Japanese Yen Short-Term Technical Outlook: USD/JPY Rally Vulnerable

The US Dollar is attempting to mark a fifth consecutive weekly advance against the Japanese Yen with USD/JPY trading less than 1.5% off the yearly highs. While the broader outlook remains constructive, the immediate advance may be vulnerable in the days ahead after reversing off uptrend resistance. These are the updated targets and invalidation levels that on the USD/JPY near-term chart. Review my latest Weekly Strategy Webinar for an in-depth breakdown of thisYen technical setup and much more!

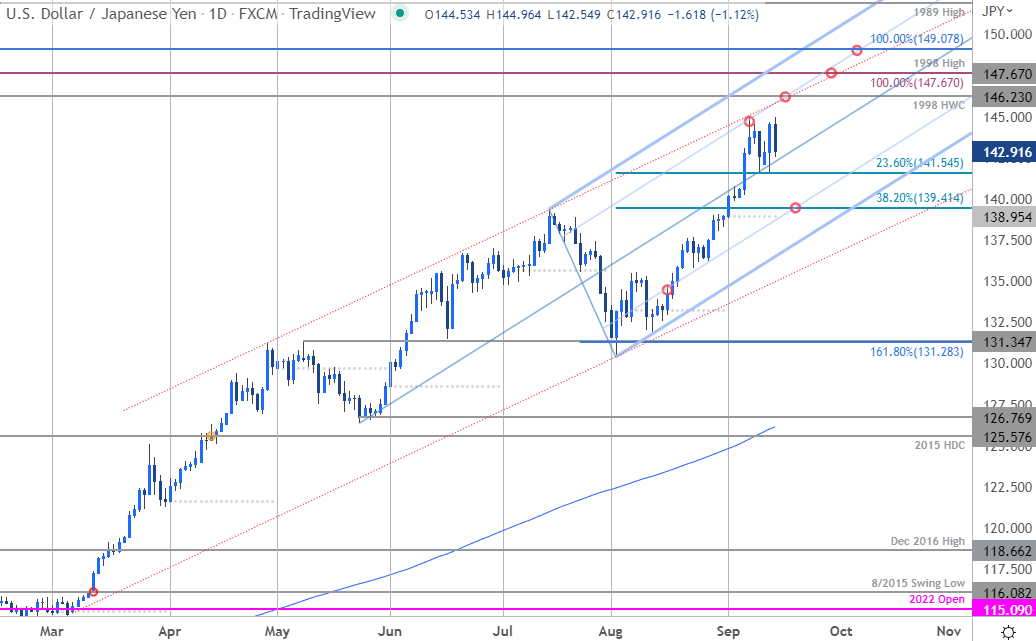

Japanese Yen Price Chart – USD/JPY Daily

(Click on image to enlarge)

Chart Prepared by Michael Boutros, Technical Strategist; USD/JPY on Tradingview

Technical Outlook: USD/JPY is trading within the confines of a broad ascending channel formation extending off the March lows with an embedded pitchfork formation extending off the May low guiding the most recent advance. The four-week rally off the August lows may be threatening exhaustion here after reversing off the 61.8% parallel earlier in the month with daily momentum divergence further highlighting the risk. That said, the focus is on this pullback with respect to the median line and we’re looking for a breakout of the objective weekly opening range to offer some guidance here.

