Pound Sterling Outperforms On Strong UK Retail Sales, PMI Data

- The Pound Sterling moves higher on upbeat UK Retail Sales and flash PMI data.

- UK Retail Sales rose by 0.4% MoM, beating market consensus of a contraction at a steady pace of 0.1%.

- The Federal Reserve is seen leaving interest rates steady in the monetary policy meeting next week.

The Pound Sterling (GBP) rises strongly against its major currency peers, jumps to near 1.3536 against the US Dollar (USD) as the flash United Kingdom (UK) S&P Global Purchasing Managers’ Index (PMI) data for January has come in stronger than projected, and Retail Sales have returned to growth in December.

The PMI report showed that the overall business output grew strongly due to a sharp increase in both manufacturing and the services sector activity. The Composite PMI jumped to 53.9 in January from 51.4 in December, also beating estimates of 51.7.

The Services PMI has come in at 54.3, higher than the 51.7 estimate and the prior release of 51.4. And, the Manufacturing PMI rose sharply to 51.6 from the previous reading of 50.6.

Meanwhile, Retail Sales figures have grown in December, after contracting in the last two months. The Office for National Statistics (ONS) has reported that Retail Sales data, a key measure of consumer spending, rose by 0.4% month-on-month (MoM), while it was expected to decline steadily by 0.1%.

On an annualized basis, the consumer spending measure grew strongly by 2.5% against the market consensus of a rise at a moderate pace of 1%, from 1.8% in November, which was revised higher from 0.6%.

Strong UK Retail Sales data is expected to weigh on market bets for interest rate cuts by the Bank of England (BoE) in the near term.

Next week will be light in terms of UK economic data, and market sentiment and expectations for the Bank of England’s (BoE) monetary policy outcome at the February meeting are set to drive the Pound Sterling.

Pound Sterling Price Today

The table below shows the percentage change of British Pound (GBP) against listed major currencies today. British Pound was the strongest against the Swiss Franc.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | 0.12% | -0.23% | -0.13% | -0.03% | -0.11% | 0.11% | 0.16% | |

| EUR | -0.12% | -0.35% | -0.24% | -0.15% | -0.23% | -0.01% | 0.04% | |

| GBP | 0.23% | 0.35% | 0.13% | 0.20% | 0.12% | 0.34% | 0.39% | |

| JPY | 0.13% | 0.24% | -0.13% | 0.10% | 0.01% | 0.22% | 0.28% | |

| CAD | 0.03% | 0.15% | -0.20% | -0.10% | -0.09% | 0.12% | 0.18% | |

| AUD | 0.11% | 0.23% | -0.12% | -0.01% | 0.09% | 0.21% | 0.28% | |

| NZD | -0.11% | 0.01% | -0.34% | -0.22% | -0.12% | -0.21% | 0.05% | |

| CHF | -0.16% | -0.04% | -0.39% | -0.28% | -0.18% | -0.28% | -0.05% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the British Pound from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent GBP (base)/USD (quote).

Daily Digest Market Movers: Fed's policy to drive GBP/USD next week

- The Pound Sterling climbs to near 1.3535 against a weakened US Dollar (USD) during the European trading session on Friday, the highest level seen in over two weeks. The GBP/USD pair strengthens as the British currency outperforms after the UK data, ignoring a slight uptick in the US Dollar.

- At the time of writing, the US Dollar Index (DXY), which tracks the Greenback’s value against six major currencies, trades marginally higher to near 98.40. Still, the DXY is close to its two-week low of 98.28 posted on Thursday. The DXY is broadly under pressure as investors turn cautious over Trump’s long-term trade relations with its trading partners.

- Since the imposition of tariff policy by United States (US) President Donald Trump on his trading partners, in an attempt to fix the widened trade deficit, relations between Washington and other big economies such as India and China have not been stable. Additionally, the US-Russia understanding has also been tested several times amid the war in Ukraine.

- Meanwhile, geopolitical and trade disputes between the US and the European Union (EU) have been resolved as Trump backed off on the possibility of forcefully purchasing Greenland and rolled back 10% tariffs imposed on several members of the old continent, after meeting with NATO Secretary General, Mark Rutte. In the meeting, both reached a framework of a “future deal with respect to Greenland, and in fact, the entire Arctic Region”.

- However, market experts believe that the framework is a temporary solution and doesn’t solve Washington’s arbitrariness, raising concerns over the stability of global peace. This scenario also raises questions about the US Dollar’s reserve currency status.

