The Rally Wagon Hits A Speed Bump

Image Source: Unsplash

MARKETS

The rally wagon has finally hit a speed bump, with US stocks dipping after an impressive 8-day sprint. Maybe it's just a case of the market catching its breath, biding time as the anticipation builds for Fed Chair Powell’s grand entrance at the Jackson Hole showdown later this week. After all, the markets have been on a tear, bouncing back from the early August chaos as fresh economic data fanned the flames of hope for a sooner—and perhaps deeper—rate cut from the Fed.

But while everyone’s been glued to the idea of the Fed hitting the "down" button on rates, let’s not forget there’s more in play here. The economy’s resilience is key—if it’s holding strong, the stock market might just keep on climbing. But here’s the kicker: everything from how deep those Fed cuts go to the actual strength of the US economy could come wrapped up in one of those “be careful what you wish for” moments when the next NFP report drops.

Even someone as hawkish as Kashkari hinting at rate cuts within the month suggests a 25bps trim on September 18th might be in the bag. The juicier question is whether there’s enough momentum for a super-sized 50bps cut. That’s probably not on the cards unless the payroll numbers take a nosedive below 125K.

But here’s where it gets interesting—would a 50 bp cut spark panic in a crowded theatre?

Recession whispers are getting louder again, which could be the early warning signs of a bull market running out of steam. Investors might start second-guessing holding onto stocks at record highs, especially with the NY Fed survey flashing red as job loss fears hit a record peak.

(Click on image to enlarge)

