The Japanese Yen Fell To A Six-Week Low After The Bank Of Japan Ended Its Meeting

Image Source: Pixabay

The Japanese yen exchange rate paired with the US dollar looks unimpressive by the end of this week. The USD/JPY pair rose to almost 158.00 immediately after the end of the June meeting of the Bank of Japan, which left the interest rate unchanged. Everything went according to expectations.

In March, the BoJ raised the rate for the first time in seven years, moving it from negative territory to zero.

In its comments, the regulator noted that it will continue to buy Japanese government bonds at the same pace as agreed in March until its July meeting. Thus, market expectations were ignored, which worked against the JPY. Investors hoped that the BoJ would at least carefully consider gradually reducing its balance sheet through government bonds as part of a smooth monetary policy transition from quantitative easing to tightening.

Previously, Bank of Japan Governor Kazuo Ueda confirmed the regulator's intention to gradually reduce its substantial balance sheet in the future. However, the timing of this action remains uncertain.

USD/JPY Technical Analysis

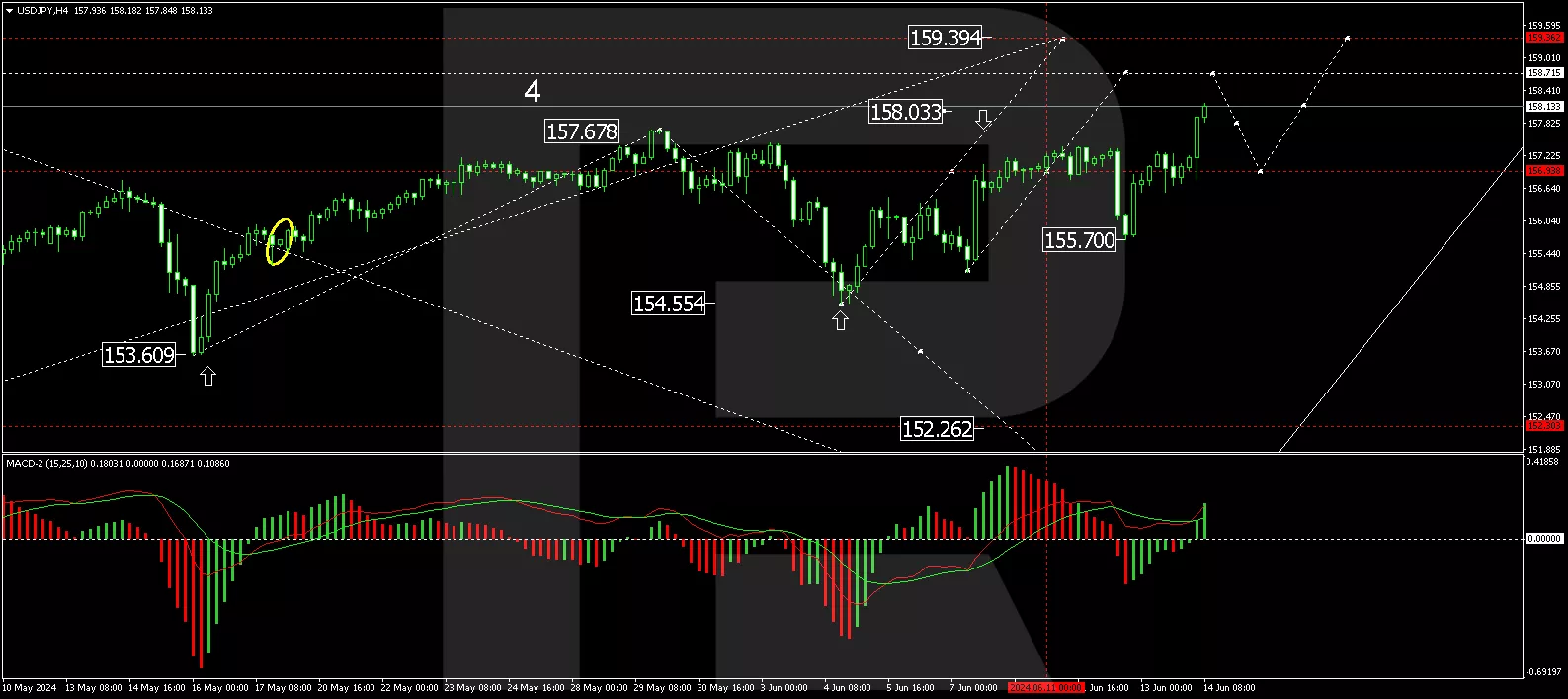

On the H4 USD/JPY chart, the market has breached 157.47 upwards and is continuing to develop a growth wave towards 158.74. After reaching this level, a correction down to the level of 157.47 is a possibility (test from above). We will then assess the probability of continuing the growth wave to 159.36. Technically, this scenario is supported by the MACD indicator, with its signal line above the zero level and pointing upwards.

