The Weekender : The Tariff Hokey Pokey—Risk Traders Strapped To A Geopolitical Tilt-A-Whirl

Image Source: Unsplash

So Much For TACO

Just when traders thought they could tiptoe into June riding the coattails of a record May melt-up, the tape reminded everyone it still twitches to Trump. What started as a sleepy session turned into a headline-fueled dump-and-pump circus, the kind that makes algos sweat and old-school traders reach for a double espresso—or a stiff drink.

The catalyst? A classic Trump triple-threat special: first, an early rebuke of Beijing, then whispers of fresh sanctions, and finally a sugar-coated tease that a phone call with Xi might be imminent. All of it delivered in the span of a few trading hours, and just like that, the S&P 500 did a nosedive, only to scrape its way back to breakeven on what can only be described as a duct-taped technical bounce. NVDA erased its post-earnings sugar high, crude prices got treated like piñatas at a birthday party.

The market’s mood swings weren’t just driven by trade tweet theatrics. The legal theatre over Trump’s tariff regime has now entered appeals-court purgatory. First, a federal court ruled his global tariffs illegal under the IEEPA. Within 24 hours, an appeals court paused that ruling—result: legal whiplash and a market pricing in both a rollback and a reinforcement at once. The ambiguity is the point. Even if the Supreme Court upholds the lower ruling, Trump’s team will simply impose new sectoral levies under different authorities. Chips, pharma, tech—you name it, it’s already in the crosshairs.

And if you think the tariff tantrum ends there, think again. Enter Section 899—a fiscal Trojan horse buried in the Senate bill, giving the administration the green light to tax foreign-held U.S. assets at punitive rates. Forget trade war; this is the capital war chapter. Investors holding U.S. assets abroad—stocks,bonds, real estate—are now forced to contemplate the unthinkable: that the U.S. may pull a sovereign rug-pull.

Meanwhile, Powell was summoned to the White House like a school protor being called into the headmaster’s office. Trump told him, point-blank, he’s screwing up by not cutting rates. The Fed, in classic deadpan form, issued a post-meeting note reaffirming its independence and data dependency. But rate cut bets perked up anyway—helped by weak GDP revisions and soggy home sales.

The plunge in Treasury yields got an extra tailwind from a blockbuster 7-year auction that landed like a bullseye. Primary dealers were left holding just 4.8% of the issue—a record low takedown—according to Morgan Stanley. That’s not just strong demand; that’s borderline frothy. It screams one thing: Where’s the so called fiscal premium ??

And then came the nuclear twist: Trump’s team is preparing a 50% rule to expand tech sanctions—any subsidiary half-owned by a blacklisted Chinese firm gets the full sanction hammer. The message? If you’re anywhere near Beijing’s shadow economy, Washington’s coming for you. No wiggle room, no arbitration. Just raw, extraterritorial economic warfare.

China talks have stalled, tariffs are evolving into financial blockades, and the next Treasury review of currency manipulation looms just weeks away. Markets are now strapped into a geopolitical tilt-a-whirl where trade, capital, and currency policy all spin simultaneously, and no one’s sure who’s manning the controls.

In this kind of environment, it's not about earnings or economic prints—it’s about interpreting the next micro-expression from the Oval Office or decoding tea leaves from the tariff and deal tone. Traders are no longer betting on outcomes. They’re betting on what set of rules even applies.

The only certainty left? More tape twitches, more headline-induced convulsions, and a summer that’s shaping up to be anything but dull. Buckle up. We’ve just hit the on-ramp to macro hell week.

So much for TACO—“No more Mr. Nice Guy” isn’t just a campaign line—it’s a macro wrecking ball. Any restraint that existed in this trade war 2.0 is now officially off the table. The tone has shifted from deal-making to deal-breaking, and soon, markets might start trading as if the gloves are off, the elbows are up, and someone’s getting benched.

This isn’t chickening out. This is Trump doubling down with steel-tipped boots, aiming straight for China’s strategic jugular—subsidiaries, semiconductors, and any sector that so much as whispers the words “ security compliance.” And as traders try to price in what a capital war looks like layered on top of a tariff war, it’s clear we’re not playing checkers anymore. This is chess with flamethrowers.

Maybe I’m just being far too cynical… but that sure felt like a relief rally wearing a Fed pivot costume stitched together low volatility. Equity markets marched higher this week, brushing off trade tremors and fiscal fog, as investors latched onto the idea that the economy is holding up just enough—and inflation is backing off just enough—to keep the dream alive.

