Pound Sterling (GBP/USD) Steady Ahead Of US And UK CPI Data

Photo by Colin Watts on Unsplash

- The GBP/USD pair rose after the strong UK wage growth data.

- The numbers showed that the country's wages are still growing.

- Focus now shifts to the upcoming UK and US inflation data.

The pound sterling inched upwards on Tuesday after the latest UK jobs numbers and as traders waited for the upcoming inflation and retail sales data. The GBP/USD pair rose slightly to a high of 1.2820, its highest point since August 2nd.

UK inflation data ahead

The main catalyst for the GBP/USD exchange rate was the latest UK jobs numbers. According to the Office of National Statistics (ONS), the country’s unemployment rate dropped from 4.4% in May to 4.2% in July, beating the consensus view of 4.5%.

The data also showed that the number of claimants increased by 135k jobs in July from the previous 36.2k. Most importantly wages remained steady in June, when it came in at 5.4%, higher than the expected 4.6%.

These numbers mean that the British economy was doing well as demand for workers rose. While the number of migrants has risen, they have not been able to fill all the jobs that the country wants.

While wage growth is a good thing, it will put more pressure on the Bank of England (BoE), which has started cutting interest rates. Higher wages lead to more inflation as people boost their spending. In a note, analysts at ING said that the BoE will likely slow down on its rate increase cycle. They noted:

“In the short term, we think the stickiness in wage growth will keep the Bank moving cautiously on rate cuts. But assuming there is further progress on both that and services inflation over the next few months, we think the Bank will accelerate the pace of cuts beyond November.”

The data came a day ahead of the upcoming UK consumer and producer price index data. Economists believe that the country’s inflation remained under pressure in July. After falling for all months this year, the view is that the headline inflation rose for the first time in July this year.

The average estimate is that the headline Consumer Price Index (CPI) rose from 2.0% in June to 2.3% in July. Core inflation, on the other hand, is seen falling from 3.5% to 3.4%, higher than the BoE’s target of 2.0%.

The next important UK data will come out later this week when the government publishes the latest retail sales data. If the recent trends continue, there are signs that retail sales continued rising last month.

US inflation data ahead

The GBP/USD exchange rate will react to the upcoming US inflation data scheduled on Wednesday. While the producer price index is set to come out on Tuesday, its impact on the pair will be limited.

The view among economists is that the country’s inflation rose slightly in July, bucking a trend that has been going on in the past few months.

According to Investing, the headline CPI is expected to have remained at 3.0% in July as the core CPI dropped slightly to 3.2%. On a MoM basis, the two are expected to have risen slightly in July.

Unless the CPI catches the market by surprise, the data, while important, will not change the Federal Reserve’s view on interest rates.

In its last meeting, the bank insisted that it was fully focused on its dual mandate, of ensuring stable inflation and jobs market.

While inflation is still higher than its target, the bank is now focused on the labor market, which has shown signs of softening. The unemployment rate has risen from 3.5% in 2023 to 4.3% in July and the trend may continue.

Therefore, the question is not if but when the Fed will start cutting interest rates. Most analysts believe that the Fed is set to start slashing as soon as in its September meeting.

What is unclear is the magnitude of the upcoming cut. Some analysts have recommended a jumbo rate cut while others have urged caution, where the Fed slashes by just 0.25%.

GBP/USD technical analysis

(Click on image to enlarge)

