Gold Forecast Bright On Weak USD; Silver Eyes Multi-Year High

Outlook for Gold and Silver Prices: Bullish Amid Weak US Dollar

- Gold price action advanced for the fourth consecutive week as Treasury yields slipped.

- Silver prices jumped to multi-year highs amid US dollar weakness, infrastructure talks.

- Gold and silver outlook remains constructive in light of the Fed staying dovish on policy.

Precious metals like gold and silver extended their stretch of gains last week. Gold prices climbed 1.5% to $1,905/oz, while silver popped 1.9% to trade around the $28.00-price level.

This likely follows sustained US dollar weakness and headwinds faced by Treasury yields owing to the Fed’s patiently dovish position on monetary policy. The outlook for gold and silver has benefited from FOMC officials undermining the taper debate as they argue recent inflationary pressures are “largely transitory.”

Gold Price Time Chart: Daily Time Frame (Dec. 14, 2020 - May 28, 2021)

Chart by @RichDvorakFX created using TradingView

With actual inflation rising in the near-term but not enough to warrant a Federal Reserve policy response, Treasury yields and the US dollar have turned lower. Gold price action has catapulted higher in turn. This bullish trend behind gold looks likely to persist so long as the Fed remains committed to its accommodative stance and continues to delay talks of tapering asset purchases.

Gold prices might even be headed for all-time highs if the US dollar weakens further and Treasury yields extend their slide. Not to mention, with major cryptocurrencies like bitcoin (BITCOMP) facing heavy selling pressure as of late, investors might look to more traditional anti-fiat assets like gold and silver.

If the US dollar stages a sharp rebound, however, it would likely correspond with a spike in Treasury bond yields caused by the market pricing in the threat of Fed tapering. That could weigh negatively on gold prices and spoil the recent rally.

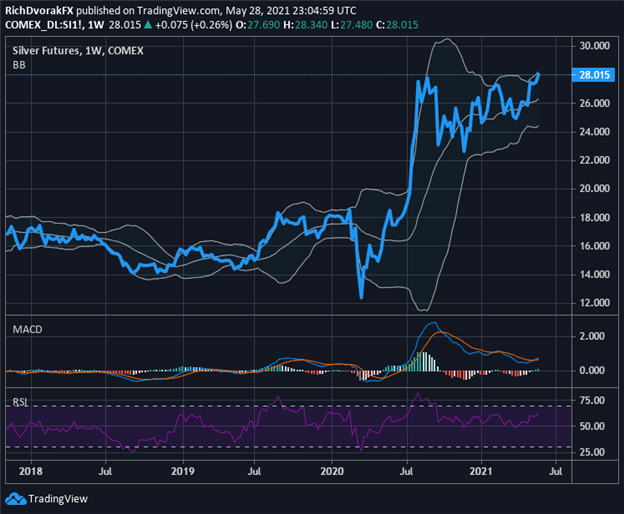

Silver Price Chart: Weekly Time Frame (Nov. 6, 2017 to May 28, 2021)

Chart by @RichDvorakFX created using TradingView

Silver price action has also benefited from subdued Treasury yields and US dollar weakness. In fact, the most active front-month futures contract for silver just recorded its highest weekly close since March 2013.

Recent silver strength could come on the heels of President Biden touting his $2-trillion green infrastructure proposal and $6-trillion budget forecast. Nevertheless, an upswing in yields and the US dollar would likely put downward pressure on silver prices.

Looking to the week ahead, gold and silver volatility might intensify around high-impact event risk posed by the release of monthly nonfarm payrolls. A notably better-than-expected jobs report could see the US dollar and yields pivot higher, which would likely steer precious metals lower. On the other hand, gold and silver prices could benefit from another round of disappointing NFP data, as this would likely bolster the argument for Fed doves.

Check out our Education Center or read up on the differences between more

Please correct me if I'm wrong but a weak dollar would naturally push gold up?