Intraday Analysis - Wednesday, Oct. 1

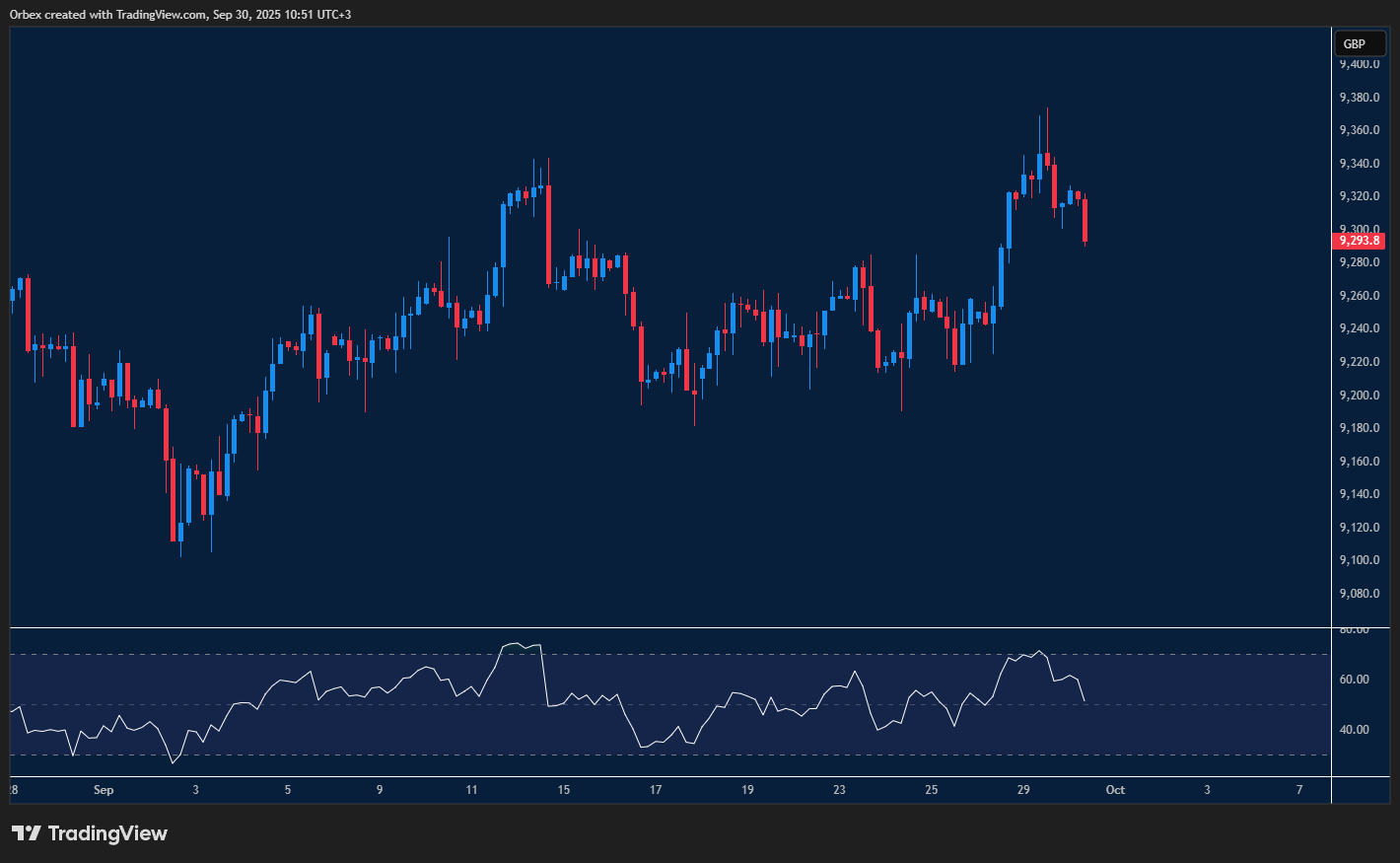

(UK 100) FTSE tests critical floor

(Click on image to enlarge)

The ( UK 100 ) FTSE took a dramatic tumble as price action fell away from its recent high at 9360. The index’s close below 9300 has invalidated the recent spike, putting the bulls under pressure. As the index steadies, look for support. 9260 on the hourly chart represents the first level of support, preventing a full reversal towards 9200. On the upside, 9320 is the first level to clear, giving the buy side a fighting chance to regain some stability.

USDCHF grinds support

(Click on image to enlarge)

The dollar consolidates as traders await signals on whether a deep correction is around the corner. In the wake of the early September sell-off, profit-taking has been driving the pair higher. The upward grind came to a halt at the support-turned-resistance of 0.8000, where bears could be looking to double down. 0.7940 is the closest support to keep the upward slope intact, and its breach would confirm that sellers are here to stay. The bulls will need to lift bids around 0.7980 to extend the recovery above 0.8060.

