Silver Price Analysis: XAG/USD Plummeted After Hitting Three-Year High, Stayed Bullish

Image Source: Pixabay

- Silver pulled back sharply from its highest point since February 2021, suggesting that the rally might be overextended.

- If it breaks below key supports at $28.28 and $28.00 in the coming days, further declines to $27.54 and $27.00 could occur.

- A recovery above the $28.00 mark could reignite bullish sentiment.

The price of silver tumbled on Friday after reaching three-year highs that were last touched in February 2021. The grey metal peaked at the $29.79 level before it plunged around $2.00. The XAG/USD cross recently traded at around $27.84, down approximately 2.01%.

XAG/USD Price Analysis: Technical Outlook

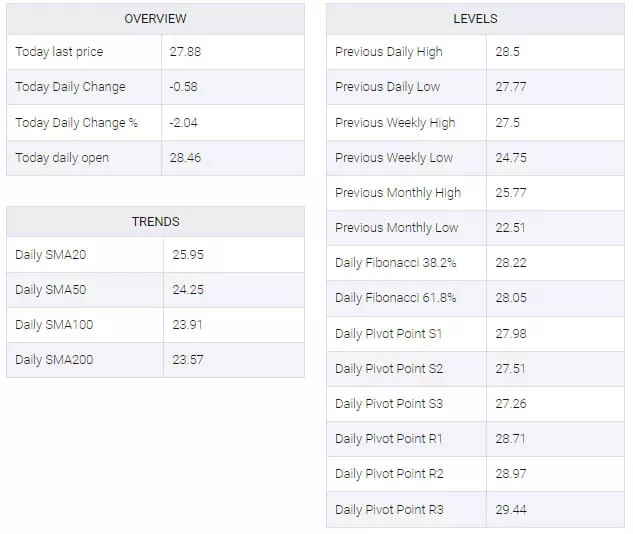

Silver appeared to be bullishly biased despite retreating sharply after spiking toward the $29.70 area. However, achieving a close below the June 10, 2021 high-turned-support at $28.28 and clearing below the $28.00 mark seemingly opened the door for a pullback.

Therefore, XAG/USD's first support would be the April 10 low at the $27.54 level, ahead of challenging the $27.00 figure. Further losses could be seen at the high-turned-support at $26.12.

On the other hand, strong bullish momentum remained, and if buyers could reclaim the $28.00 level in next week's trading, that could put the continuation of the rally back on the table. The first supply zone would be the June 10, 2021 high at $28.28, before testing the $28.74 level. Once surpassed, the next stop would be the year-to-date high at $29.79.

XAG/USD Price Action – Daily Chart

(Click on image to enlarge)

XAG/USD Technical Levels

More By This Author:

AUD/USD Stays Firm Amid Mixed US Economic DataAUD/USD Hovers Near 0.6600 As Markets Await Aussie’s Business, Consumer Confidence Data

The Gold Price Soared To Unseen Highs Amid High US Yields, Unfazed By US Jobs Data

Disclaimer: Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only ...

more