Gold Price Forecast: Bulls Recovered The 20-Day And 200-Day SMAs Before Jumping To $1,923

Image Source: Unsplash

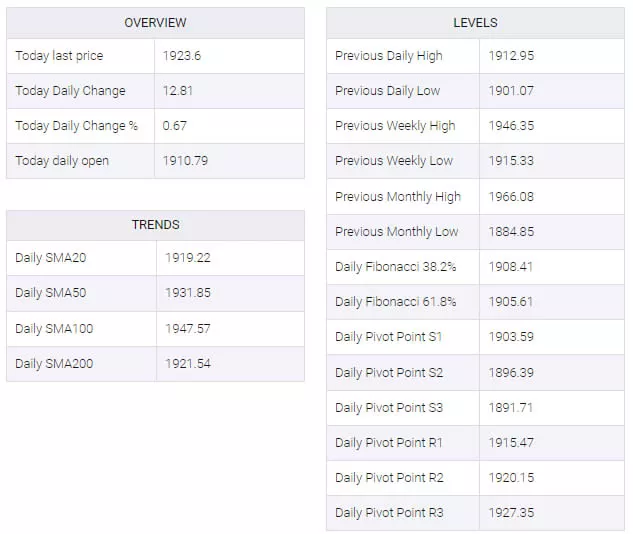

- On Friday, XAU/USD tallied 0.60% in daily gains and jumped to a daily high of approximately $1,930 before settling at around $1,923.

- Bulls quickly recovered the 20-day and 200-day SMAs at the $1,920 area after losing them at the beginning of the week.

- Indicators seem to point to a bullish resurgence.

At the end of the week, the gold spot price closed with a weekly gain, recovering losses seen throughout the trading period. This momentum took the price to a weekly low of around $1,900, before closing above the $1,920 level.

Based on the daily chart, XAU/USD seemed to exhibit a bullish outlook for the short-term. Both the Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) showed signs of buyers recovering and staying in positive territory, with the RSI seen jumping back above its midline and displaying a northward slope.

The MACD was also displaying green bars, indicating a strengthening bullish momentum. Additionally, on the four-hour chart, the price jumped above the 20, 100, and 200 Simple Moving Averages (SMA), and their indicators also gained significant momentum.

However, on the larger time frame, the spot price appears to be well below the 100-day SMA, which suggests that the buyers still have some work to do to confirm a recovery.

- Support levels include $1,923-$1,920 (200-day and 20-day SMAs), $1,910, and $1,900.

- Resistance levels include $1,930, $1,940, and $1,950 (100-day SMA).

XAU/USD Daily Chart

-638304076955950023.png)

(Click on image to enlarge)

XAU/USD Technical Levels

More By This Author:

USD/CAD Price Analysis: Rebounded Off Key Support As The Downtrend Remains Suspect

NY Fed Empire State Manufacturing Index Jumps To 1.9 In September Vs. -10 Expected

AUD/USD Price Analysis: Struggles To Extend Recovery As US Dollar Recovers

Disclaimer: Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only ...

more