risk.

The question now isn’t whether investors will acknowledge it—it’s how they’ll trade it.

VIEW

The Inflation Expectation Illusion—Are We Looking at the Wrong Data?

For all the sophisticated models, high-frequency data, and real-time analytics, the Federal Reserve and Wall Street still put far too much weight on the opinions of 500 random people. Inflation expectations surveys—like the University of Michigan’s—are treated as gospel by policymakers and traders alike, but let’s be honest: they’re flawed at best, misleading at worst.

The reality? These surveys are riddled with political bias and primacy bias. Ask a participant where inflation is heading, and more often than not, they’ll do one of two things:

-

Regurgitate their political frustrations—Democrats see doom when a Republican is in office, and vice versa.

-

Google historical inflation and pick a number out of a hat.

Neither of those behaviours is a reliable indicator of where prices are actually going.

Which brings us to the deeper issue: inflation expectations don’t dictate inflation—controlling inflation dictates expectations. The idea that anchoring expectations brings down inflation is a dangerous feedback loop that policymakers love to sell, but at the end of the day, real-world price pressures move the needle, not survey responses.

If we’ve learned anything from the post-pandemic cycle, it’s that hard data trumps sentiment. Instead of relying on survey-based inflation expectations, the market should focus on actual wage trends, supply chain bottlenecks, and fiscal policies that inject liquidity into the system. Everything else? Noise.

OIL MARKETS

Oil Markets in Disarray as U.S.-Russia Talks Stoke Geopolitical Uncertainty

Of course, widening cracks in US consumer confidence damage oil prices, but in the bigger picture, . The diplomatic maneuvering—held in Riyadh without Ukraine or any of its European allies at the table—has only deepened fractures between Washington and Brussels, with potential repercussions for global energy flows.

U.S. Secretary of State Marco Rubio threw fuel on the fire, suggesting that EU sanctions on Russian crude and fuel imports could become a bargaining chip in future negotiations to end the war. That statement alone rattled markets, with traders now having to position for more Russian oil coming back to the markets, so sanction premium baked into crude prices is about to shift dramatically.

But the real wildcard? Donald Trump.

The former president has made no secret of his shifting stance on Ukraine, increasingly appearing to side with Moscow while simultaneously pressuring Kyiv to sign over mineral rights to the U.S. as repayment for past military aid. This has set off alarm bells in Europe, where policymakers are already grappling with energy security concerns amid doubts about their ability to enforce sanctions without US support.

For now, oil prices are caught in the downward vortex —with increased supply risks, diplomatic maneuvering, and market uncertainty driving volatility. The question isn’t just whether the U.S. and Russia will reach an agreement—it’s how much oil will flow back to the markets.

THE VIEW

An oil analyst from one of the big banks—a shop I used to funnel most of my oil trades through—reached out Wednesday to discuss a key question: Why would Trump lift sanctions when they appear to be working? After all, if keeping them on longer means extracting more leverage over Russia, wouldn’t that be the logical play?

Paraphrasing the conversation from my perspective.”

That’s the thing—logic in geopolitics is always filtered through political bias.

The EU has clung to the “bring Russia to its knees” narrative for far too long, but let’s be real—weaponizing oil and gas was never about “defeating” Russia; it was always about forcing them back to the table. And now, whether European politicians like it or not, that’s exactly where we’re heading.

When—not if—sanctions are lifted, Russian crude will flood the market, setting off a mini supply shock that traders aren’t fully prepared for. Everyone’s been obsessed with the “risk-on” trade around peace negotiations, but the real mispricing isn’t about geopolitical optimism—it’s about the sheer volume of oil that’s about to hit global markets.

Markets may have priced in diplomacy, but they haven’t priced in the supply-side reality that follows. And that’s the real trade.

NUTS & BOLTS

2025 Kicks Off on a Sour Note—The Fed’s Next Challenge Begins

2024 ended with a roaring economy, fueled by resilient job growth and consumer spending that defied expectations. But the opening act of 2025 is painting a far less optimistic picture, forcing markets and policymakers alike to question whether the latest data signals a genuine shift toward slower growth or is merely a temporary, seasonal blip.

The Federal Reserve is now caught in a guessing game. Is January’s slump the result of one-off seasonal adjustments, extreme winter weather, or cautious consumers stepping back from their credit-fueled spending spree? December’s staggering $40.9 billion surge in consumer credit—the largest monthly increase ever recorded—suggests American households had been stretching their wallets to the limit.

Growth Momentum Is Slipping

So far, the early 2025 data points to a clear slowdown. Many are trimming their Q1 real GDP growth forecast. The main culprit? A sharp deceleration in consumer spending is expected to fall to 2.5-—2.8% from Q4’s blistering 4.2% pace.

The warning signs are stacking up:

-

January’s employment report was a disappointment, with just 143k jobs added—well below the three-month, six-month, and twelve-month averages (Chart 2).

-

The real gut punch? January retail sales. Inflation-adjusted sales collapsed at a staggering 15% annualized rate, the biggest downside shock yet.

-

Walmart’s chilling forecast confirmed the fears—higher-income households, the backbone of recent spending gains, may be starting to tighten their purse strings. The retail giant’s warning of slowing sales and profit growth sent its stock plunging 6.5%.

Inflation’s Not Dead—It’s Changing Shape

Even as growth wobbles, inflation is refusing to fade into the background. A fresh wave of trade policy uncertainty and new tariffs from Washington are stoking inflation fears across small businesses, homebuilders, and consumers alike.

