Pound Rallies Sharply Weak Dollar Boosts GBP, But BoE Rate Outlook May Complicate Future Gains

Photo by Colin Watts on Unsplash

GBP/USD has risen for the third consecutive session, reaching 1.2857, primarily driven by a weaker US Dollar amid escalating US-China trade tensions.

Key factors influencing GBP/USD movements

China has raised tariffs on US goods to 84%, effective 10 April, in retaliation for the US increasing duties on Chinese imports to 104%.

Bank of England Deputy Governor Clare Lombardelli warned that these tariffs could dampen UK economic growth, though their impact on inflation remains uncertain.

Markets are now pricing in a high probability of a 50-basis-point rate cut in May, with expectations shifting to four cuts by the end of 2025 – up from three previously forecast. Investors are nearly 100% confident in a second cut in June, while a third reduction in September is already fully priced in.

Technical Outlook: GBP/USD

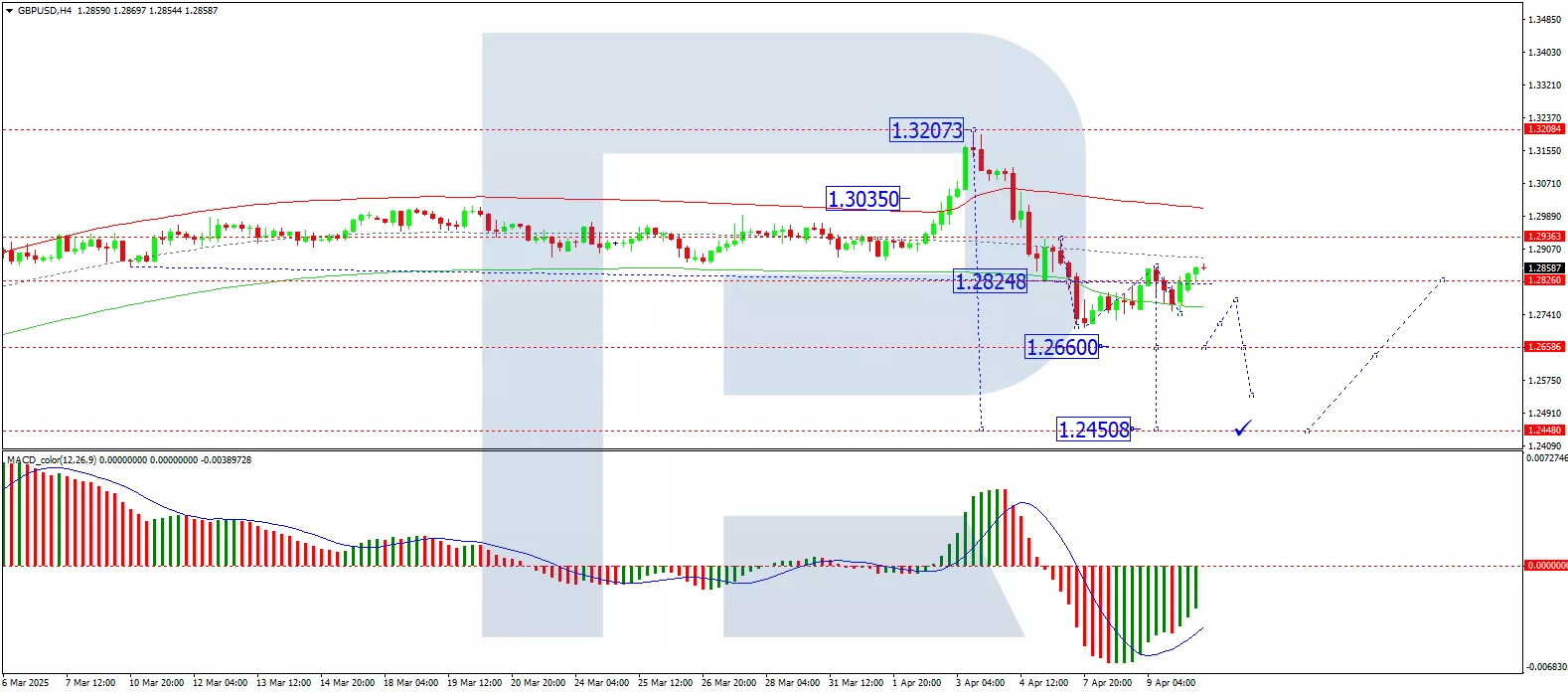

H4 Chart Analysis

(Click on image to enlarge)

- GBP/USD is consolidating around 1.2825, with the potential for an upward extension to 1.2875

- A downward wave towards 1.2660 remains plausible, with further downside risk to 1.2450

