Japanese Yen (USD/JPY) Outlook – The Battle With Technical Support Resumes

Today’s FOMC policy decision and updated economic projections look set to steer the US dollar, and a range of FX pairs, going into the Christmas break and beyond. The US dollar has weakened over the last two months and one pair that has been noticeably driven by the USD/JPY is now under renewed pressure. Technical indicators are also coming into play.

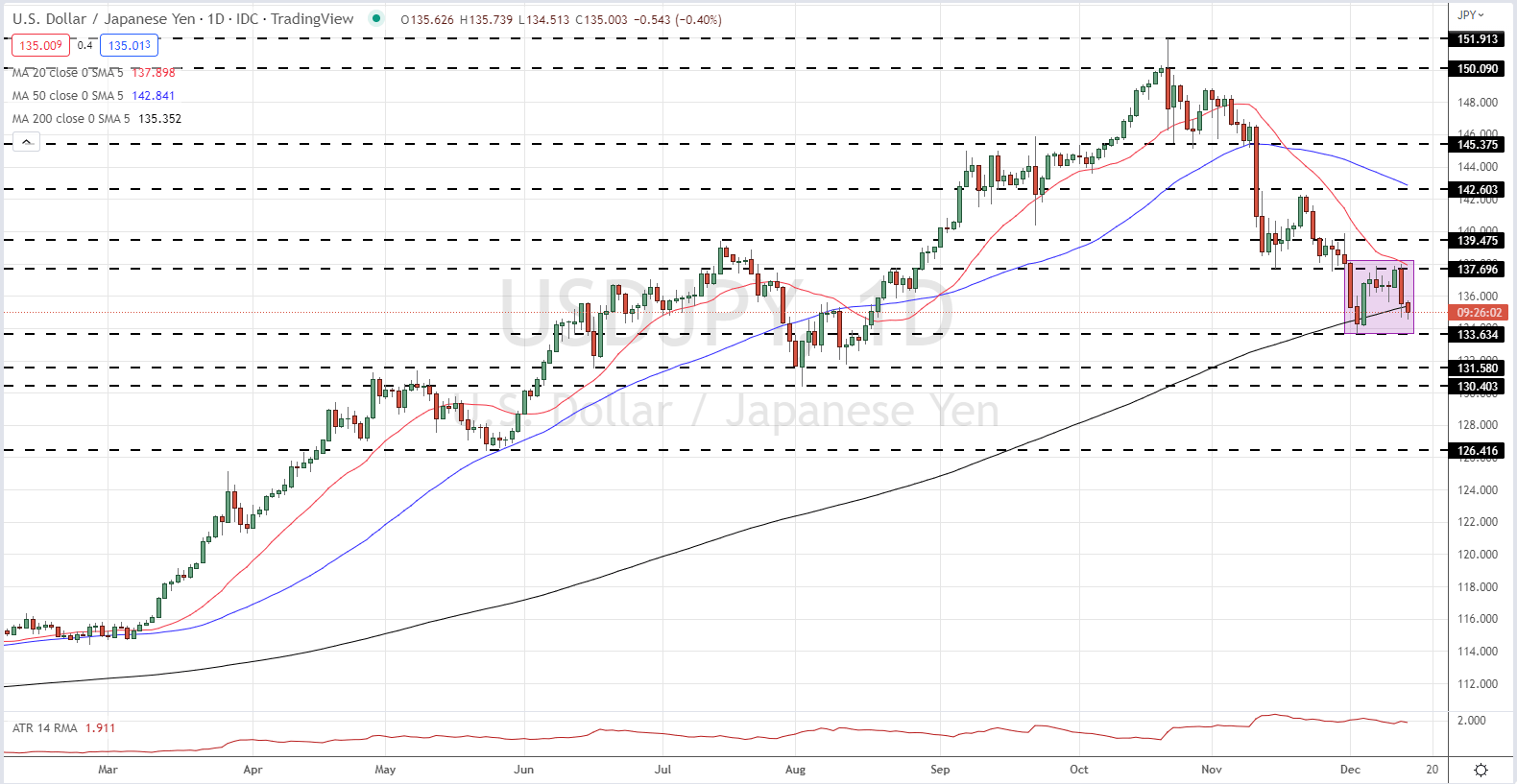

The US dollar has lost around 10% of its value against the Japanese Yen in the last two months and is now probing a fresh multi-month low. The move lower, driven primarily by the greenback, has seen the pair test the 200-day moving average once again, and a confirmed break below could add further downside pressure.

The daily USD/JPY chart looks weak and further losses look likely. A break below the 200-DMA leaves the 133.63 recent swing-low vulnerable and a close and open below this level would suggest that 130.40 is the next area of support for the pair. Below here, 126.42 comes into view. Resistance on either side of 138.00 has been held recently and is likely to hold any fresh attempt.

USD/JPY Daily Price Chart

(Click on image to enlarge)

Chart via TradingView

Retail Trader Sentiment Is Mixed

Retail trader data show 43.04% of traders are net-long with the ratio of traders short to long at 1.32 to 1. The number of traders net-long is 6.02% higher than yesterday and 6.30% lower from last week, while the number of traders net-short is 7.23% lower than yesterday and 4.20% higher from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests that USD/JPY prices may continue to rise. Positioning is less net-short than yesterday but more net-short from last week. The combination of current sentiment and recent changes gives us a further mixed USD/JPY trading bias.

What is your view on the USD/JPY – bullish or bearish?

More By This Author:

Euro (EUR/USD) Latest - Braced For A Fed And ECB Double-Header

US Dollar Volatility Primed To Move With CPI, FOMC Within Touching Distance

US Dollar (DXY) Outlook – One Last US Data Drop Before CPI And FOMC Next Week

Disclosure: See the full disclosure for DailyFX here.