-

Small businesses are freezing capital spending plans.

-

Homebuilders are bracing for a weaker housing market as mortgage rates remain stubbornly high.

-

Consumer sentiment is unraveling, with inflation expectations ticking higher.

And this is just the beginning. The biggest inflation threat looming over 2025? Import tariffs. The moment those policies hit, inflation will get another jolt, forcing core PCE inflation estimates to stay well above the Fed’s 2% target through 2026

The Fed’s New Balancing Act

With consumer and business demand set to weaken, the risk of sharp federal spending cuts, and trade wars brewing, the Fed faces a minefield on both sides of its mandate. Keeping full employment intact while battling re-accelerating inflation will be a high-stakes balancing act.

Markets may be pricing in rate cuts, but the inflationary impact of tariffs could upend those bets quickly. The risk of a prolonged stagflationary environment is growing, and the Fed’s ability to navigate these crosscurrents will define the trajectory of 2025’s economy.

For investors and businesses, this is no time to get complacent—the economy is shifting, and positioning for a more volatile, policy-driven landscape will be key.

AI TRADE EVOLVING

The AI Trade Is Evolving—And Wall Street Is Taking Notice

The AI-fueled market frenzy that defined 2024 is undergoing a seismic shift. While the Magnificent Seven—the tech behemoths that led last year’s rally—have stumbled in 2025, a new generation of AI-exposed stocks is capturing investor attention.

“The Magnificent Seven, which powered markets higher through 2024, have underperformed significantly this year,” notes John Marshall, head of Derivatives Research at Goldman Sachs. “This makes it look like investors are losing their taste for the AI trade.”

But the reality? AI fever is alive and well—it’s just taking a different shape.

Marshall points to a surge in buying activity from retail investors, which has climbed to a two-year high, with much of it concentrated in the tech-heavy Nasdaq 100 index.

The shift in strategy is key.

Instead of chasing the big AI builders, investors are piling into companies that are integrating AI to unlock new revenue streams. These aren’t the firms building large language models or optimizing their supply chains—they’re the ones finding ways to monetize AI in their core businesses.

“The AI trade is still on,” Marshall concludes. “It’s just different.”

For investors, this means the usual suspects won’t lead the next AI wave—but by the companies that can capitalize on AI’s commercial potential in ways that weren’t obvious last year. In short, the playbook is changing—and those who adapt stand to gain the most.

CHART OF THE WEEK

The JPY Playbook: Risk, Rates, and the Carry Trade Unwind

(Click on image to enlarge)

Anyone who’s spent time in FX markets over the past two decades understands the tight correlation between global risk appetite and XXX/JPY pairs. Simply put:

-

When markets are thriving, XXX/JPY and risk-on trades flourish.

-

When fear takes hold—whether through recession or stagflation—USD/JPY and XXX/JPY tumbles.

It’s a relationship as old as modern currency markets, but right now, JPY is performing exceptionally well for an additional reason—it’s the only major currency with a clear-cut rate-hiking bias.

Why JPY Moves With Risk Appetite

The macroeconomic logic behind JPY’s relationship with risk is straightforward:

- Japan holds one of the world’s largest pools of savings.

- Domestic interest rates have historically been low, so Japanese investors are incentivized to park their money abroad in search of yield.

- When confidence is high, they sell JPY and buy higher-yielding foreign assets.

- When fear sets in, they bring their capital home—selling foreign assets and buying back yen.

This dynamic manifests across the financial spectrum. From Mrs. Watanabe (retail traders managing FX portfolios) to CIOs at Japan’s massive pension funds, Japanese capital flows often serve as a proxy for global risk sentiment.

The Carry Trade & JPY’s Role as a Funding Currency

The second key driver of JPY’s safe-haven status is its use as a funding currency for the carry trade.

-

In low-volatility environments, funds and traders borrow and sell low-yielding currencies (like the yen) to buy high-yielding ones, pocketing the rate differential.

-

As these carry trades accumulate, traders short more yen and buy more higher-yielding assets.

-

But when volatility spikes, the trade reverses sharply—high-yielding currencies sell off, and the yen strengthens as traders rush to unwind leveraged positions.

This is why the carry trade moves “up the escalator and down the elevator”—profits build gradually, but unwinds happen in brutal, rapid waves. The TRY/JPY flash crashes are a prime example—when risk aversion surges, illiquid high-yielding FX pairs get obliterated, and JPY rips higher.

Where Does This Leave JPY Now?

The yen’s risk-off behaviour remains intact, but with Japan’s hawkish tilt and U.S. yields falling , the setup is evolving:

- If U.S. yields continue to decline, JPY strength could persist even if risk sentiment stabilizes.

- If Japan hikes sooner than expected, expect an even stronger yen, as real rate differentials shift in its favor.

- If volatility spikes again, whatever carry trades are on the books will unwind and boost the JPY further —just as it always does when fear returns.

For now, JPY bulls hold the upper hand, but the bigger question is how far Tokyo is willing to let the yen run before stepping in and buying bond on the MOF orders.. Stay tuned.

More By This Author:

U.S. Exceptionalism Losing It's Swagger

Markets Cling To Highs – Resilient Or Wishful Thinking?

Xi's Billionaire Charm Offensive Or Europe's Guns And Butter Trade?