GBP/USD Under Local Pressure: Focus On Bank Of England Signals

Photo by Colin Watts on Unsplash

GBP/USD fell to 1.3627 on Thursday. Investors are awaiting the outcome of today's Bank of England meeting.

UK interest rates are expected to decline throughout the year. However, the regulator is unlikely to provide clear signals about the timing and scale of easing, as it needs to wait for a clearer picture of inflation.

Additional pressure on the US dollar stems from the delay in the publication of key US labour market data due to the partial government shutdown. This increases uncertainty about the Fed's future policy.

By the end of the year, global markets are pricing in around 35 basis points of Bank of England easing – one 25 bp cut and a second cut priced with a probability of around 40%.

Political risks remain in the UK. Investor attention is focused on the by-elections in Gorton and Denton County on 26 February, alongside the May local elections. Pollsters show a rise in support for the Reform UK party. It is ahead of both Prime Minister Keir Starmer's Labour Party and Kemi Badenoch's Conservatives, despite the general election not being scheduled until 2029.

Technical Analysis

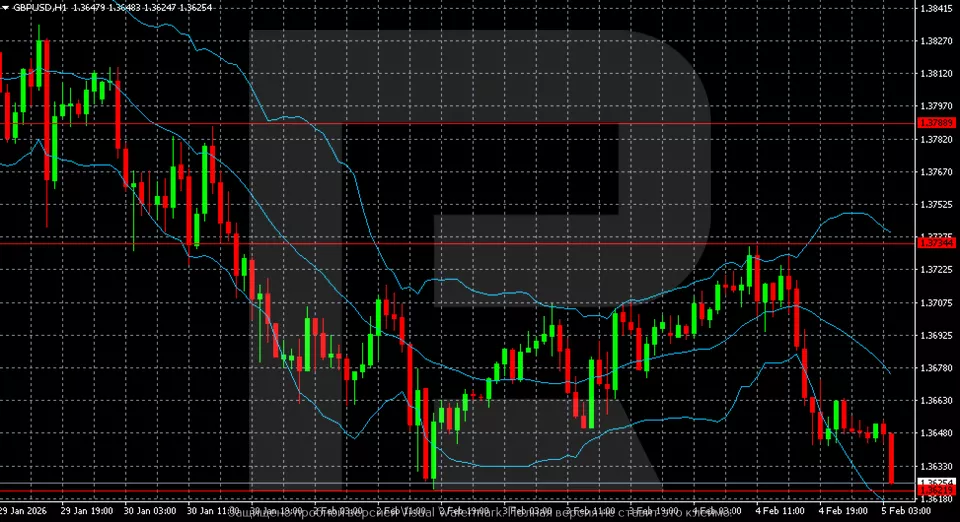

(Click on image to enlarge)

On the H4 chart, after a sharp rally in the second half of January and a fresh high in the 1.3850–1.3880 zone, GBP/USD entered a correction phase. The price has turned down from the upper end of the Bollinger Bands and is now testing the 1.3620–1.3650 support area. Upward momentum has weakened, leaving the structure short-term neutral-to-bearish. At the same time, the broader upward context has not yet been breached.

(Click on image to enlarge)

On the lower H1 chart, a descending corrective channel has formed. The price is consistently posting lower lows and remains near the lower Bollinger Bands. Selling pressure persists, with the nearest support at 1.3520–1.3550. To stabilise, the market would need a return above the 1.3660–1.3700 zone.

Conclusion

In summary, GBP/USD is experiencing a tactical pullback driven by pre-BoE caution and delayed US data, which is creating a temporary dollar squeeze. The technical correction appears orderly and is testing key support within a larger bullish structure. The near-term trajectory hinges almost entirely on the Bank of England's tone today: any dovish hints could extend the correction towards 1.3520, while a neutral or hawkish hold could trigger a recovery attempt. Political uncertainty in the UK adds a layer of medium-term risk, but for now, the primary focus remains on monetary policy signals and the defence of the 1.3620 support zone.

More By This Author:

Gold Is Back In The Black: Geopolitics Dictates Conditions Again

The Fall In EUR/USD Has Stopped: Markets Seek Stability Ahead Of Employment Statistics

USD/JPY Realizes Correction: BoJ Policy Weighs On Yen

Disclaimer Any forecasts contained herein are based on the author's particular opinion. This analysis may not be treated as trading advice. RoboForex bears no responsibility for trading results ...

more