Investors Flooded Into Money-Market Funds & Bank Deposits As Markets Crashed

Image Source: Pexels

Money-market fund assets rose to a fresh record ($6.19TN) as a global selloff in risk assets earlier in the week sent investors flying into cash. About $52.7BN flowed into US money-market funds in the week through Aug. 7, the largest weekly inflows since the period ended April 3 (Tax-Day prep)...

Source: Bloomberg

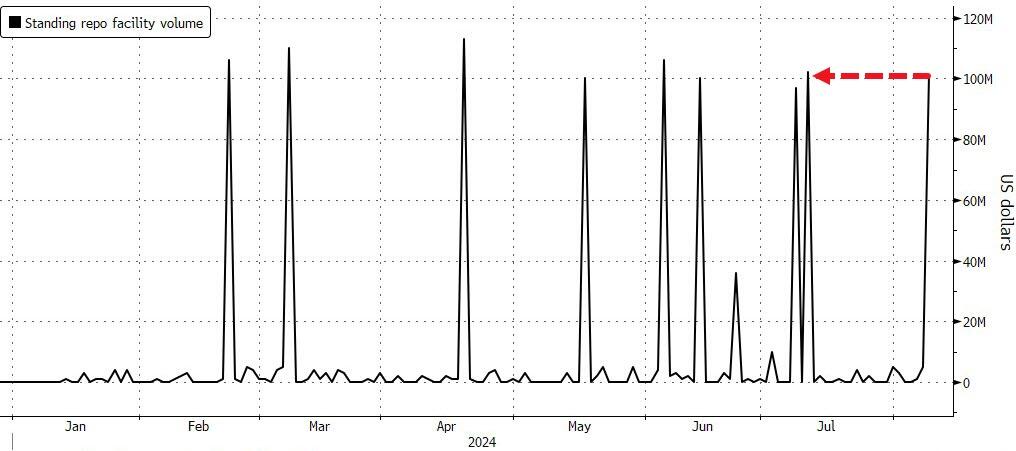

Also of note this week, demand for a rarely used Federal Reserve facility rose to the highest level in almost a month on Thursday as counterparties tested its accessibility.

Counterparties tapped the Fed’s Standing Repo Facility, or SRF - where eligible banks can borrow reserves in exchange for Treasury and agency debt - for $101 million on Thursday, the most since July 11.

There’s been at least one pop in usage every month since February, which suggests banks are testing their systems, though with minuscule amounts for a facility that at its peak attracted $153 billion in March 2020

Source: Bloomberg

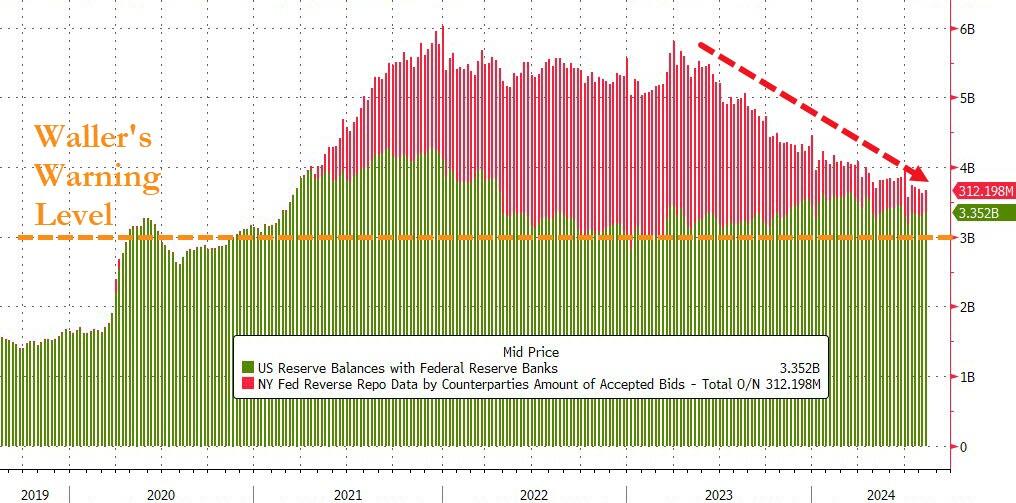

Reserves are closing in on the $3 trillion level Federal Reserve Board member Christopher Waller has touched upon as the lowest comfortable level of reserves, i.e. the level that funding problems could manifest.

The RRP represents a sort of buffer on top of the current level of reserves, as (principally) money market funds can draw down it, adding to reserves in the process.