The S&P 500 clocked a tidy 1.9% gain, with the usual suspects—tech and communication services—leading the charge like it’s 2021 again. Meanwhile, materials and energy sat this one out, suggesting the real economy isn't quite buying the same optimism Wall Street is selling. But hey, who needs breadth? And so much for sell in May—this market just flipped the script and laughed in the face of seasonal clichés. May delivered its best monthly performance since the post-election surge in November, with the S&P 500 posting numbers that would even make the most cynical macro bear take a double-take.

The tape’s reclaimed the 200-day moving average and now sits just a stone’s throw—less than 4%—from its all-time highs. Not bad, considering the legal circus, tariff whiplash, and growing mutterings of capital war risk. Maybe the market’s just tuning it all out. Or maybe it’s lulled by the idea that bad news is good again, and rate cuts are back on the table.

Either way, sentiment seems to be outrunning the fundamentals, much like a momentum trader on a high from liquidity. But maybe—just maybe—that is the fundamental this cycle. We’re living in a market where perception is policy, and jawboning is just as potent as actual legislation. All this trade and capital war theater? It could just be the mother of all bluffs—a high-stakes poker hand where Trump’s White House is trying to win trade concessions not by showing strength, but by manufacturing chaos.

Tariff roulette. Section 899 saber-rattling. Xi call teases. Powell summons. One day it’s legal overreach, the next it’s “no more Mr. Nice Guy,” and by the close, we’re back to happy talk about mutual respect. The whipsaw isn’t the side effect—it’s the strategy. Keep counterparties off-balance, keep markets twitchy, and maybe wring out a deal in the confusion. Meanwhile, U.S. equities quietly grind higher, powered less by macro conviction and more by FOMO, AI froth, and an unshakable belief that, bluff or not, the Fed’s got everyone's back if things break.

It’s not fundamentals vs. sentiment anymore. Sentiment is the trade.

🔥 This Week’s Market Moves: May Closes With a Bang (and a Few Bruises)

As May limps into the close, it’s a tale of two tapes—equities partying like it’s late 2023 while bonds and crypto flash caution.

📉 Bond Market: Best of a Bad Month

U.S. Treasuries finally caught a bid, snapping a four-week losing streak. The long end led the charge, but let’s not kid ourselves—May was brutal. The ICE BofA Treasury Index posted its worst monthly drawdown of the year. Across the Pacific, Japan’s long bond yields staged an epic reversal. The 40-year JGB collapsed nearly 45 bps, the biggest weekly drop on record. Fiscal nerves and issuance jitters are clearly taking their toll.

📈 Equities: Risk-On Revival

Global risk turned on the jets. The MSCI World Index surged 5.5%, while the Nasdaq ripped 9.5% higher, both marking their best month since November 2023. Japan joined the party, with the Nikkei up over 5%, logging its strongest monthly performance since February last year.

Asia wasn’t all sunshine, though—MSCI Asia ex-Japan broke its six-week win streak, sliding 0.9% as China wobbles kept regional bulls in check.

🚀 Nvidia: The AI God Candle Lives On

Nvidia continued its melt-up—up 24% in May, its biggest monthly gain in a year. That’s not a typo. It's the third consecutive May ramp (+36% in 2023, +26% in 2022), and Q1 earnings once again lit the fuse.

💶 FX: The Euro’s Quiet Power Move

Not much headline juice here—EURUSD up just 0.4% in May—but this marks five straight monthly gains, the longest winning streak since 2017. Slowly but surely, is the euro really back in vogue?

🪙 Bitcoin: Trend Break

Bitcoin dropped 3% on the week, cooling off after tagging a record high of $112,000. That breaks a six-week winning streak, but bulls won't panic yet—this still looks like a consolidation, not a capitulation.

From Tariffs to Treasuries — Section 899 and the Dawn of Capital War

Forget the court ruling. That was the warm-up act. The real macro hand grenade is buried deep in the Senate's "Big Beautiful Bill" under a deceptively bureaucratic label: Section 899. While the headlines fixate on the trade court swatting down Trump’s IEEPA tariffs, savvy desks are already two steps ahead—trading the shift from trade war to capital war.

Here’s the kicker: if passed, Section 899 would mark the most aggressive structural shift in U.S. capital policy since the Reagan era. This is not just tariff 2.0—it’s a potential dismantling of the post-Bretton Woods capital flow regime. The dollar’s “exorbitant privilege” could suddenly come with a tax bill stapled to it.

The premise? If your country runs a tax policy that Washington deems “discriminatory,” your sovereign wealth funds, banks, insurers, and pension giants holding U.S. assets could be slapped with a 20% withholding tax on passive income—dividends, interest, you name it. The exemptions carved out under Reagan for foreign central banks and reserve holders? Suspended. Translation: USTs just got 100bps less attractive for the folks who actually fund America’s twin deficit.

