New Record Highs For Bitcoin & Gold As Dollar Suffers Worst Week In Three Months

Image Source: Unsplash

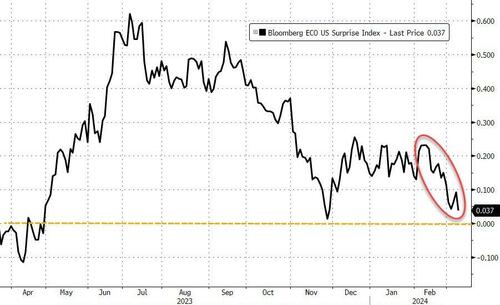

US macro data serially disappointed this week.

Source: Bloomberg

'Bad' news was good news for the doves, and the market's expectations for rate-cuts in 2024 ticked back up to 4 rate-cuts (from 3).

Source: Bloomberg

Bonds were bid on the week, with the belly outperforming the wings.

Source: Bloomberg

The 10-year yield dropped down to almost 4.0% (closing below its 50-DMA) at its lowest in almost six weeks.

Source: Bloomberg

While yields were lower on the week, stocks were more mixed, with the Nasdaq down on the week as a red-end to the week for mega-cap tech spoiled the party. Magnificent 7 stocks ended the week lower after fading from Friday's gains.

Source: Bloomberg

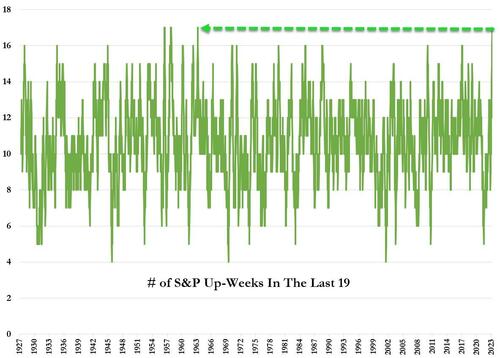

Small-caps outperformed, The Dow lagged, and the S&P 500 desperately tried to close green on the week (but failed).

If it had closed green, that would have been the 17th positive week in the last 19 -- the greatest streak in stocks since 1964.

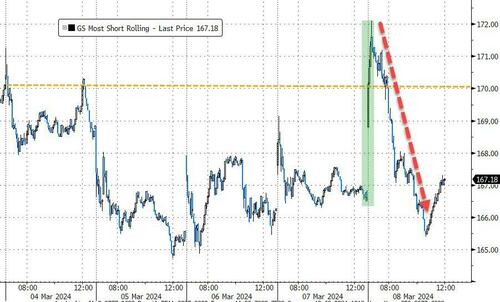

The 'most shorted' stocks were squeezed hard at the open on Friday, moving into the green for the week, before tumbling back to the lows of the week.

Source: Bloomberg

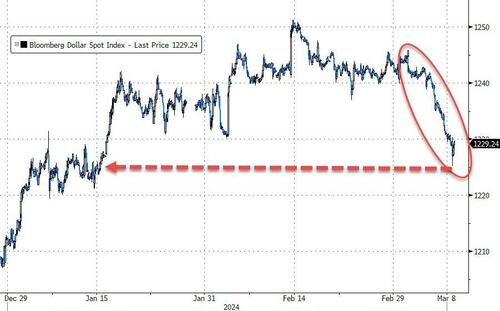

The dollar was down for the sixth straight day on Friday, ending the worst week in three months for the greenback.

Source: Bloomberg

And dollar weakness helped spur the gains in gold, which soared to a new record high just shy of $2200 on Friday. Gold has been up for eight straight days -- the longest winning streak since July 2020.

Source: Bloomberg

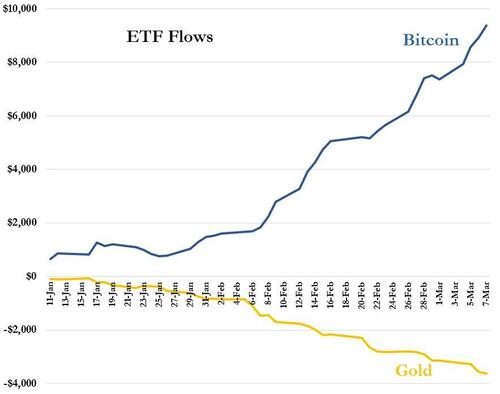

The gains in gold continued despite seeing outflows from gold ETFs (as Bitcoin ETF inflows soared).

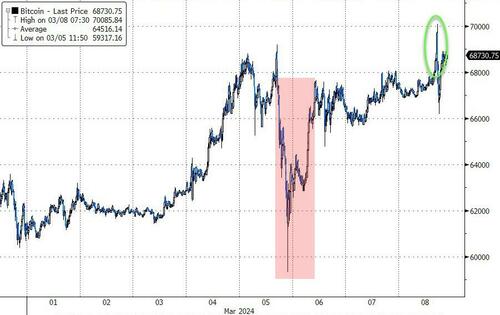

And in the meantime, cryptocurrencies roared higher this week, with Bitcoin topping $70,000 (a new record high) for the first time.

Source: Bloomberg

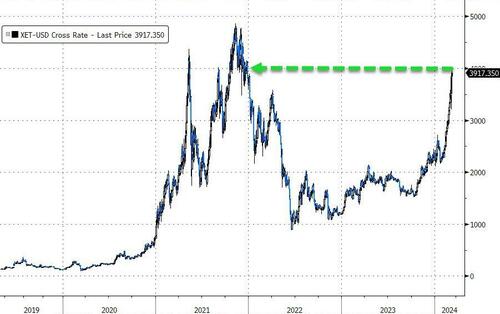

But, Ethereum outperformed Bitcoin on the week (+14% vs +10%), hitting the $4000 figure.

Source: Bloomberg

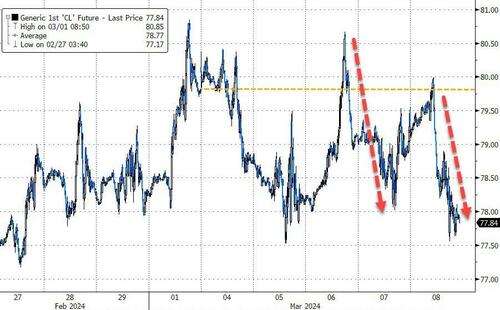

Oil prices ended the week lower (at the low end of its recent range).

Source: Bloomberg

Finally, this is nuts. Yes, a trillion dollars added year-to-date.

Source: Bloomberg

And this next chart should be noted, as well.

Source: Bloomberg

More By This Author:

Rivian Shelves New Georgia Factory In Latest Cost-Cutting Measures

JP Morgan Looked To Acquire Discover Before Capital One

Large US Banks Saw Over $7BN Deposit Outflows Amid NYCB Chaos Last Week

Disclosure: Copyright ©2009-2024 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more