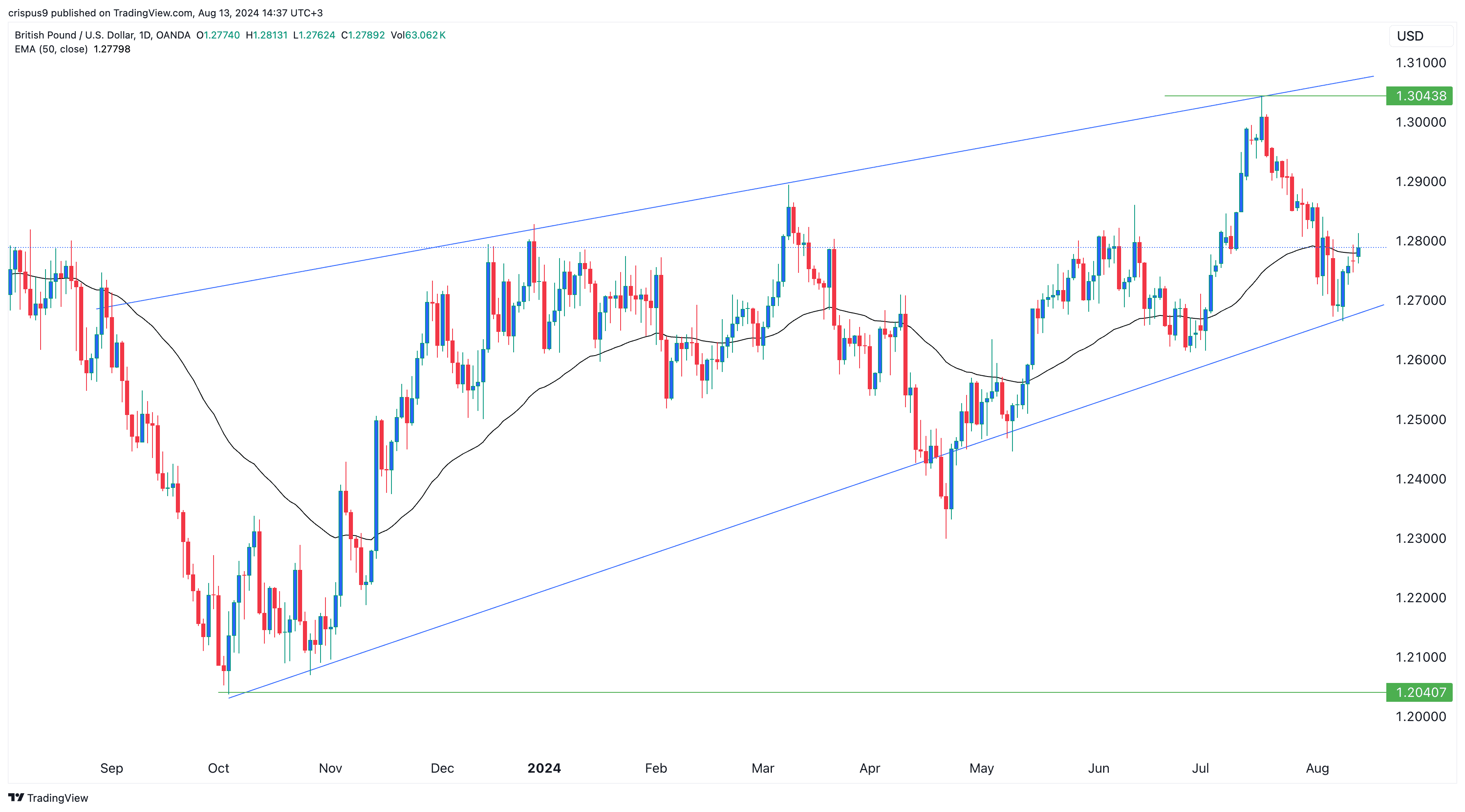

The daily chart shows that the GBP/USD exchange rate has been in a strong bull run since 2023 when it bottomed at 1.2040 in October last year. This rally peaked when the pair reached a high of 1.3043 in August.

The pair has formed an ascending channel, which is shown in blue. Also, it has moved above the lower side of this channel. It is also attempting to move above the 50-day Exponential Moving Average (EMA).

At the same time, the MACD indicator, the Relative Strength Index (RSI), and the Stochastic Oscillator (SO) have all pointed upwards. Therefore, the pound sterling pair will likely continue rising as buyers target the key resistance point at 1.2900.

On the flip side, a drop below the key support at 1.2700 will point to more downside. A drop below the lower side of the channel will point to more downside.

More By This Author:

Europe’s Inflation May Rise Due To Olympics And Taylor Swift Events, But UBS Claims Local Wallets Will Remain Unscathed

USD/CHF Analysis Ahead Of US Inflation, Retail Sales Data

Is A US Recession Imminent?

Disclosure: Invezz is a place where people can find reliable, unbiased information about finance, trading, and investing – but we do not offer financial advice and users should always ...

more