JPY Has Sharply Strengthened

Image Source: Pixabay

The yen’s exchange rate rose to the US dollar on Thursday in response to improving prospects for the Federal Reserve interest rate. The USD/JPY pair has declined to 153.88.

After the US released up-to-date data on April inflation, the likelihood of a reduction in the cost of borrowing in the country increased markedly. Both the overall and the core consumer price index slowed in April, while retail sales stagnated. Hypothetically, an interest rate cut from the Federal Reserve means a narrower gap between the Federal Reserve and the Bank of Japan’s monetary approaches, which is a positive signal for the yen.

Japan’s GDP statistics were weaker than expected, with Japan’s economy contracting by 2.0% y/y in Q1 2024 compared to the expected decline of 1.5%. The primary driver is weak private consumption, which has been declining for four consecutive quarters.

Such a report considerably complicates the operations of the Bank of Japan. The regulator needs to take action to keep a balance between supporting the economy and fighting the consequences of the weak yen.

USD/JPY Technical Analysis

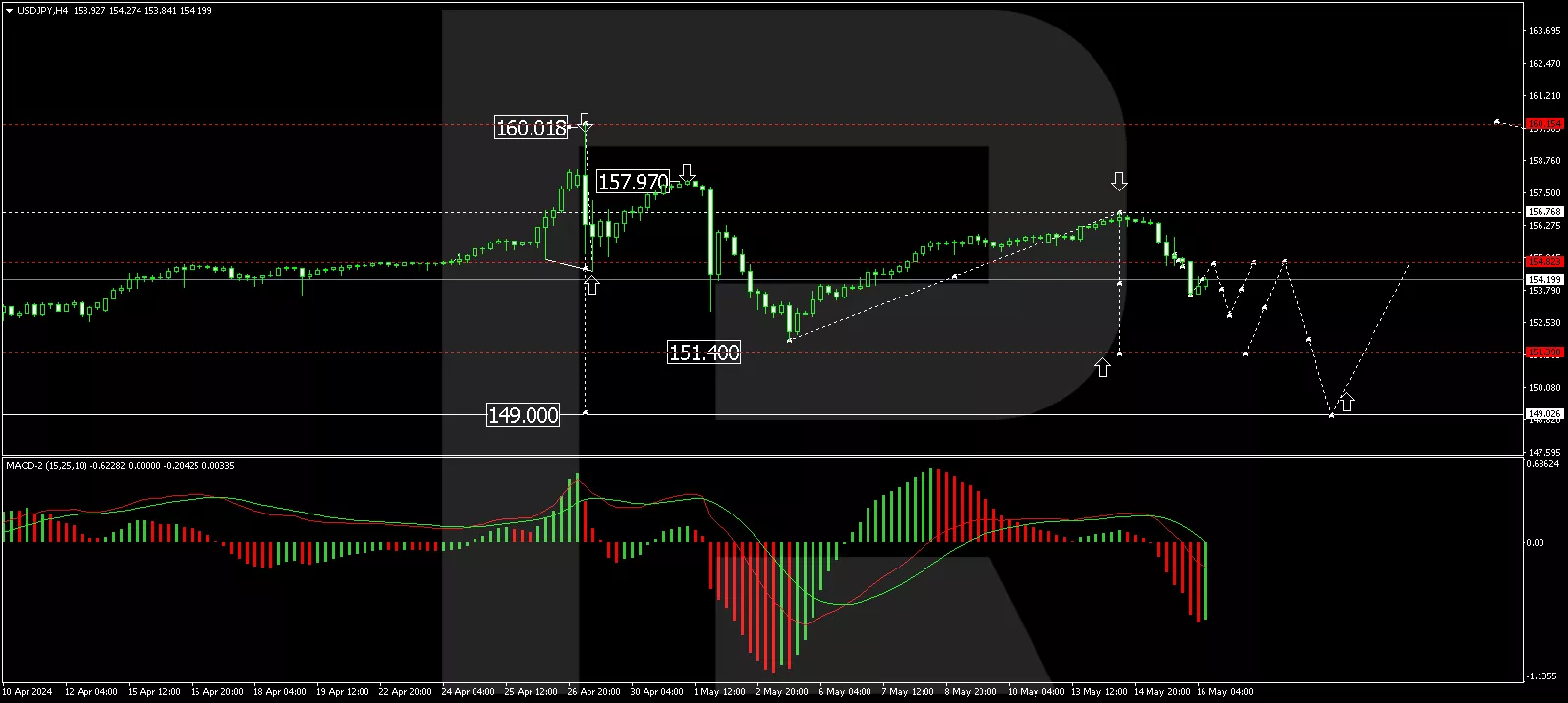

On the H4 chart, USD/JPY has completed a corrective wave, reaching 156.76. Today, another decline towards 151.40 is forming. After the price reaches this level, a correction could start, aiming for 154.80 (testing from below). Subsequently, the trend might continue to 149.00 representing the first target of the decline wave. This scenario is technically confirmed by the MACD oscillator, with its signal line below the zero level, directed strictly downwards.

(Click on image to enlarge)

On the H1 chart, USD/JPY has completed an impulse structure, reaching 154.80. A narrow consolidation range has formed around this level. Today, with a downward breakout, the price has reached the local target of 153.60. Next, a rise to 154.80 (testing from below) is expected, followed by another possible decline wave, aiming for 152.90 and potentially continuing to 151.40. Technically, this scenario is confirmed by the Stochastic oscillator, with its signal line above 20, poised to rise to the 80 mark.

(Click on image to enlarge)

More By This Author:

Euro Climbs To Five-Week High Ahead Of US CPI Data

JPY Declines Again

Brent Crude Oil Faces Downward Pressure Amid Demand Uncertainties

Disclaimer: Any forecasts contained herein are based on the author's particular opinion. This analysis may not be treated as trading advice. RoboForex bears no responsibility for ...

more