Silver Looks Ready To Shine As The US Dollar Index Rolls Over

Image Source: Pixabay

This was an interesting week in the financial markets, as the Federal Reserve once again decided not to raise or lower interest rates. Fed Fund futures are now projecting no change in rates for the next six months. People are starting to lock in their CD rates and buy more one- and two-year bonds to capture the current yields, just in case next year sees rate cuts.

The next direction does seem to be likely to be cuts, instead of hikes, on the part of the Federal Reserve, as current GDP numbers for the fourth quarter are tracking in to be at 1.2%, according to Federal Reserve live projections. The inverted yield curve says a recession will come, but when is the question, as it’s been inverted for well over a year and half now.

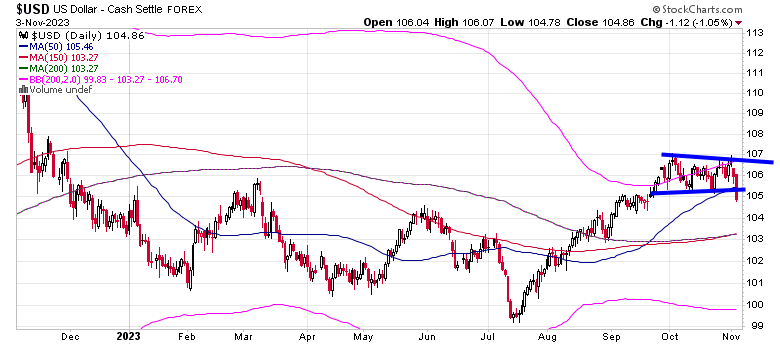

The US dollar index put on a rally starting in July, but that rally ended this Friday as the index broke down.

(Click on image to enlarge)

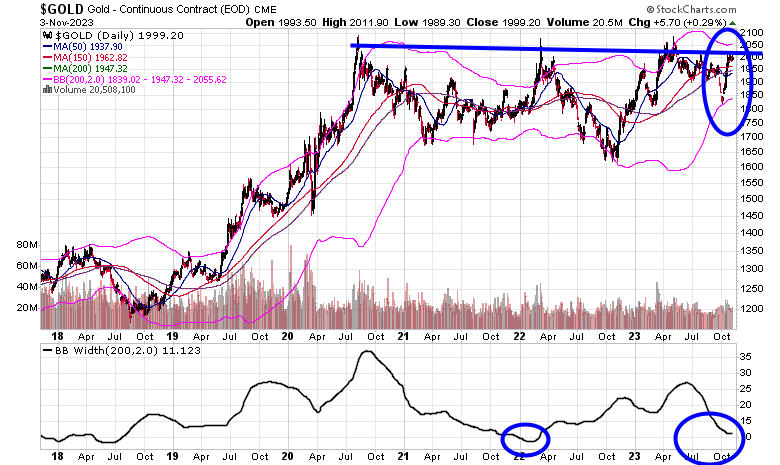

Gold also rallied last month up to the $2000 level, which has served as resistance for the past three years. If the US dollar index declines into the end of the year, look for gold to rally too, as gold historically goes up when the dollar falls in value.

(Click on image to enlarge)

You may notice how the 200-day Bollinger Bands on gold have narrowed. Gold has been in an $1800-$2000 an ounce range all year, and it is now at the top of this range.

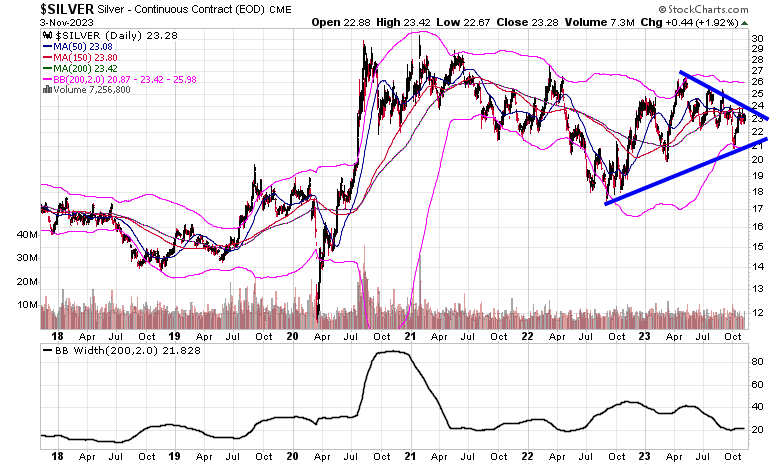

If the dollar continues to fall, it can finally break out to have another big leg up in price, like what started in the spring of 2019 when it went from $1250 an once to make a play for $2100. Silver also is positioning for a breakout move, with a triangle chart pattern.

(Click on image to enlarge)

Silver has short-term resistance at around $24.00 an ounce. One of the things I’ll be watching very closely for the rest of this month is this price point, and I'll be looking for a close above that level for silver. That would signal a breakout.

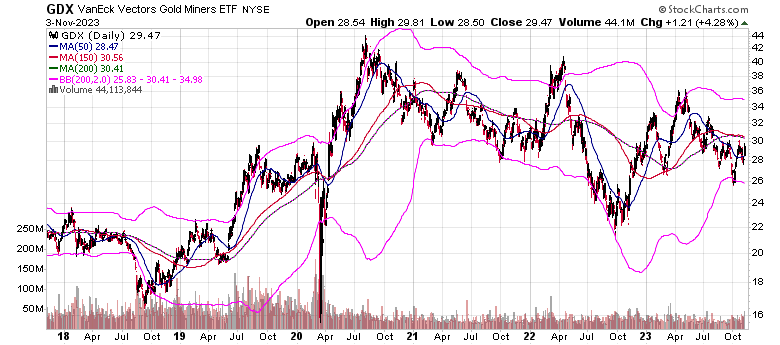

If these breakouts happen, look for the mining stocks to come alive and run, as well. The GDX mining stock ETF has a chart that basically is mimicking the price of silver.

(Click on image to enlarge)

I think the stock market can perform decently going into the end of this year, but if silver closes above $24 an ounce, then I expect we’ll see the metals and mining stocks outperform any stock market rally.

More By This Author:

My Stock Market Outlook For The Rest Of The YearThe Stock Market Is Now The Most Oversold It Has Been All Year

Here Is A Sector Coming Out Of A Stage One Base