Gold Price Forecast: XAU/USD Surged To A Seven-Month High Amid Powell's Remarks

Image Source: Unsplash

- The price of gold rallied to a new multi-month high of $2060.62 after Powell’s speech.

- Federal Reserve Chair Jerome Powell's remarks on soft inflation data and high core inflation boosted gold's appeal as a hedge.

- US interest rate expectations now include nearly 135 basis points of Fed rate cuts by the end of 2024, as indicated by money market futures.

The price of gold extended to a new seven-month high in the mid-North American session on Friday after Federal Reserve Chair Jerome Powell discussed soft inflation data, though he stressed core inflation “is still too high.” At the time of writing, the XAU/USD duo was recently seen trading at around $2059, gaining more than 1.10%.

XAU/USD Extended its Gains Despite Powell’s Neutral Stance

During a Q and A session, Fed Chair Powell said, “We are getting what we wanted to get,” giving a green light to bullion traders, who took advantage of XAU/USD’s dip to the $2044.50 area, before jumping to new day and multi-month highs.

Meanwhile, US Treasury bond yields were plunging, with the 10-year benchmark note coupon dropping six and a half basis points, at 4.263%, after reaching a high of 4.349%. This appeared to be a tailwind for gold prices. Consequently, the greenback tumbled, as revealed by the US Dollar Index, which was down 0.24%, at 103.26.

Meanwhile, money market futures seemed to suggest that investors are expecting close to 135 basis points of Fed rate cuts for the end of 2024.

The Institute for Supply Management (ISM) revealed the Manufacturing PMI for November, which showed that business activity remained in contraction for the thirteenth straight month. Prices paid by manufacturers rose while the employment index eased, which was in alignment with the recent unemployment claims data.

XAU/USD Price Analysis: Technical Outlook

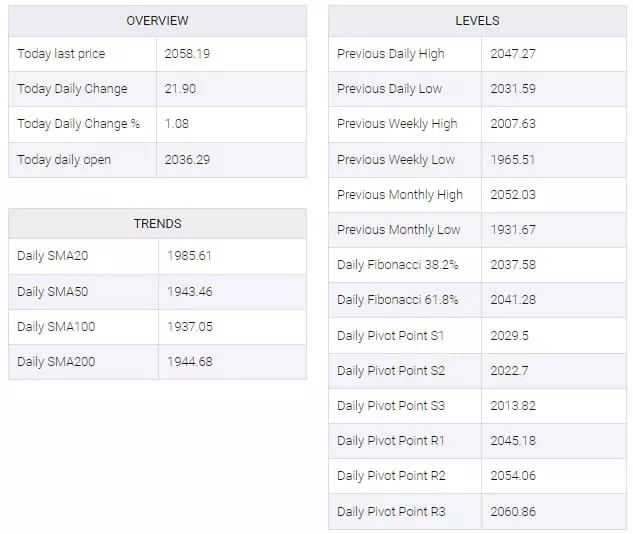

Gold appeared to be rallying sharply, as buyers were eyeing the all-time high of $2081.82. It should be noted that there appear to be no additional resistance levels on the way, besides the $2060 and $2070 areas. If those psychological levels were to be taken out, the all-time high could be within reach. On the flip side, the first support can be seen at the Nov. 29 daily high at $2052.13, before opening the door to slip to the Nov. 30 daily low at $2031.58.

(Click on image to enlarge)

XAU/USD Technical Levels

More By This Author:

EUR/USD Clears Daily Losses And Defends The 20-Day SMA, Closes A Losing WeekCrude Oil Heading Back Down Once Again

US Dollar Just A Sigh Away From Ending The Week In The Green

Disclosure: Information on this article contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes ...

more