Japanese Yen Slightly Rises Against USD

The Japanese yen slightly increased against the US dollar on Monday, with the USD/JPY pair holding near 156.73.

Investors have already priced in previous remarks from Bank of Japan (BoJ) officials. BoJ Governor Kazuo Ueda emphasized the need to anchor inflation expectations before revisiting interest rate decisions, highlighting the challenge of accurately determining the necessary interest rate level.

BoJ Deputy Governor Shinichi Uchida stated that the final battle against deflation is close, predicting continued wage growth.

Last week, the yen experienced pressure from statistics, which reflected a slowdown in Japan's core inflation to 2.2% in April from 2.6% in March, with food inflation contributing significantly to the decrease. Overall inflation fell to 2.5% in April from 2.7% in March, marking the second consecutive month of decline. Given the BoJ's efforts to reduce price pressure, these figures are concerning.

Externally, the yen experienced further pressure from robust US economic data and the hawkish tone of the Fed minutes.

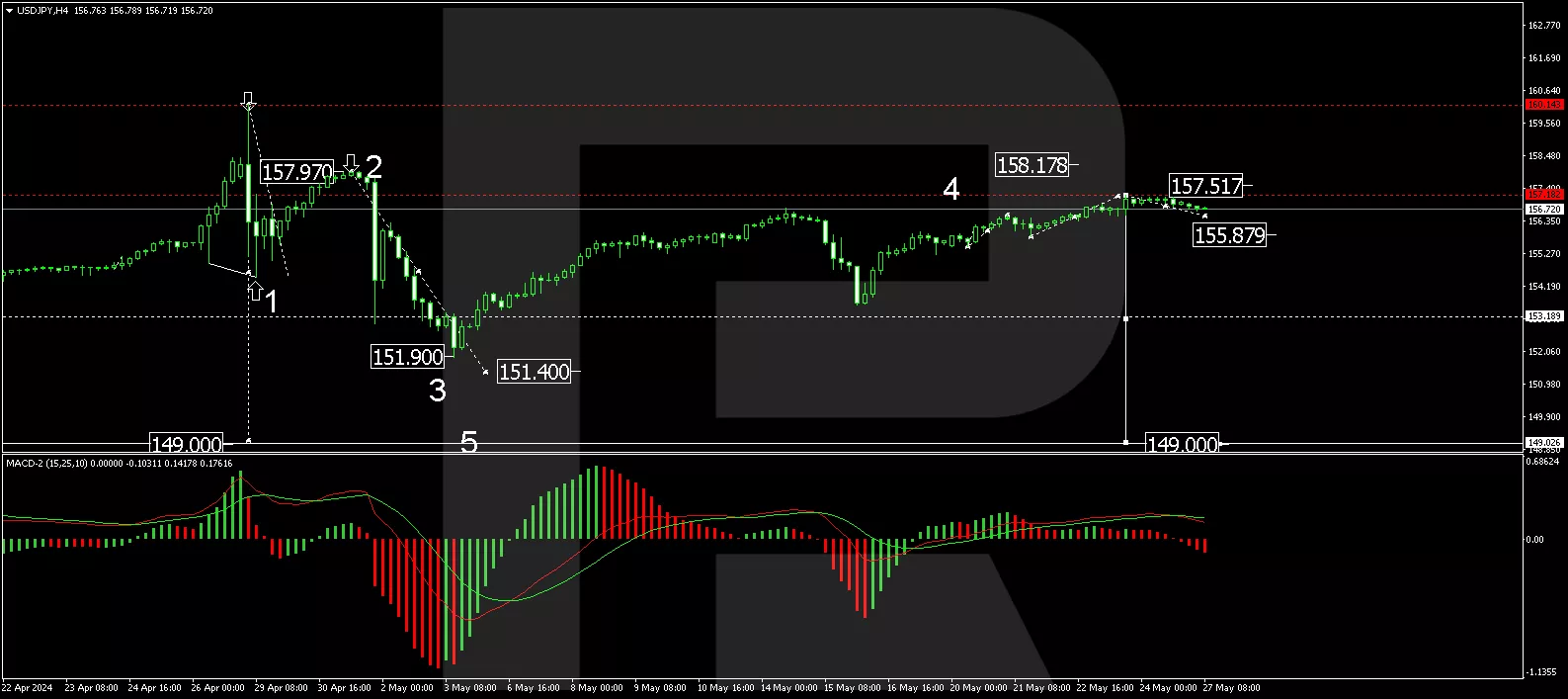

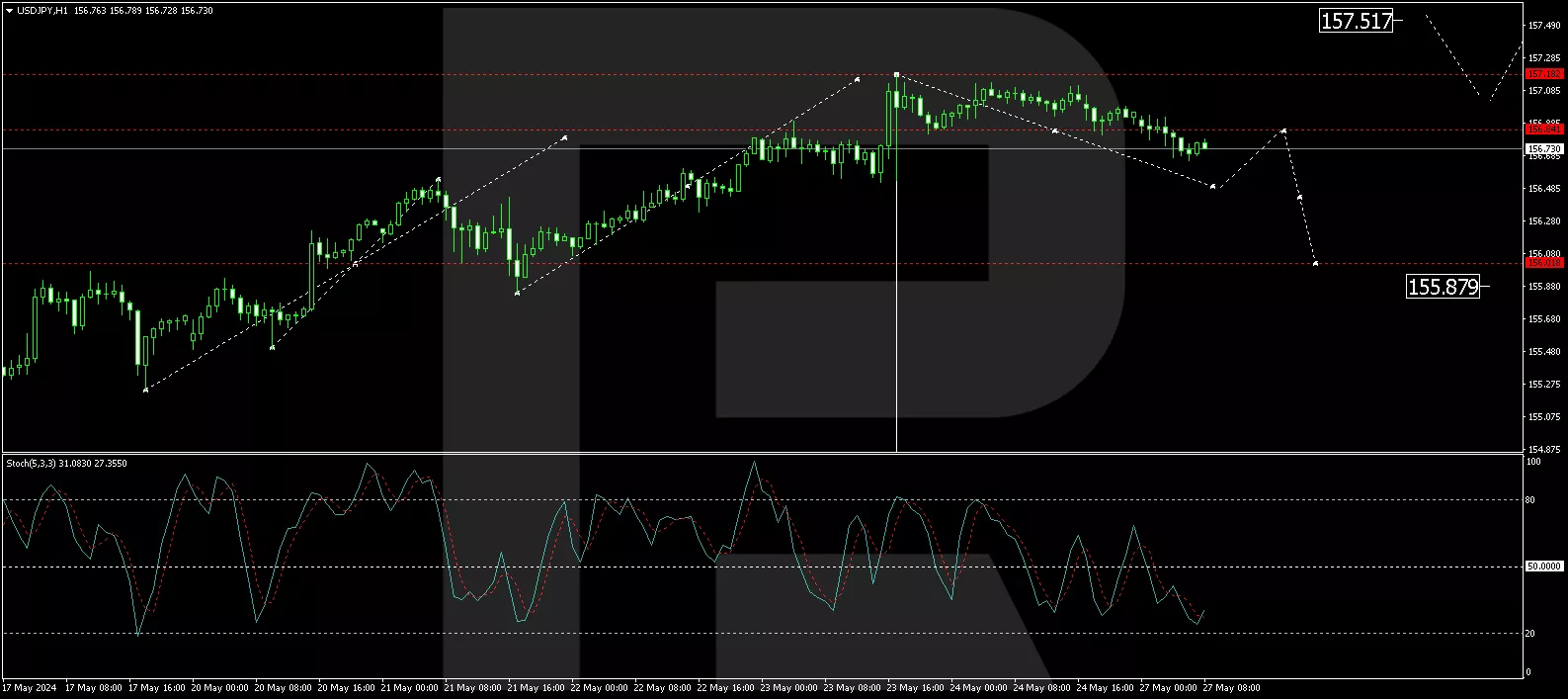

Technical analysis of USD/JPY

On the H4 chart, USD/JPY has completed a correction wave towards 157.18 and is now forming a consolidation range below this level. An upward breakout could extend the structure to 157.51. Conversely, a downward breakout could initiate a new decline wave towards 153.20, potentially extending to 149.00. This scenario is technically supported by the MACD indicator, with its signal line above zero and pointing strictly downwards.

On the H1 chart, USD/JPY has completed a growth wave towards 157.18, followed by a downward impulse to 156.84. A narrow consolidation range has now formed around this level. A downward breakout from this range could lead to a continuation of the decline to 156.50, with a subsequent correction to 156.84 (testing from below). Further decline to 155.90 is possible. This scenario is technically confirmed by the Stochastic oscillator, with its signal line below 50 and ready to drop to 20.

Summary

The Japanese yen's slight rise against the US dollar is influenced by BoJ officials' comments and recent economic data. Technical indicators suggest the potential for both upward and downward movements, with significant support and resistance levels to watch. Investors should closely monitor these levels and market conditions.

Disclaimer

Any forecasts contained herein are based on the author's particular opinion. This analysis may not be treated as trading advice. RoboForex bears no responsibility for trading results based on trading recommendations and reviews contained herein.

More By This Author:

The Australian Dollar Rapidly Depreciates

Gold Falls From Highs

The New Zealand Dollar Shows A Steady Rise

Disclaimer: Any forecasts contained herein are based on the author's particular opinion. This analysis may not be treated as trading advice. RoboForex bears no responsibility for ...

more