Think about that. At a time when Treasury auctions are already soaking up record issuance, when foreign demand is thinning, and when the Fed is boxed in by politics, Section 899 could drive a wedge between the U.S. and the very capital it needs to function. It’s like torching the bridge and then asking your creditor to swim across.

Saravelos over at DB nails the bigger picture: this isn’t just about retaliation—it’s about weaponizing capital flows as an extension of foreign policy. The trade war toolkit has officially been upgraded. Now, every country negotiating with Washington knows that if tariffs hit legal roadblocks, capital taxes are waiting in the wings.

And let’s not pretend this is a high bar to clear. The legislation gives the Treasury Secretary unilateral power to publish a list of “discriminatory countries.” Add your name, get taxed. Boom. Done. No WTO, no warning, just a press release and a yield downgrade.

Even if carve-outs blunt the initial bite, the real damage comes from uncertainty. Who wants to allocate billions into U.S. paper when tax policy can flip on a political whim? Real money accounts are already murmuring. This isn’t noise anymore—it’s a volatility regime shift.

The dollar’s knee-jerk rally on the tariff court ruling? Gone. Vanished. The market has moved past the ping-pong match between courts and executive powers. It’s now digesting the possibility that capital allocation models themselves are under structural review.

The irony? If Section 899 gets voted through, the U.S. might end up triggering the very global currency war it claims to oppose. Once dollar flows get taxed or discouraged, other countries may respond the only way they can—by leaning on their own exchange rates. Competitive devaluation. Call it Plaza Accord 2.0 without the handshake.

Bottom line: the capital war is no longer theoretical. It's on the table, being priced in. This isn’t just about tariffs anymore—this is about what kind of financial system the U.S. wants to lead, and whether the rest of the world is still willing to play along. If not, buckle up. The next macro battleground won’t be fought over goods. It’ll be over capital, custody, and credibility.

Trapped in Tariff Purgatory: Bounced, Bruised, and Nowhere Near Done

You’d be forgiven for feeling like a shopping cart in a hurricane—pushed one way by judicial rulings, yanked another by appeals courts, rattling down a policy path with no brakes and no clear direction. Businesses, consumers, investors—everyone’s being blown around by crosswinds of tariff uncertainty, struggling to stay upright while the rules of the game keep shifting mid-gale.

What began as a “Liberation Day” legal win, with the U.S. Court of International Trade striking down Trump’s IEEPA-based tariff authority, quickly unraveled. Within 24 hours, an appeals court slapped on a stay, putting those same tariffs back in play—at least through mid-June, while it decides whether the administration’s long game holds water. It’s classic D.C. chaos: tariffs off, tariffs on, now wait for litigation to sort it out while global supply chains and pricing models hang in limbo.

Let’s not sugarcoat it—the original tariff spike took U.S. import rates to 26%, the highest level since Smoot-Hawley. At that altitude, recession risk wasn’t hypothetical—it was imminent. That brief reprieve, cutting average tariffs to 14%, felt like a break in the storm. Then came this week’s double twist: a short-lived crash to ~5%, followed by a legal boomerang back to 14%. It's like trying to forecast trade policy while someone keeps kicking the legal tripod out from under you.

But here’s the kicker: despite the tariff volatility, confidence metrics are staging a surprising comeback. The Conference Board’s consumer confidence index soared over 12 points in May, the strongest monthly gain since the early COVID recovery. PMIs are flashing green shoots—Philly, Dallas, Kansas City, Richmond—all showing signs of life. And equity markets? They're practically erasing the Liberation Day dip like it was a bad dream. Stocks are back, sentiment is up, and for a moment, it almost feels like the old macro regime is trying to reassert itself.

Don’t buy it.

This isn’t stability—it’s the eye of the storm. The White House still has a war chest of tariff tools, Section 301 authority, and now, potentially, Section 899 to weaponize the capital account. The temporary drop in tariffs might stabilize confidence for a few weeks, but the hard data is about to roll in—and it’s going to show the bruises. Nonfarm payrolls, retail sales, and Q2 business investment are likely to wear the scars of months of supply chain snarls and pricing distortions.

So where does that leave us? Smack in the middle of tariff purgatory. The old rules are gone. The new ones haven’t been written yet. Legal limbo has replaced economic clarity. And those waiting for a full reset back to pre-Liberation Day norms are chasing ghosts. This isn’t just a delay—it’s a structural shift. Markets may be floating on a raft of rate-cut hopes and consumer resilience, but beneath the surface, the foundations are still buckling under the weight of a global trade regime rewriting itself in real time.

Brace for the next gust. This hurricane isn’t done yet.