- On the domestic front, investors await the Federal Reserve’s (Fed) monetary policy announcement on Wednesday. The Fed is expected to leave interest rates unchanged in the range of 3.50%-3.75%, according to the CME FedWatch tool.

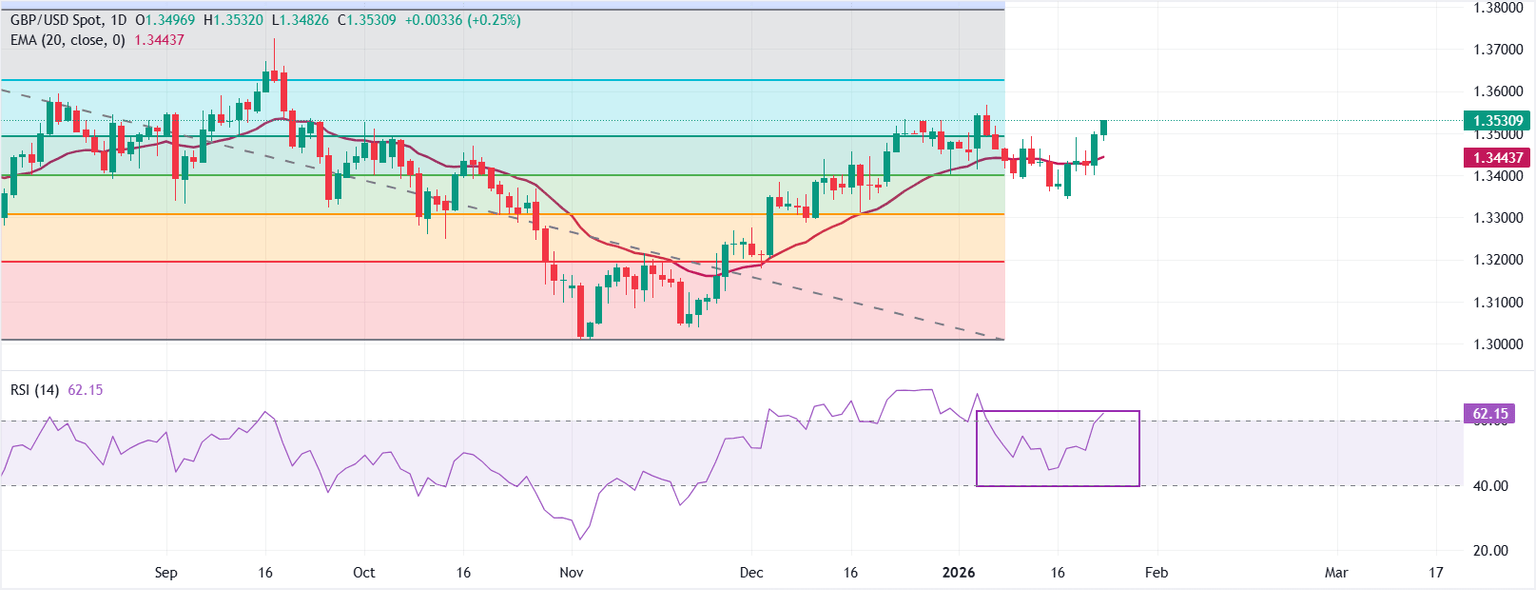

Technical Analysis: GBP/USD approaches 78.6% Fibo retracement at 1.3625

(Click on image to enlarge)

GBP/USD extends the advance to near 1.3530 as of writing. Price holds above the rising 20-day Exponential Moving Average (EMA) at 1.3444, keeping the near-term bias pointed higher.

The 14-day Relative Strength Index (RSI) at 62.15 (bullish), supporting improving momentum without being overstretched.

Measured from the 1.3793 high to the 1.3009 low, the 61.8% Fibonacci retracement at 1.3494 stands as immediate support. A sustained move above it would open a move toward the 78.6% retracement at 1.3625, while failure to clear it would keep the rebound capped and encourage consolidation.

(The technical analysis of this story was written with the help of an AI tool.)

More By This Author:

Pound Sterling Gains On Strong UK Retail Sales, PMI DataGBP/JPY Trades Firmly Near Multi-Year High While BoJ Holds Interest Rates Steady At 0.75%

Pound Sterling Gains On Higher UK CPI, Retail Sales And Flash PMI Data Awaited

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not ...

more