- The MACD indicator supports this outlook, with its signal line below zero and pointing sharply downward

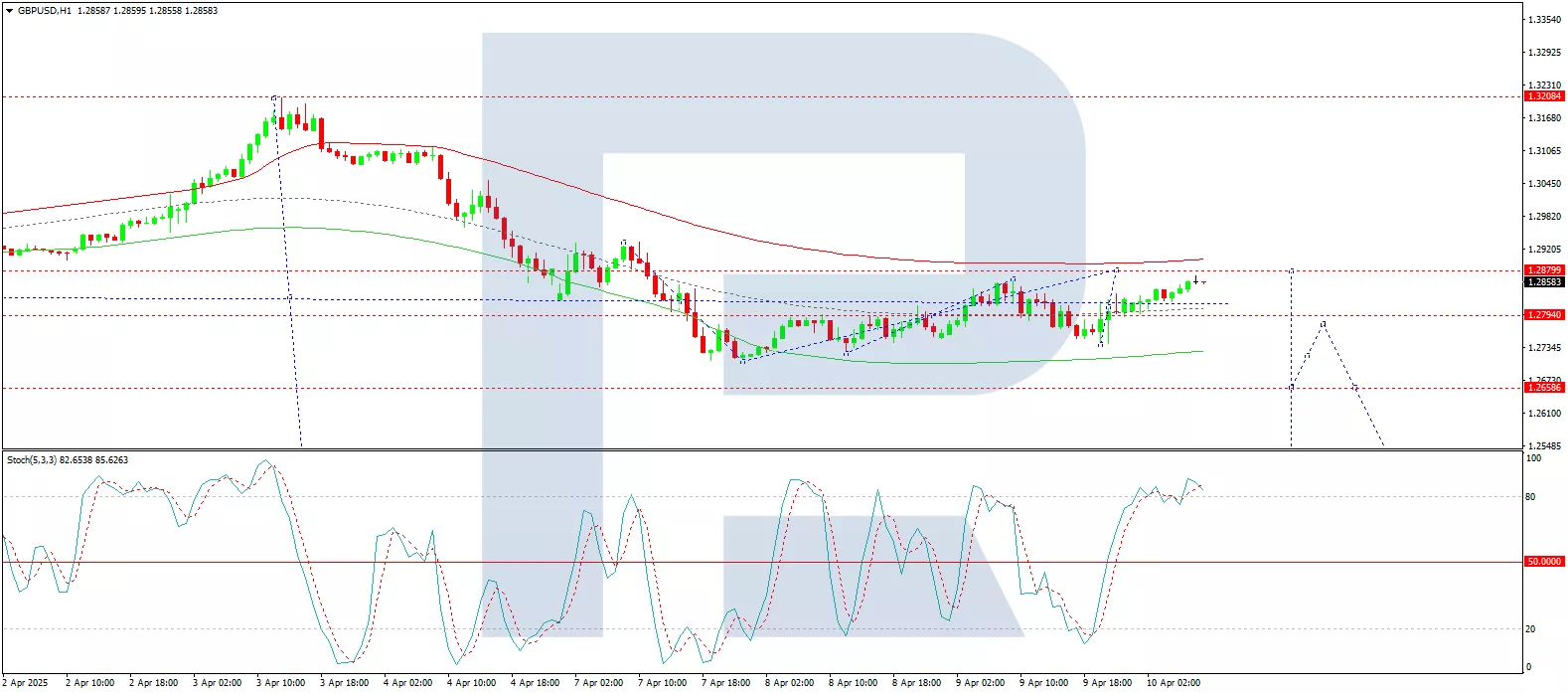

H1 Chart Analysis

(Click on image to enlarge)

- The pair has formed a tight consolidation range near 1.2794, with scope for a rise to 1.2880 to complete the current growth wave

- A subsequent decline back to 1.2794 is likely, potentially forming a new consolidation range

- A breakout upwards could see a correction towards 1.2934, while a downward exit may extend the downtrend to 1.2450

- The Stochastic oscillator aligns with this view, as its signal line sits above 80 but is trending downward towards 20

Conclusion

While the Pound benefits from Dollar weakness, the BoE’s evolving rate-cut trajectory and external trade risks could challenge further gains. Traders should monitor technical levels and central bank signals closely.

More By This Author:

Japanese Yen Recovers Some Losses As Investors Seek Safe-Haven Assets

USD/JPY Collapses To A 6-Month Low: Safe-Haven Assets In Demand

GBP/USD Hits 21-Week High: The Pound Outperforms Its Peers

Disclaimer: Any forecasts contained herein are based on the author's particular opinion. This analysis may not be treated as trading advice. RoboForex bears no responsibility for ...

more