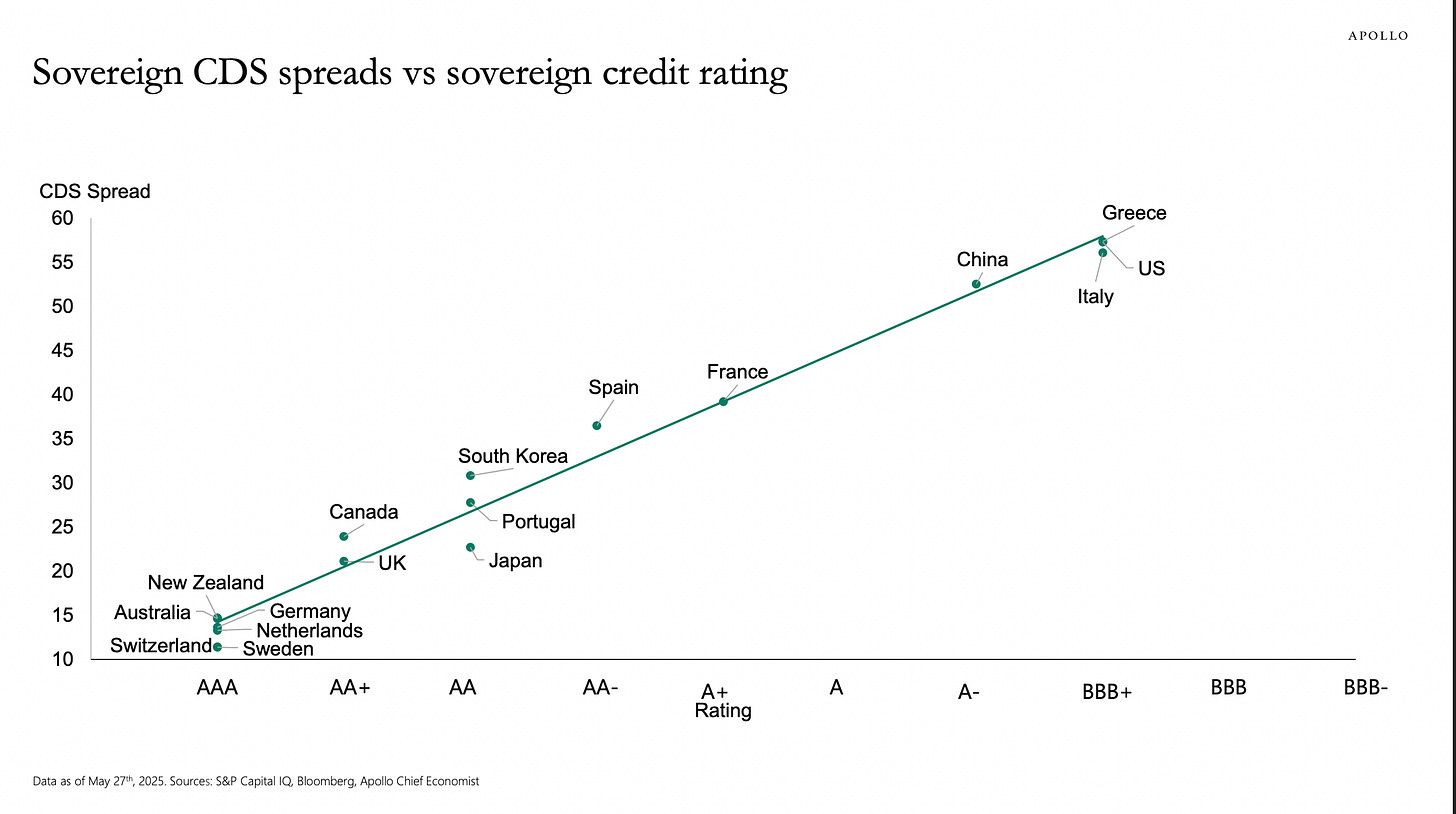

Chart Of The Week

U.S. Sovereign CDS: Trading Like a BBB Credit

The U.S. sovereign CDS spread is flashing yellow. It’s now trading at levels typically reserved for BBB+ credits—think Italy, think Greece. In other words, the market is quietly pricing America’s credit risk more like a structurally fragile European sovereign than the issuer of the world’s reserve currency.

Whether it’s the relentless debt ceiling theatrics, ballooning fiscal deficits, or rising political risk premium heading into November, the message from CDS land is clear: the "risk-free" label is getting tested.

More By This Author:

Boom, Fade, Litigate: Markets Reel As Tariff Reprieve Becomes Legal Mirage

Semis Slip, Markets Swerve: Nvidia’s Pre-Earnings Wobble Jolts The Rally Ride

Tariff Tango Turns Risk On Rumba: Wall Street Rips On The Reversal