The Economy Looks Bad – IMF Says

Photo by Ibrahim Boran on Unsplash

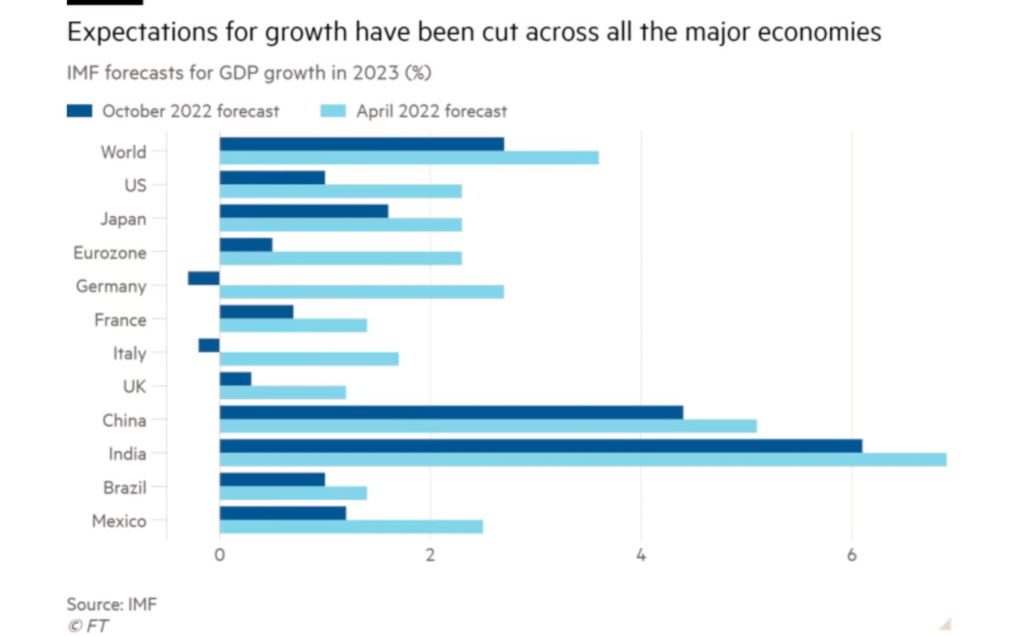

The International Monetary Fund (IMF) just shared a depressing (pan-intended) outlook for the world economy.

Ok, What’s Next?

The economy hasn’t really been having its best year in a long time. There are several factors curbing China’s manufacturing powerhouse and second-biggest economy. For one, the country’s faltering housing market and unwavering commitment to its zero-Covid policy are having an effect. But that is no secret (at least to the non-Chinese part of the world).

Furthering the issue is that the War in Europe is still having ripple effects on global food and energy prices. Central banks have been raising interest rates to fight inflation, but that risks weakening economies.

Although the IMF believes that banks should continue to fight inflation, it believes that the situation will deteriorate before it improves.

In fact, the fund expects the global economy to grow by a measly 2.7% next year, with around a third of the world’s economies actually shrinking. This is the most pessimistic forecast that the IMF has published since 2001 when you exclude the pandemic and the 2008 financial crisis. TWEET THIS

What are your moves?

As we grow tired of repeating, the US Dollar, despite its own liking, might be one of the few refuges from this calamitous turn of events.

The Federal Reserve’s recent aggressive rate hikes have bolstered the US dollar. The IMF thinks that’s a massive risk for the many countries – not least those in emerging markets – that hold dollar-denominated debt, as those payments are already growing far loftier.

And with more fearful investors likely to flock to safe-haven investments like US government bonds, the dollar might be poised to become even stronger.

That is likely to send ripples through local economies, subsequently hammering local economies as well as most likely SP500, which already sits 40% lower than its January highs. In comparison to the dot-com crash, it still looks like child’s play.

Respectively, there’s still room to fall without something that starting to sound more and more like a miracle.

Fortunately, these shorts on SP500, careful longs on commodities, and possibly shorting Oil are all the decisions that you can take to benefit from the world in flames.

More By This Author:

Weekly Waves: EUR/USD, XAU/USD And BitcoinHow To Invest In UK Market Turmoil

Key Market Insights September 2022

Disclaimer: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. On average around 80% of retail investor accounts loose money when trading with high ...

more