(Click on image to enlarge)

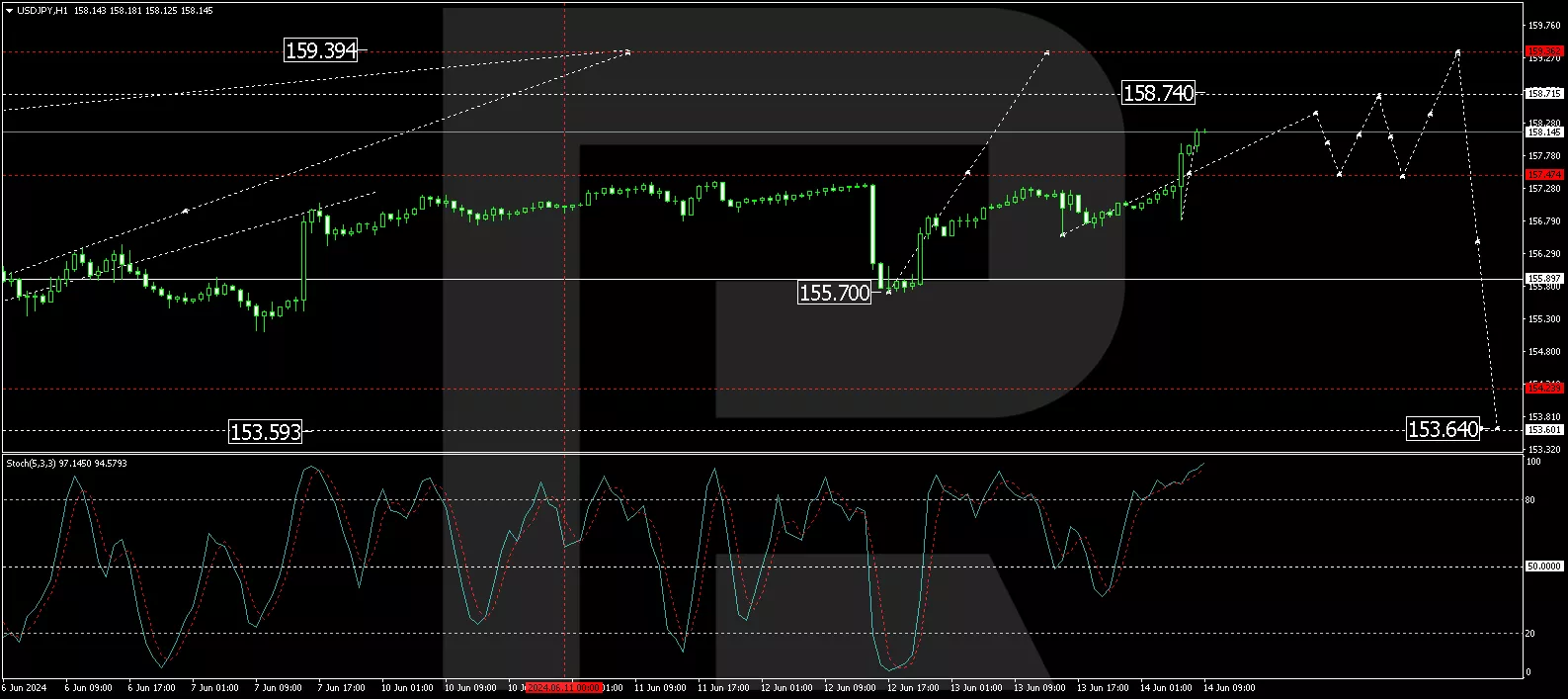

On the H1 USD/JPY chart, the market continues to develop a wave of growth to the level of 158.40. Further, a correction wave to 157.47 is possible, followed by growth to 158.74, the local target. Technically, this scenario is confirmed by the Stochastic oscillator, with its signal line above level 80 and preparing to decline to level 20.

(Click on image to enlarge)

More By This Author:

US Dollar Declines As Fed Signals Potential Rate Cut And Inflation Eases

Euro Hits Monthly Low Amid Political Instability In France

Brent Crude Oil Stabilizes Around 81.50 USD Amid Demand Optimism

Disclaimer: Any forecasts contained herein are based on the author's particular opinion. This analysis may not be treated as trading advice. RoboForex bears no responsibility for ...

more