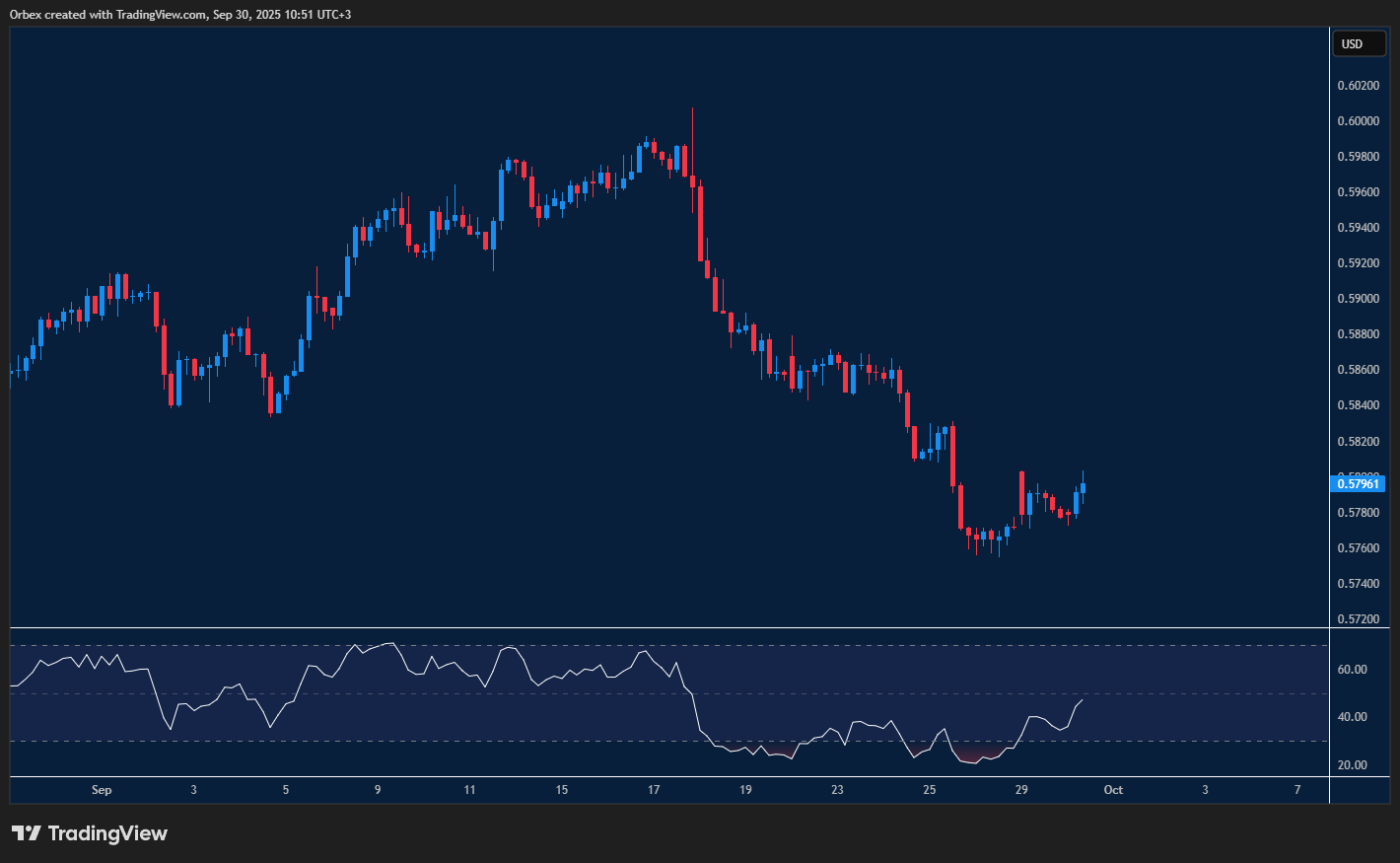

NZDUSD attempts to bounce

(Click on image to enlarge)

The Kiwi attempted to stop the freefall after dropping over 200 pips in the past couple of weeks. The pair is attempting to stabilise above 0.5780, and a bullish divergence on the RSI suggests a slowdown in the sell-off momentum, opening the door to a potential bounce. The first zone, between 0.5840 and the psychological level of 0.5900, is the first obstacle to clear in order to ease the selling pressure. On the downside, 0.5750 serves as a fresh support level in the event of a prolonged consolidation.

More By This Author:

Sell-Off Continues As Oil Loses $4Intraday Analysis - Tuesday, Sep. 30

Gold Keeps Pushing To Break $3800

Disclaimer: Orbex LIMITED is a fully licensed and Regulated Cyprus Investment Firm (CIF) governed and supervised by the Cyprus Securities and Exchange Commission (CySEC) (License Number ...

more