Pound Sterling Turns Upside Down Against Its Peers

- The Pound Sterling outperforms its major currency peers as the market sentiment improves.

- Weak US ISM Manufacturing PMI data has weighed on the US Dollar.

- Investors await the US NFP data for fresh cues on the Fed’s monetary policy outlook.

The Pound Sterling (GBP) gives back early gains against the US Dollar (USD) and drops to near 1.3520 during the European trading session on Tuesday. The GBP/USD pair falls back as the US Dollar recovers its early losses.

As of writing, the US Dollar Index (DXY), which tracks the Greenback’s value against six major currencies, trades mildly higher to near 98.45.

However, the outlook of the US Dollar remains uncertain due to weak United States (US) ISM Manufacturing PMI data for December and signals from Minneapolis Federal Reserve (Fed) President Neel Kashkari that the labour market is weak.

The data released on Monday showed that the ISM Manufacturing PMI dropped to 47.9 in December from 48.2 in the previous month. This is the 10th straight month with the manufacturing business activity contracting.

On Monday, Fed Kashkari warned that the “job market is clearly cooling”. Kashkari also signaled that there is more room for interest rate cuts, citing that “My [Kashkari] guess is we're [Fed] close to neutral now”.

Pound Sterling Price Today

The table below shows the percentage change of British Pound (GBP) against listed major currencies today. British Pound was the strongest against the Swiss Franc.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | 0.14% | 0.13% | 0.06% | 0.05% | -0.02% | -0.02% | 0.20% | |

| EUR | -0.14% | -0.01% | -0.09% | -0.09% | -0.16% | -0.16% | 0.06% | |

| GBP | -0.13% | 0.00% | -0.08% | -0.08% | -0.15% | -0.15% | 0.07% | |

| JPY | -0.06% | 0.09% | 0.08% | -0.01% | -0.08% | -0.09% | 0.14% | |

| CAD | -0.05% | 0.09% | 0.08% | 0.00% | -0.07% | -0.08% | 0.15% | |

| AUD | 0.02% | 0.16% | 0.15% | 0.08% | 0.07% | -0.00% | 0.22% | |

| NZD | 0.02% | 0.16% | 0.15% | 0.09% | 0.08% | 0.00% | 0.22% | |

| CHF | -0.20% | -0.06% | -0.07% | -0.14% | -0.15% | -0.22% | -0.22% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the British Pound from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent GBP (base)/USD (quote).

Daily digest market movers: Investors await US NFP data for December

- The Pound Sterling turns upside down, even as the market sentiment remains upbeat. Earlier in the day, the British currency outperformed its major peers as market jitters due to the capture of Venezuelan President Nicolas Maduro by the United States (US) military over drug-trafficking charges eased.

- On Monday, investors turned risk-averse after the US military action in Venezuela and the announcement from US President Donald Trump that Washington will restructure Venezuela’s Oil industry.

- On the domestic front, the United Kingdom (UK) economic calendar is light this week, therefore, market expectations for the Bank of England’s (BoE) monetary policy outlook are expected to drive the Pound Sterling.

- The BoE is expected to follow a gradual monetary easing path in 2026 as the UK inflation is still above the 2% target, despite price pressures slowing down in the past two months. The UK headline Consumer Price Index (CPI) inflation came down to 3.2% year-on-year (YoY) in November from a peak of 3.8% seen in September.

- Going forward, investors will focus on the US Nonfarm Payrolls (NFP) data due for release on Friday. The US official employment data will significantly influence market expectations for the Fed's monetary policy outlook as the central bank reduced interest rates by 75 basis points (bps) to the 3.50%-3.75% range in 2025 due to downside labor market risks.

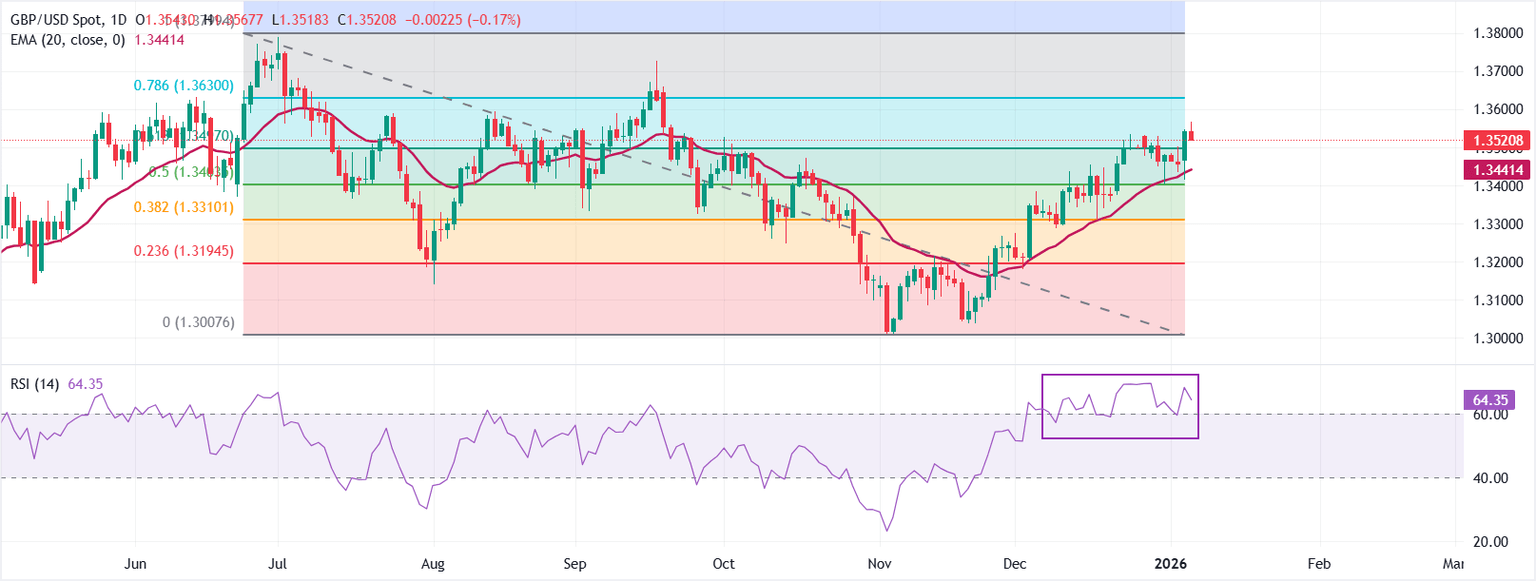

Technical Analysis: GBP/USD struggles to hold above 61.8% Fibo retracement at 1.3500

(Click on image to enlarge)

GBP/USD trades lower to near 1.3520 at the time of writing. However, the outlook of the price is bullish as the 20-day Exponential Moving Average (EMA) is rising, keeping the short-term bias pointed higher. A sustained close above this gauge favors follow-through on the advance.

The Relative Strength Index (RSI) at 64.35 is positive for bulls, confirming firm bullish momentum. Measured from the 1.3799 high to the 1.3008 low, the pair struggles to hold above the 61.8% Fibonacci retracement at 1.3497.

The trend tone remains positive while the pair holds over the ascending 20-EMA, with the indicator last at 1.3444 acting as dynamic support on dips. On the topside, the pair could gain further towards the 78.6% retracement at 1.3630 if it holds above the 61.8% Fibo hurdle.

More By This Author:

Pound Sterling Gains As Market Sentiment ImprovesUSD/CHF Ticks Down To Near 0.7910 As US Dollar Falls Back

Pound Sterling Drops As US Attack On Venezuela Dampens Market Mood

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not ...

more