Pound Sterling Revisits Weekly Low Against US Dollar Ahead Of US NFP Data

- The Pound Sterling declines for the fourth straight day against the US Dollar.

- The Greenback trades firmly ahead of the US NFP data release for December.

- Investors await UK employment figures for fresh cues on the BoE’s monetary policy outlook.

The Pound Sterling (GBP) trades near its weekly low around 1.3420 against the US Dollar (USD) during the European trading session on Friday. The GBP/USD pair is under pressure as the US Dollar rallies further ahead of the United States (US) Nonfarm Payrolls (NFP) data for December, which will be published at 13:30 GMT.

During the press time, the US Dollar Index (DXY), which tracks the Greenback’s value against six major currencies, trades 0.17% higher near 99.00, the highest level seen in four weeks.

Investors will pay close attention to US official employment data to get fresh cues on the Federal Reserve’s (Fed) monetary policy outlook. Also, the significance of the December NFP report is higher as numbers from previous months were distorted due to the historically longest government shutdown.

According to estimates, the US economy created 60K fresh jobs in December, slightly lower than 64K in November. The Unemployment Rate dropped to 4.5% from the prior reading of 4.6%. Signs of soft job demand would boost Fed dovish expectations, while the negative impact of upbeat data would be limited on them, as one-time good figures would be insufficient to dramatically ease policymakers’ concerns over the labor market.

Markets will also focus on Average Hourly Earnings figures for new insights about inflation. This key measure of wage growth is expected to have grown at a faster pace of 3.6% year-on-year (YoY) in December against 3.5% the previous month. On a monthly basis, the wage growth measure is estimated to have risen at a faster pace of 0.3% against the prior reading of 0.1%.

US Dollar Price Today

The table below shows the percentage change of US Dollar (USD) against listed major currencies today. US Dollar was the strongest against the Japanese Yen.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | 0.09% | 0.22% | 0.44% | 0.08% | 0.25% | 0.37% | 0.09% | |

| EUR | -0.09% | 0.13% | 0.37% | -0.02% | 0.17% | 0.32% | 0.00% | |

| GBP | -0.22% | -0.13% | 0.23% | -0.15% | 0.04% | 0.15% | -0.13% | |

| JPY | -0.44% | -0.37% | -0.23% | -0.37% | -0.20% | -0.08% | -0.36% | |

| CAD | -0.08% | 0.02% | 0.15% | 0.37% | 0.18% | 0.29% | 0.02% | |

| AUD | -0.25% | -0.17% | -0.04% | 0.20% | -0.18% | 0.11% | -0.13% | |

| NZD | -0.37% | -0.32% | -0.15% | 0.08% | -0.29% | -0.11% | -0.28% | |

| CHF | -0.09% | -0.00% | 0.13% | 0.36% | -0.02% | 0.13% | 0.28% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the US Dollar from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent USD (base)/JPY (quote).

Daily Digest Market Movers: BoE monetary policy expectations to be driven by UK employment data

- The Pound Sterling trades mixed against its major currency peers in Friday’s European trading hours. The British currency is expected to stay on the sidelines as markets shift focus to the United Kingdom (UK) labor market data for three months ending in November.

- Investors will closely monitor UK employment data to get fresh cues on the current state of the job market. UK labor market conditions remained weak in 2025 as firms slowed down hiring to offset the impact of an increase in employers’ contributions to social security schemes. In the three months ending in October, the Unemployment Rate rose to 5.1%, the highest level seen since March 2021.

- The UK labor market data will significantly influence market expectations for the Bank of England’s (BoE) monetary policy outlook. At December's meeting, the BoE guided that the monetary policy will remain on a “gradual downward path”.

- This month, the major trigger for the GBP/USD pair would be the announcement of Fed Chairman Jerome Powell’s successor. In December, US President Donald Trump said that he would announce the new Fed chair in early January.

- On Wednesday, US President Trump said in an interview with The New York Times (NYT) that he has made a decision on who will be the next Fed boss, but has not talked about it with anybody. In the interview, Trump refrained from confirming White House Economic Adviser Kevin Hassett to replace Powell, but kept the option on the table. According to recent comments from the president, former Fed Governor Kevin Warsh, and current ones, Christopher Waller and Michelle Bowman, are also leading contenders to be in charge of the central bank.