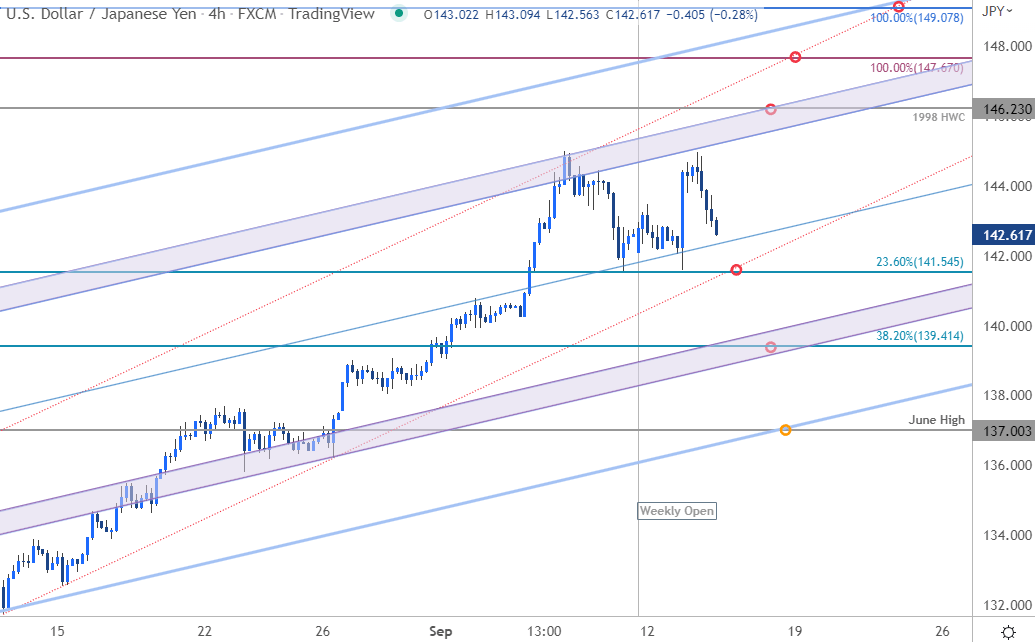

Japanese Yen Price Chart – USD/JPY 240Min

(Click on image to enlarge)

Chart Prepared by Michael Boutros, Technical Strategist; USD/JPY on Tradingview

Notes: A closer look at USD/JPY Price action shows highlights yesterday’s US CPI surge which essentially defined the weekly opening range just above the median line. A break below near-term support at 141.55 would threaten a larger pullback within the uptrend towards the 38.2% Fibonacci retracement of the August rally at 139.41. Ultimately, a break below the 137-handle would be needed to invalidate the broader uptrend.

A topside breach of the weekly range-highs exposes subsequent resistance objectives at the 1998 high-week close at 146.23 backed by the 1998 high at 147.67 and the 100% extension of the 2011 advance at 149.07- look for a larger reaction in their IF reached.

Bottom line: A reversal of uptrend support threatens a bull-market correction- the immediate focus is on a break of the weekly opening range for guidance. From a trading standpoint, losses should be limited to the lower parallel / 137 IF price is heading higher on this stretch with a breach / close above 146.23 needed to clear the way. Review my latest Japanese Yen Weekly Price Outlook for a closer look at the longer-term USD/JPY technical trade levels.

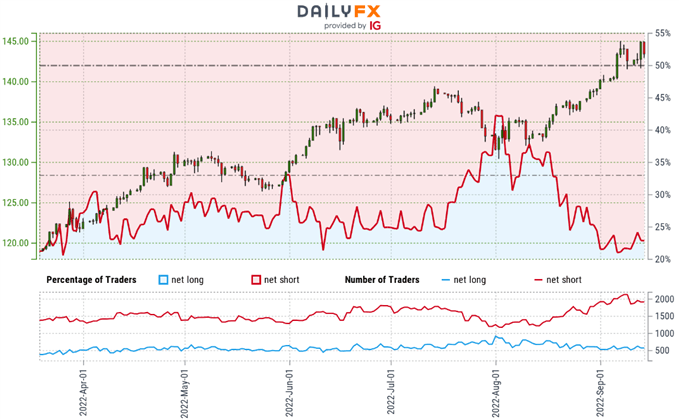

Japanese Yen Trader Sentiment – USD/JPY Price Chart

- A summary of IG Client Sentiment shows traders are net-short USD/JPY - the ratio stands at -3.23 (23.65% of traders are long) – typically bullish reading

- Long positions are1.83% lower than yesterday and 7.82% lower from last week

- Short positions are6.26% lower than yesterday and 7.40% lower from last week

- We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests that USD/JPY prices may continue to rise. Traders are less net-short than yesterday but more net-short from last week. The combination of current positioning and recent changes gives us a further mixed USD/JPY trading bias from a sentiment standpoint.

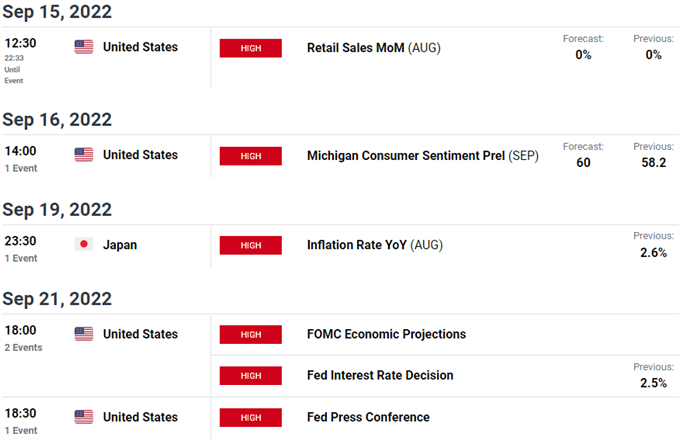

US /JAPAN Economic Calendar

More By This Author:

Crude Oil Prices Gain Amid USD Softness, Bulls Eye Key Trendline ResistanceS&P 500 And Nasdaq 100 Sink As High Inflation Bolsters Case For Hawkish Fed

US Dollar Price Action Setups: EUR/USD, GBP/USD, USD/CAD, JPY/USD

Disclosure: See the full disclosure for DailyFX here.