S&P 500 Forecast: Stocks Rise After MSFT Impresses

US stocks are rising after a solid start to big tech earnings and after stronger-than-expected US durable goods orders. Meta is up next.

US futures

Dow futures +0.15% at 33590

S&P futures +0.27% at 4083

Nasdaq futures +1.06% at 12860

In Europe

FTSE -0.3% at 7870

Dax -0.60% at 15778

- MSFT & GOOGL beat forecasts

- Banking woes linger

- US durable goods rebound strongly

- USD falls giving back yesterday’s gains

Big tech impress, Meta up next

US stocks are rising, with the tech-heavy Nasdaq 100 leading the charge as investors digest stronger-than-expected earnings from both Microsoft and Alphabet and as investors look ahead optimistically toward the release of Meta earnings after the close.

While tech stocks are bounding higher, lingering banking concerns weigh on the broader S&P 500 and the Dow Jones.

On the data front, US durable goods orders rebounded family in March, jumping 3.2% MoM, after falling -1.2% in February. Expectations had been for a more modest rise of 0.7%.

Data comes ahead of US GDP data tomorrow and Friday’s core PCE inflation figures, which will be the final major readings ahead of the Federal Reserve rate decision next week. Consumer confidence data yesterday fell to a 9-month low, raising concerns over the strength of the consumer and the impact of a weaker consumer on the broader economy.

The market is pricing in an 80% probability of a 25 bps rate hike next week, but what happened after is less certain.

Corporate news

Microsoft rises pre-market after earnings and revenue beat forecasts and after the UK competition regulator moved to block the firm’s acquisition of Activation Blizzard. The later is down 11% pre-market.

Alphabet trades marginally higher pre-market after beating both earnings and revenue forecasts as ad spending held up better than feared.

First Republic Bank falls 15% and is set to open at a record low as investors worry about plans to turn around its business.

Meta is set to release earnings after the close and come as the share price trades up 65% so far this year as investors have been impressed by the year of efficiency, which has included another 4000 layoffs in a recent spate of cuts.

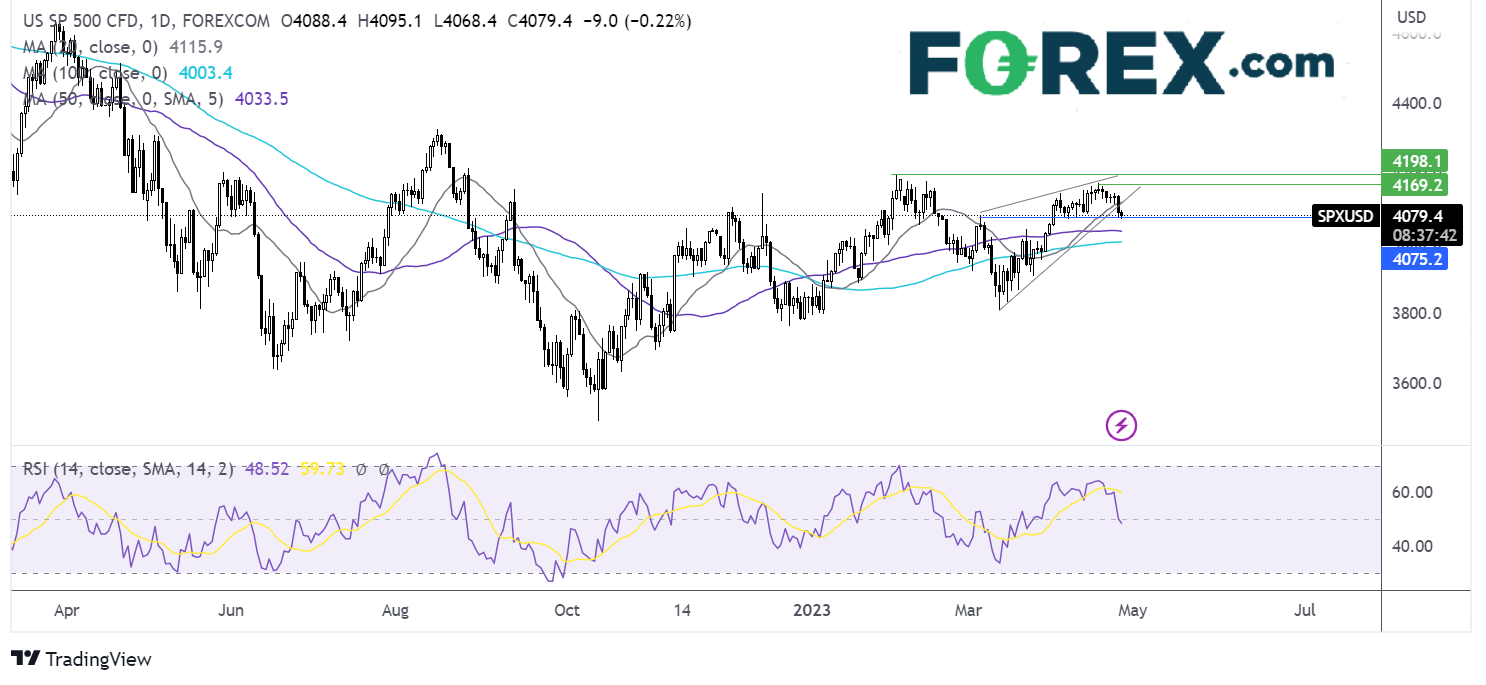

Where next for S&P500?

The S&P500 has fallen out of the rising wedge which had been forming since March, which along with the RSI falling below 50 keeps sellers hopeful of further downside. A break below 4067 the April low would be a sell signal, opening the door to 4035 the 50 sma and 4000 round number. Meanwhile, should the support at 4067 hold, buyers could look to rise back above the 20 sma and rising trendline support at 4115. A move above here opens the door to 4175 the April high.

(Click on image to enlarge)

FX markets – USD falls, EUR rises

The USD is falling after gains in the previous session as risk sentiment improves after encouraging big tech earnings boosted the market mood. The market is pricing in a May rate hike but bets for a June hike have disappeared.

EUR/USD is rising after German consumer confidence improved by more than expected in May to -25.7, up from -29.3. Optimism surrounding higher wages lifted morale. ECB speakers continue sounding hawkish with the central bank considering both 25 and 50 basis points hike in May.

GBP/USD is rising after losses yesterday, capitalizing on the weaker USD and boosted by the CBI retail sales report, which showed retail sales rose to +5 in April the highest level this year. However, expectations for May were still slightly negative.

EUR/USD +0.67% at 1.1045

GBP/USD +0.5% at 1.2468

Oil slips of a second day

Oil prices are sliding for a second straight session as recession fears weigh on the oil demand outlook, but losses are limited by falling oil stockpiles.

Weaker-than-expected US data has raised fears that the US economy is heading toward a slowdown. Yesterday US consumer confidence fell to a 9-month low, raising the prospect of a recession in the US, the world’s largest consumer of oil.

Meanwhile, API stockpiles fell by 6.1 million barrels, significantly more than the 1.5 million barrels forecast. US crude oil stockpiles have been falling since the middle of March as refineries have ramped up production to produce more gasoline ahead of driving season.

WTI crude trades -0.85% at $78.07

Brent trades at -0.33% at $81.87

Looking ahead

N/A

More By This Author:

Two Trades To Watch - Nasdaq 100, Gold

S&P 500 Forecast: Stocks Fall Ahead Of Earnings From Microsoft & Alphabet

Two Trades To Watch - GBP/USD, DAX - Tuesday, April 25

Disclaimer: The information on this web site is not targeted at the general public of any particular country. It is not intended for distribution to residents in any country where such ...

more