The Japanese Yen Faces Further Depreciation Amid Rate Differentials

Image Source: Pixabay

The USD/JPY pair continues to escalate, currently positioned at 160.88, nearing the 37-year peak of 161.27 achieved last Friday.

Early today, the yen temporarily strengthened following Japan’s Q2 Tankan survey results, which indicated a slight improvement in industrial sentiment to 13 points from 11. However, the services sector displayed mixed results, maintaining 27 points against predictions of an increase, with future expectations slightly downgraded.

Despite these data points, the predominant driver of the yen’s weakness remains the significant interest rate differential between the Bank of Japan (BoJ) and the US Federal Reserve.

The BoJ has no immediate plans to adjust interest rates but might alter its government bond purchases, hinting at potential monetary tightening. However, market sentiment remains skeptical about such changes, contributing to the yen’s downward pressure.

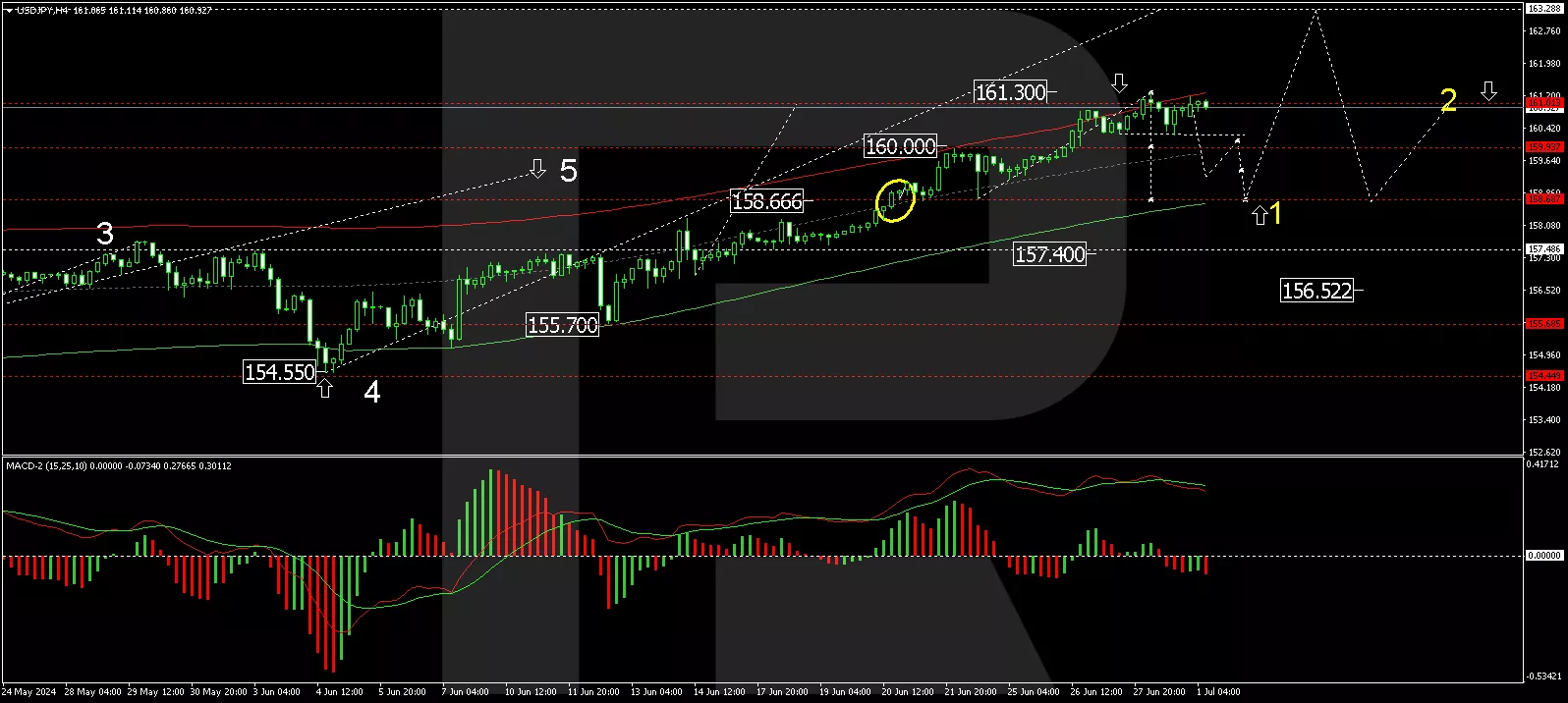

USD/JPY technical analysis

(Click on image to enlarge)

The USD/JPY is creating a consolidation range just below the 161.26 level. A brief surge to 161.33, considered a local peak within this upward trend, is possible. After this level, a corrective movement to 158.66 might initiate, potentially followed by another upward wave aiming for 163.30. This forecast is supported by the MACD indicator, with its signal line positioned above zero but pointing downwards, suggesting upcoming corrections.

