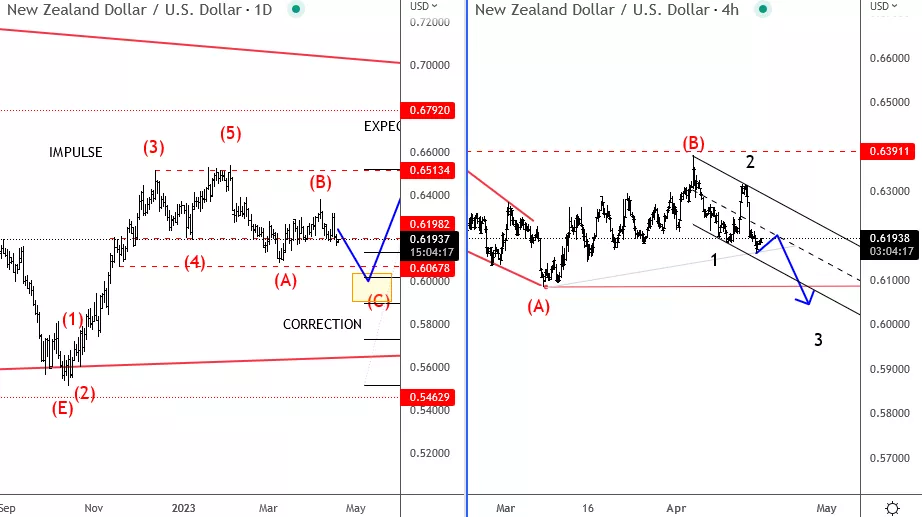

Kiwi Has Room For More Weakness Towards 0.6 Level

Photo by Jay Gomez on Unsplash

NZDUSD recovered nicely from 0.6083 but it's in three waves after recent rejection down from 0.6390 resistance. We see this as a potential corrective rally that represents (B) wave, possibly already completed after the lower swing high and new swing low formed in the last few trading days. Ideally, the pair is headed south for five wave drop within (C) which has room even for 0.6000. However, this wave (C) is still part of a higher degree contra-trend movement, so we believe that kiwi will turn bullish this year, but from lower support levels, according to the daily count.

Big Picture

On a higher degree chart, we see the pair turning up from an important trendline of a potential triangle, so wave (E) can be finished. As such, more gains will be expected in the upcoming weeks/months.

For a more detailed analysis check our video below:

Video Length: 00:41:40

More By This Author:

Silver Can See More Gains After A Pullback

Bonds Are Ready For Further Recovery

USDNOK Is In Free Fall

Disclosure: Please be informed that information we provide is NOT a trading recommendation or investment advice. All of our work is for educational purposes only. Visit www.wavetraders.com for more ...

more