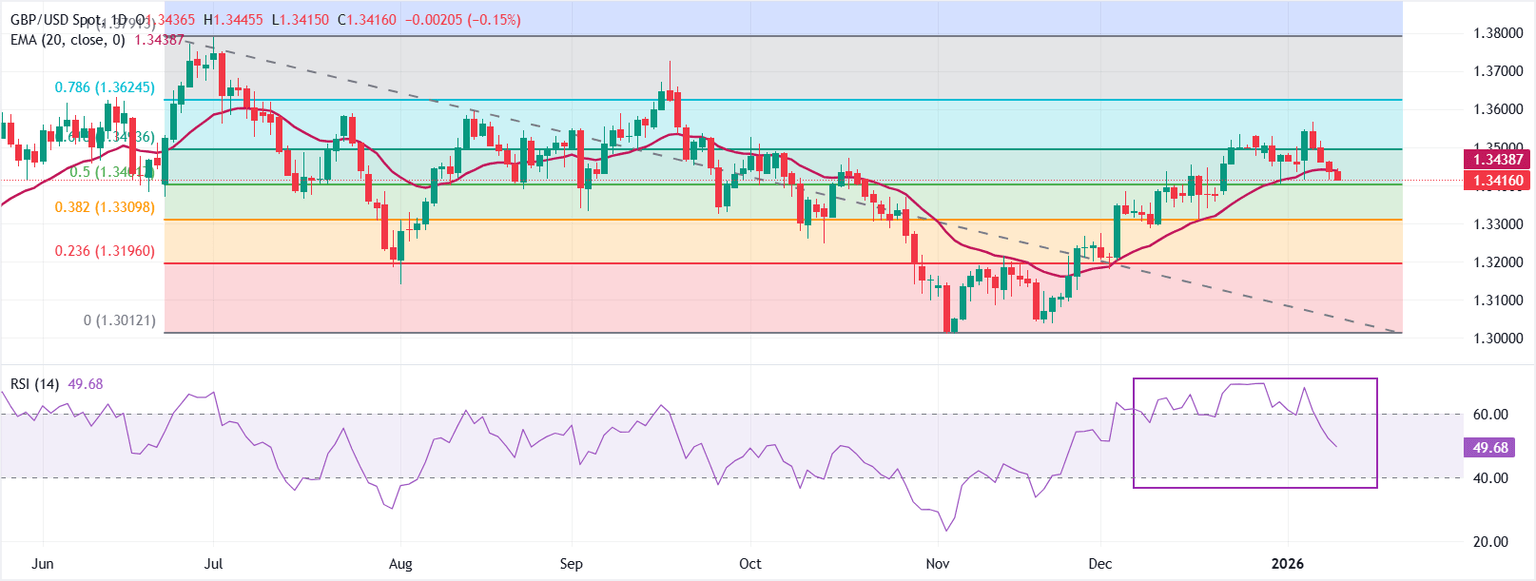

Technical Analysis: GBP/USD slides below 20-day EMA

(Click on image to enlarge)

GBP/USD trades lower at 1.3416 at the time of writing. The 20-day Exponential Moving Average (EMA) slopes higher, but the pair tests it from below at 1.3439, where it caps near-term recovery attempts.

The 14-day Relative Strength Index (RSI) at 50 (neutral) confirms momentum has cooled after recent overbought readings.

Measured from the 1.3791 high to the 1.3012 low, the 50% Fibonacci retracement at 1.3402 stands as a nearby pivot after failing to hold the 61.8% Fibonacci retracement at 1.3494. A recovery move above the same would open the path toward the round-level resistance of 1.3600.

On the contrary, the continuous close below the 20-day EMA would prompt negative bias and open the door for further downside towards the 38.2% Fibonacci retracement at 1.3309.

More By This Author:

Pound Sterling Extends Decline Against US Dollar, While Focus Shifts To US NFPWTI Price Forecast: Sees Immediate Support Near $55 Amid US-Venezuela Clash

Pound Sterling Turns Upside Down Against Its Peers

(The technical analysis of this story was written with the help of an AI tool.)

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and ...

more