Gold Monthly Forecast For July 2025

Image Source: Pixabay

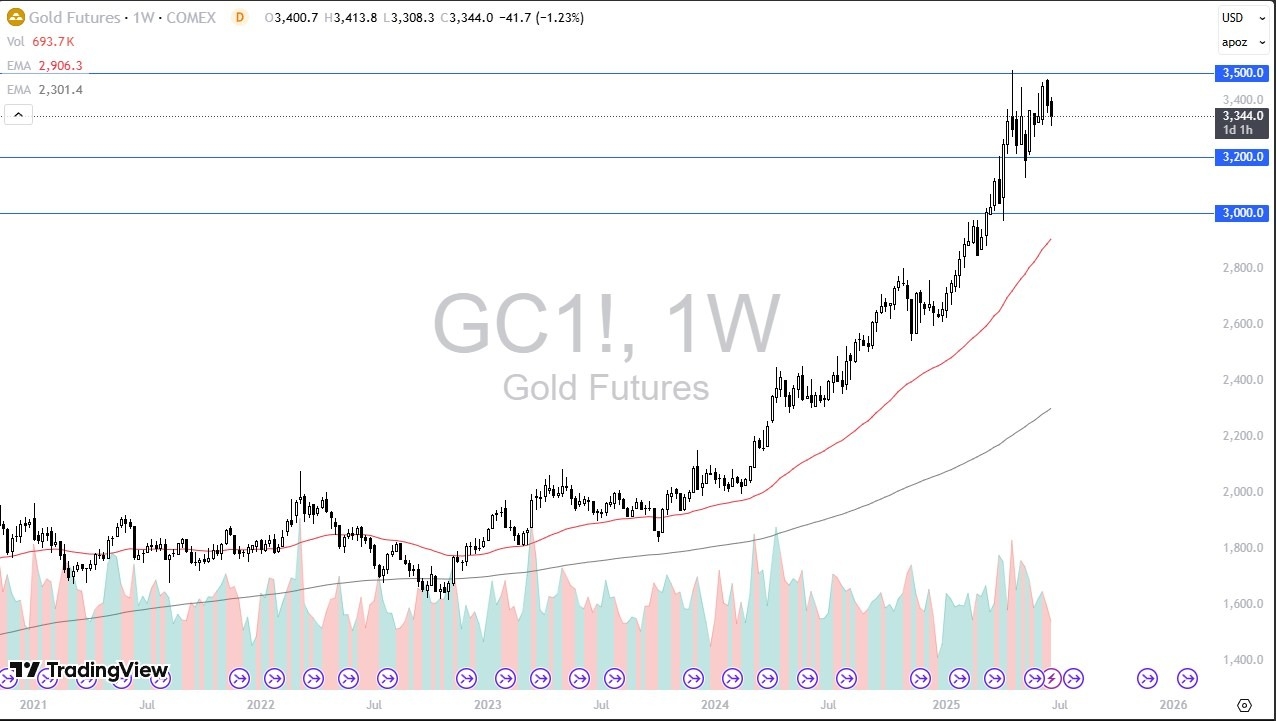

The gold market has moved all over the place during the month of June, as we have continued to see a lot of noisy trading overall. That being said, it’s not a huge surprise to see a scenario where traders don’t really know where to go next, due to the fact that there are so many external factors.

For example, we recently have had a hot war between Iran and Israel, and, of course, there was also the conflict in Gaza. In other words, there’s been plenty of geopolitical risks out there that have played a part in gold's price action.

(Click on image to enlarge)

Furthermore, you also have to keep in mind that central banks around the world have been collecting gold for some time, and, of course, we have seen the US dollar soften a bit as well.

With this, and the fact that simple momentum has shifted to the upside, it makes a lot of sense that we have seen noisy but somewhat sideways trading - especially as we have been in consolidation over the last couple weeks, as the market has essentially gone straight up in the air since the beginning of the year.

July Could Bring More of The Same

I suspect that July could bring more of the same type of sideways action, although it seems like gold has been moving sideways in this $300 range forever, the reality is that it’s only been a couple of months in what has been a very bullish market for a couple of years.

As traders are stuck in this $300 range, breaking out of it obviously would attract a lot of attention. I suspect it would probably break higher, but there is also the argument to be made that maybe gold needs to pull back a bit after that monster run higher.

If the yellow metal does break down below the $3200 level, then it’s possible that gold could go looking to the $3000 level, where I would anticipate a lot of psychological support, especially as the 50-week EMA races toward that area.

On the other hand, if it can break to the upside, clearing the $3500 level would potentially open up a move to the $3800 level. All things being equal, I suspect that gold will probably stay range-bound. However, it would be wise to keep an eye on those levels, because they could lead the way going forward.

More By This Author:

Pairs In Focus - Crude Oil, Gold, Silver, EUR/USD, USD/MXN, USD/CAD, AUD/USD, DAX

ETH/USD Forex Signal: Momentum Stalls

BTC/USD Forecast: Consolidates Below $112K: Breakout Or More Range-Bound Trading?

Disclosure: DailyForex will not be held liable for any loss or damage resulting from reliance on the information contained within this website including market news, analysis, trading signals ...

more