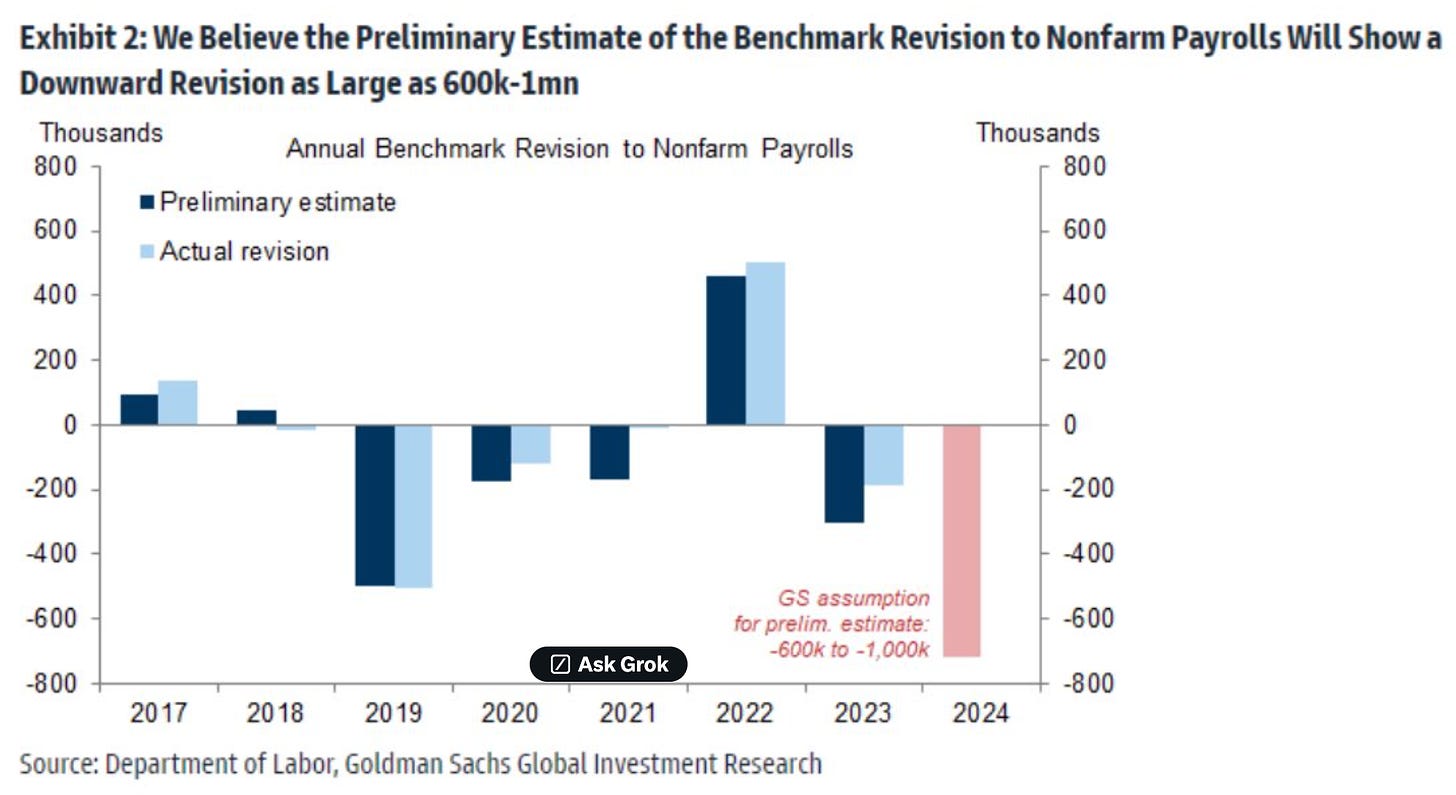

Not to mention those upcoming benchmark revisions to the non-farm payrolls data—those might take a chainsaw to the illusion of a strong economy that’s been keeping everyone so optimistic. It’s the scenario that could have everyone scrambling for the exits.

(Click on image to enlarge)

Sure, markets have almost shaken off this month's recession jitters, which gave us a choppy stretch. But let’s be honest—if economic data were a TV show, we’d grab the popcorn and soda, ready for a recessionary cliffhanger every week.

So don't get too comfortable while the market’s basking in the glow. Confidence is high, but that’s precisely when the market loves to catch everyone off guard. The bullish crowd can flip to bearish in a heartbeat if the economic winds shift, and when the tide turns, it might just take the whole ship with it.

Note: Markets don’t typically pay much attention to the NY Fed survey, given that it’s just a poll of around 1,000 respondents. It’s not precisely top-tier data, or even secondary-tier for that matter. However, with Americans now more worried about job security than they’ve been since the summer of 2014, it might be worth filing this one under "concerned." Especially with the BLS NFP revisions about to hit the tape

FOREX

The dollar's been taking a hit lately, and it’s no mystery why. Market confidence in a hefty Fed rate-cutting spree, along with a not-so-subtle move by some central banks to diversify away from the greenback, is doing a number on the dollar. It’s like everyone’s slowly sneaking out of the dollar party, leaving it a little less lively—and a lot weaker.

USD/JPY was back in the spotlight last night, dropping a hefty 200 pips in intraday action, with the overnight session serving up a fader's delight. If there’s one thing the yen loves, it’s a Fed rate cut party. Through 146, sell triggers hit the tape, and the chase lower was on again.

As expected, the EUR/USD drifted above 1.1100, riding the wave of Fed rate cut bets.

The dollar's recent moves have been especially pronounced in Asia’s FX laggards, such as the MYR and THB.

While there are likely some domestic quirks at play—like Malaysia’s stronger-than-expected economy and foreign inflows and Thailand’s sky-high travel receipts paired with soaring gold prices—the silver lining here is that a weaker US dollar gives Asia’s central banks the green light to cut rates more confidently, further stimulating their economies. It’s like the Fed’s party is giving everyone in Asia the excuse they needed to join in on the rate-cutting fun!

We also believe Asia FX has further to run, riding the coattails of a weakening USDCNH, which we expect to hit 7 by year-end. This move will be driven by a softer US dollar, a narrowing yield spread between China and the US, and virtually zero demand for large-scale CNY carry trades( like the yen). With these external factors pushing the dollar downhill, it should complement government initiatives to prop up the economy and trim rates.

Overall, we're stepping into a prolonged period of easing fears of capital outflows as Asia’s central banks cut rates with the dollar on the back foot. This trend looks set to persist throughout the Fed's entire rate-cut cycle.

More By This Author:

Betting Big On A ‘Goldilocks’ Scenario For The US Economy

The Disinflation Trend Is Unfurling But Not Quick Enough For The 50 Mission Rate Cut Crew

Wall Street Is Back In The Grove