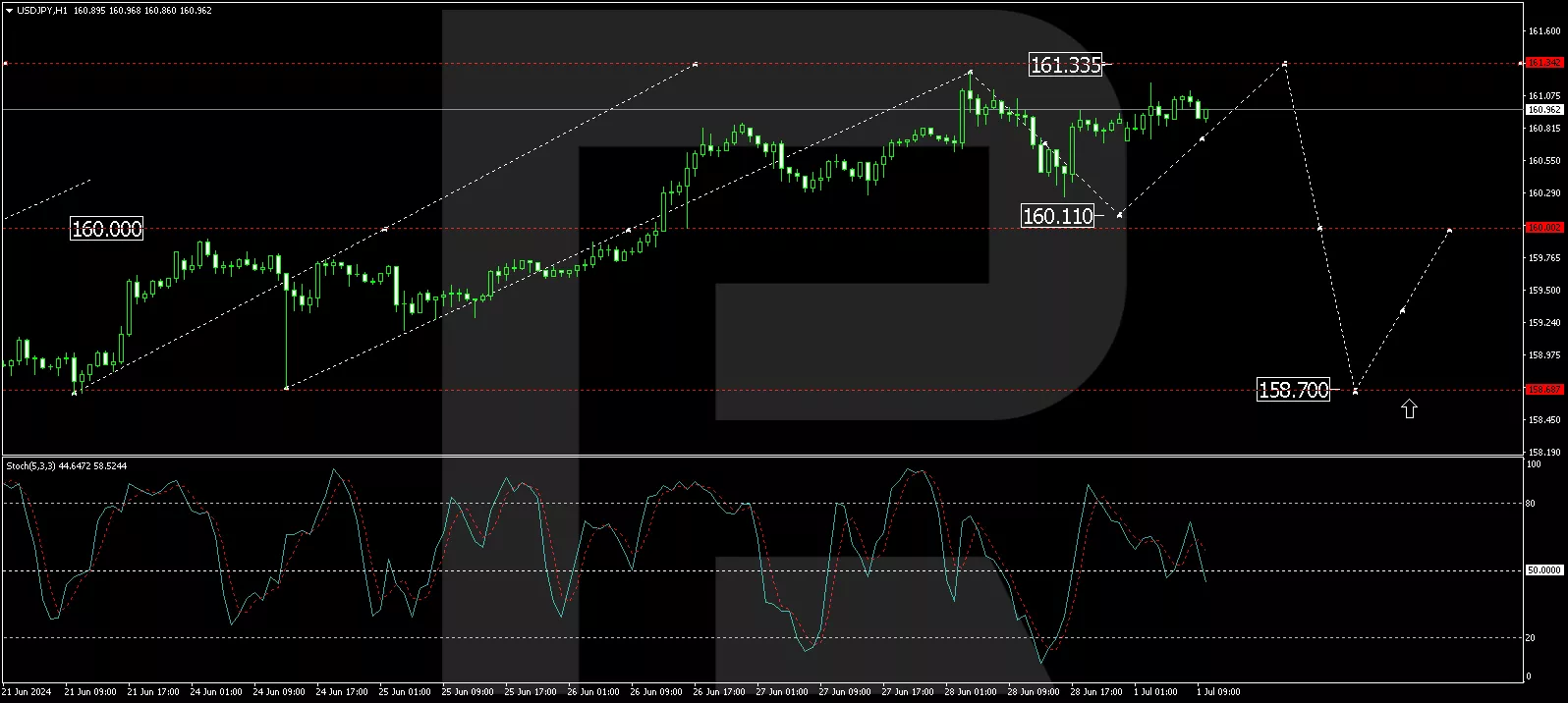

(Click on image to enlarge)

The pair completed an upward movement to 161.26, followed by a correction to 160.26. Currently, it has surged to 160.88, forming a consolidation range. Breaking above this range could lead to a rise towards 161.30. Conversely, a downward break might lead to a correction to at least 160.11 before another potential rise to 161.30. The Stochastic oscillator indicates that the signal line, currently above 50, is poised to drop to 20, reflecting potential short-term declines before further gains.

Market outlook

As investors navigate these fluctuations, the broader focus remains on global central bank policies, particularly any shifts by the BoJ or the Fed that could influence the USD/JPY trajectory. The upcoming economic releases and central bank updates will be crucial in shaping market dynamics and the yen’s valuation against the dollar.

More By This Author:

EUR/USD Continues To Struggle Amid US Inflation Concerns

Yen Under Pressure As USD/JPY Hits New Highs Since 1986

AUD/USD Surged, Buoyed By RBA Confidence And Inflation Growth

Disclaimer: Any forecasts contained herein are based on the author's particular opinion. This analysis may not be treated as trading advice. RoboForex bears no responsibility for ...

more