Silver Price Forecast: XAG/USD Caught A Firm Friday Bid, Climbed Back Into $22.70

Image Source: Pixabay

- Silver saw a recovery after Thursday's minor backstep.

- Spot prices gained on Friday, up nearly 4% from the day's opening bids.

- A declining trendline on the daily candlesticks poses a near-term threat to additional gains.

XAG/USD bids cleared the way on Friday, as spot silver gained nearly 4% for the day. Prices ended the trading week at a new high. Yet, despite the gains, XAG/USD remained bearish overall. It was still down 4.75% from the last swing high, with the year's high bids resting above at $26.13.

With the US dollar seen falling back on Friday and investor inflation-fueled fears abating, silver prices caught a firm bid. Additionally, with Middle East geopolitical tensions on the rise, and markets worried about potential spillover into neighboring countries via sanctions from larger, international neighbors, XAG/USD also saw some investor appetite for precious metals.

XAG/USD Technical Outlook

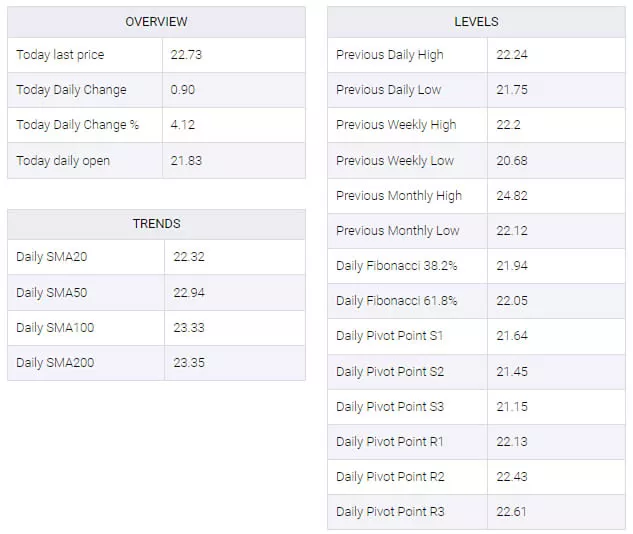

Friday's firm bid for spot silver prices sent the XAG/USD spinning directly into a descending trendline from late-August's swing high into the $25.00 handle, while the 50-day Simple Moving Average (SMA) rested just overhead near the $22.90 level.

The 200-day SMA turned mildly bearish at the $23.35 level, and this will be capping off technical action moving ahead if silver bulls aren't able to extend a bull run and capitalize off the near-term floor set at $20.75.

XAG/USD Daily Chart

(Click on image to enlarge)

XAG/USD Technical Levels

More By This Author:

WTI Price Skyrockets Amid Escalating Israel-Palestine Tensions

Gold Price Forecast: XAU/USD Soared Above $1925 Amid Escalating Middle East Tensions, Dovish Fed

Nvidia Stock News: NVDA Declines As US government Seeks To Seal Off AI Chips From China

Disclosure: Information on this article contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes ...

more