Macro Briefing - Monday, June 16

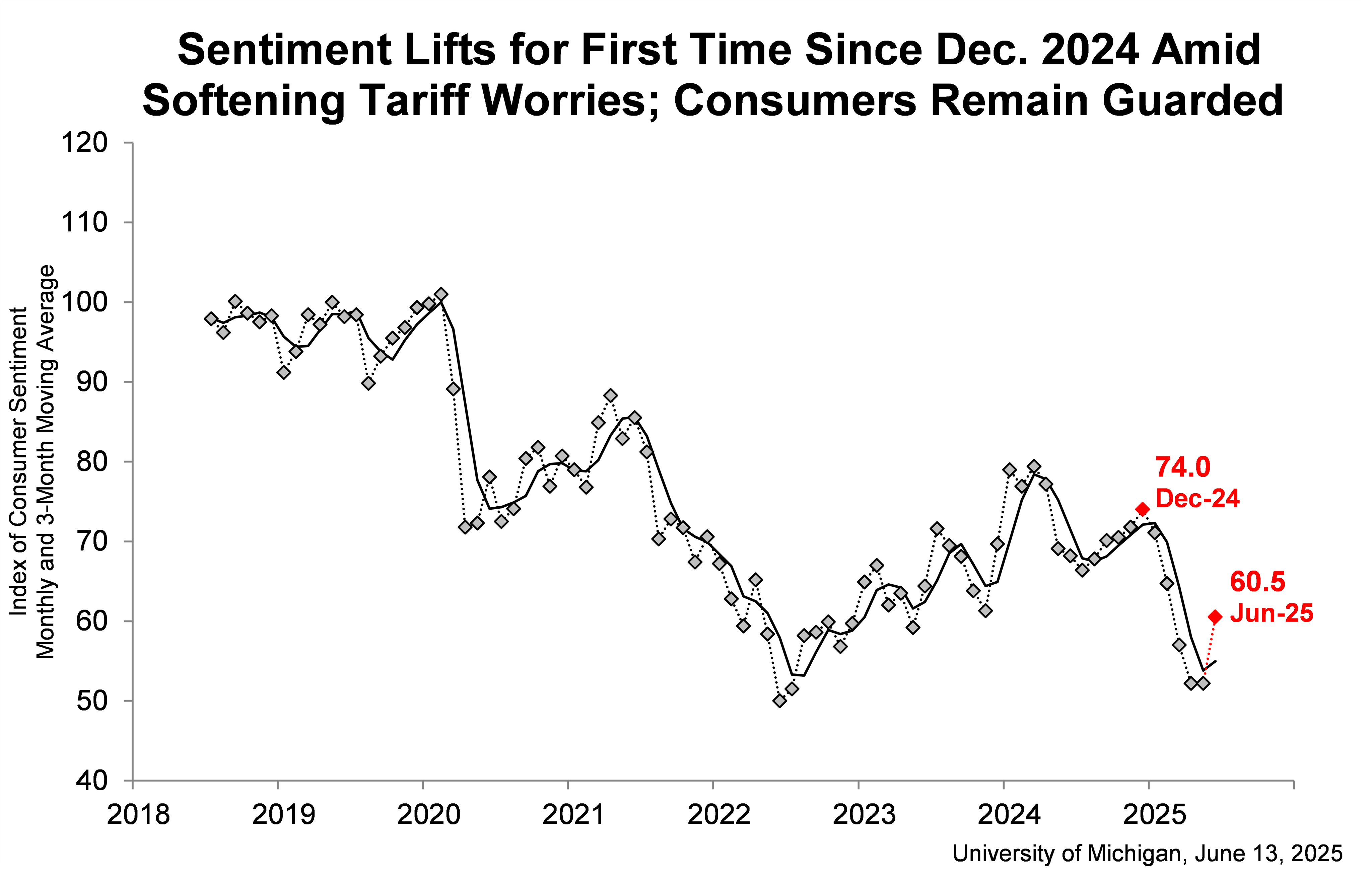

US consumer sentiment improved in June for the first time this year. The rise was modest and still leaves the University of Michigan’s index about 20% below December 2024, when sentiment posted a post-election bump. “Consumers appear to have settled somewhat from the shock of the extremely high tariffs announced in April and the policy volatility seen in the weeks that followed. However, consumers still perceive wide-ranging downside risks to the economy,” said Joanne Hsu, survey director, said in a statement.

(Click on image to enlarge)

Israel and Iran attacks continue for a fourth day as both countries widen their targets. Iranian missiles struck Israel’s Tel Aviv and the port city of Haifa on Monday. The Israeli Air Force destroyed more than 20 surface-to-surface missiles on Sunday evening.

Ahead of tomorrow’s Fed policy announcement, Former Cleveland Fed president advised that the central bank will keep rates steady for near term. “The Fed is on hold until we get a little more clarity about not only the magnitude of the tariffs and the breadth of the tariffs, but what effect they all have on inflation and what effect the tariffs and other policies, including the budget bill, will have on growth and employment,” said Loretta Mester.

Investors are watching Treasury yields for signs that the Israel-Iran conflict will trigger a selloff in bonds.

“Steepening pressures on the Treasury curve could continue,” said Wei Liang Chang, Singapore-based macro strategist at DBS Group Holdings Ltd. “Investors may weigh a rise in military expenditure over the longer term due to a more uncertain geopolitical environment, and risks of inflation turning sticky if oil prices are to stay elevated.”

US dollar continues to slide, sinking to 3-year low. The decline “took the currency past the low it hit in the wake of Trump’s ‘liberation day’ tariff blitz in early April and to its weakest level since March 2022, according to the FT.

More By This Author:

The Israel-Iran Conflict Complicates The Macro OutlookMacro Briefing - Friday, June 13

Macro Briefing - Thursday, June 12

Disclosure: None.