Source: Bloomberg

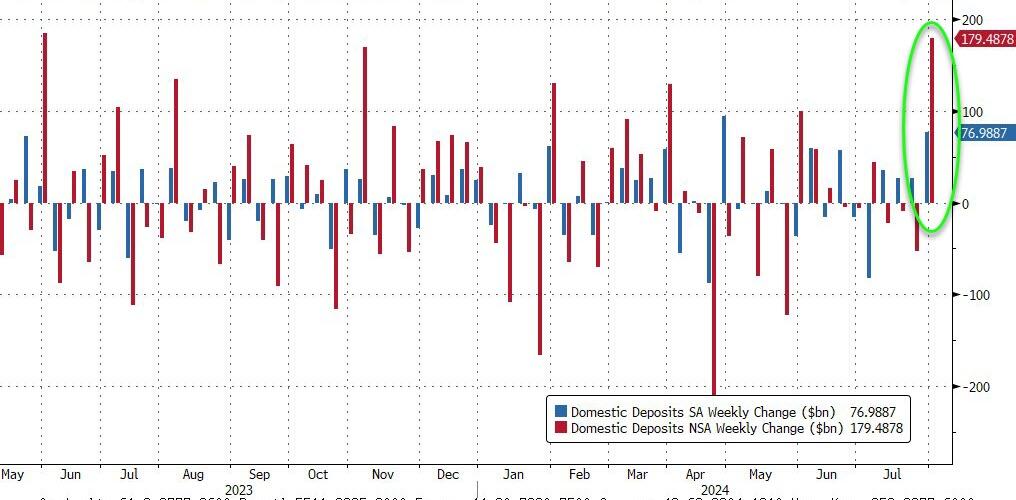

As all of that was happening, and yen carry trades unwound, US bank deposits soared on both a seasonally-adjusted (+$90BN) and non-seasonally-adjusted (+$189BN) basis.

That surge pushes SA deposits back above pre-SVB levels for the first time...

Source: Bloomberg

The NSA rise is the largest since May 2023 and the SA rise in deposits is the largest since the end of April 2024.

Excluding foreign flows, US domestic deposits spiked dramatically: +$77BN SA (large banks +$75BN, small banks +$2BN)..., +$179BN NSA (large banks +$149BN, small banks +$30BN)...

Source: Bloomberg

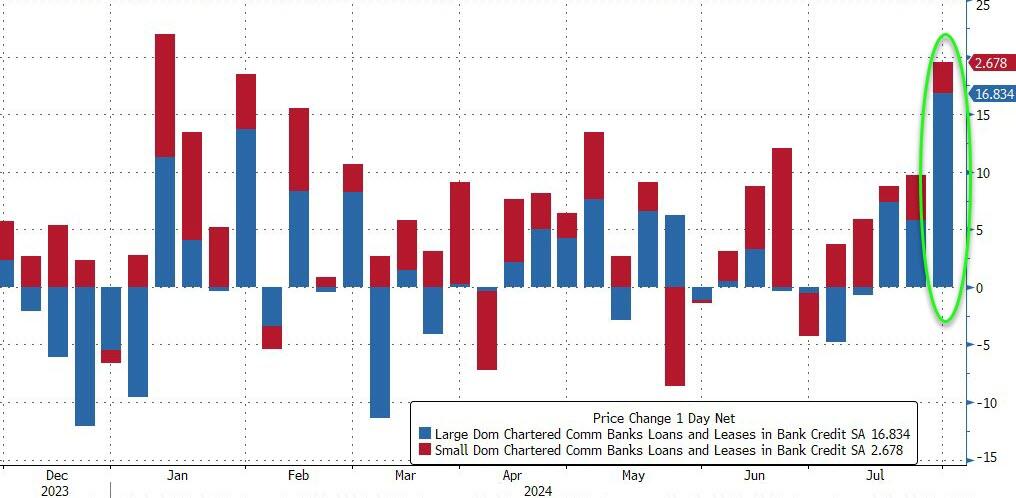

On the other side of the ledge, loan volumes soared by their most since the start of the year with large bank loan volumes rising $16.8BN and small bank loan volumes up $2.7BN...

Source: Bloomberg

Finally, we note that as reserves fade, US equity market capitalization has begun to catch down to that long-tight-correlation...

Source: Bloomberg

The question is - how long will The Fed allow this to drop before juicing reserves once again?

More By This Author:

Cisco Prepares Second Round Of Layoffs Amid Increasing AI SkepticismStocks Surge On Small Drop In Initial Jobless Claims; Continuing Claims Hits 33-Month High

Cocoa Prices Rise As US Stockpiles In Exchange-Monitored Warehouses Hit Four-Year Low

Disclosure: Copyright ©2009-2024 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more