Politics Might Support GBP

Photo by Colin Watts on Unsplash

GBP/USD is balancing at 1.1987 on Monday. The Pound Sterling remains under pressure despite a recent rebound caused by political news.

British Prime Minister Boris Johnson's resignation drama seems to be gathering pace – it’s going to be a long story. First of all, the Conservative party has to find a new leader, and it will surely take some time. Until then, Johnson will continue to carry out his duties. Secondly, a reshuffle of the Cabinet is ahead –some of the ministers resigned due to disagreement with the current policy, while the others might be reassigned by the next Prime Minister. Market rumors have it that such global changes in British policy might solve some aspects of political uncertainty; for example, the Bank of England might finally raise its interest rates. If so, it’s nothing but positive for the Pound.

Currencies seldom respond to political changes in a positive way, but the Pound may get a lot of opportunities here.

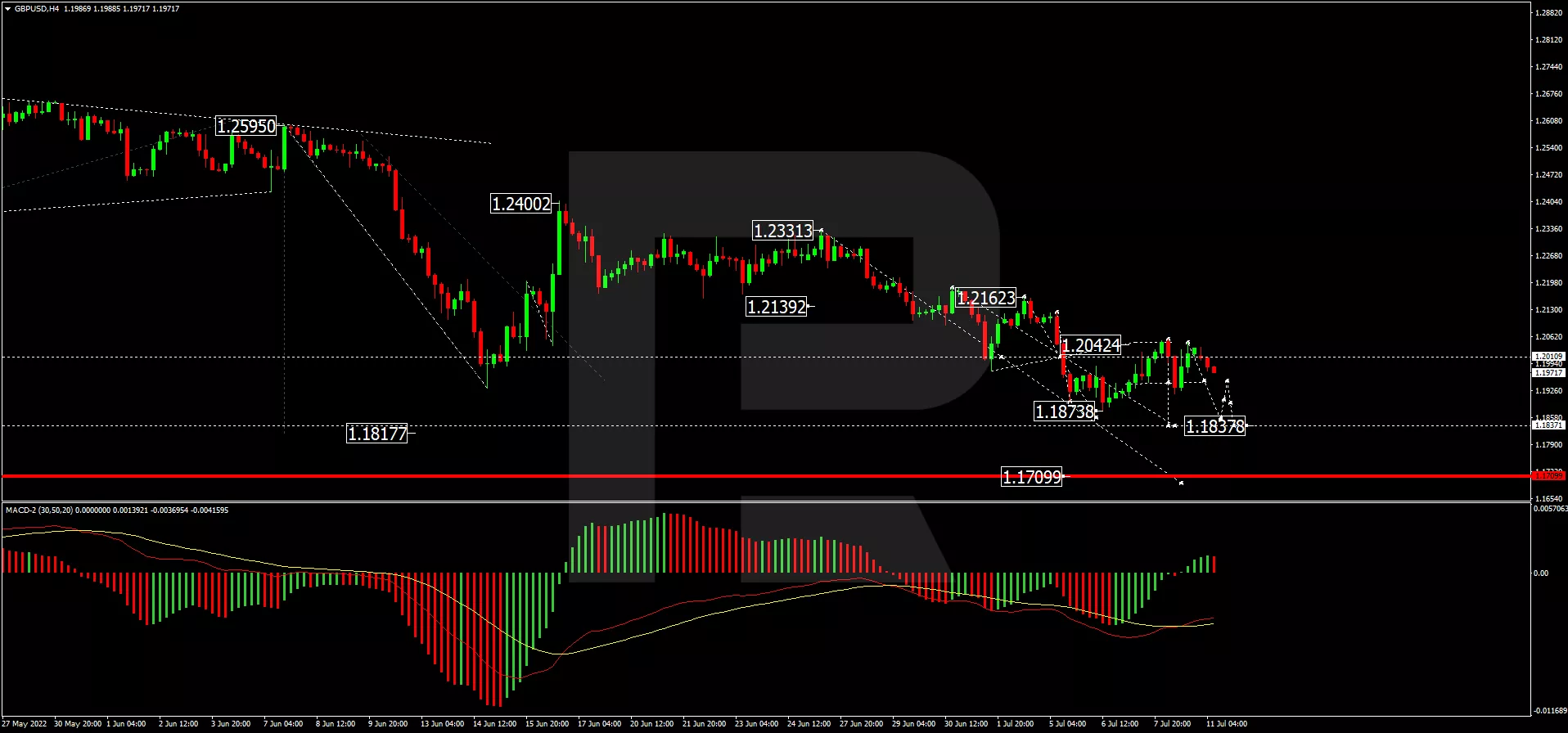

As we can see in the H4 chart, after rebounding from 1.2042, GBP/USD is forming another descending wave towards 1.1837 and may consolidate there. Later, the market may correct test 1.2042 from below and then resume trading within the downtrend with the target at 1.1700. From the technical point of view, this scenario is confirmed by the MACD Oscillator: its signal line is moving below 0 and may continue falling to update the lows.

(Click on image to enlarge)

In the H1 chart, having completed the descending impulse at 1.1919 along with the correction up to 1.2020, GBP/USD is forming another descending structure towards 1.1944 and may later consolidate there. If the price breaks this range to the downside, the market may resume moving within the downtrend with the short-term target at 1.1856, and then start a new growth to test 1.1944 from below. After that, the pair may resume falling towards 1.1837. From the technical point of view, this scenario is confirmed by the Stochastic Oscillator: after breaking 50 and reaching 20, its signal line is expected to return to 50, rebound from it again, and resume falling to re-test 20.

(Click on image to enlarge)

More By This Author:

Gold Price Analysis: Too Much Pressure

Crude Oil Is Consolidating

Japanese Yen Might Change The Trend

Disclaimer: Any forecasts contained herein are based on the author's particular opinion. This analysis may not be treated as trading advice. RoboForex bears no responsibility for trading ...

more