GBP/USD Smashes Through Psychological 1.15 Level As PM Sunak Takes Charge

GBP/USD Fundamental Backdrop

GBP/USD continued its rally higher this morning on renewed US dollar weakness, breaking above the psychological 1.15 level. This comes despite comments from UK Foreign Minister James Cleverly that he cannot confirm if the budget will still come on October 31. He continued by saying that PM Sunak will want to take time and look at the details of the fiscal statement.

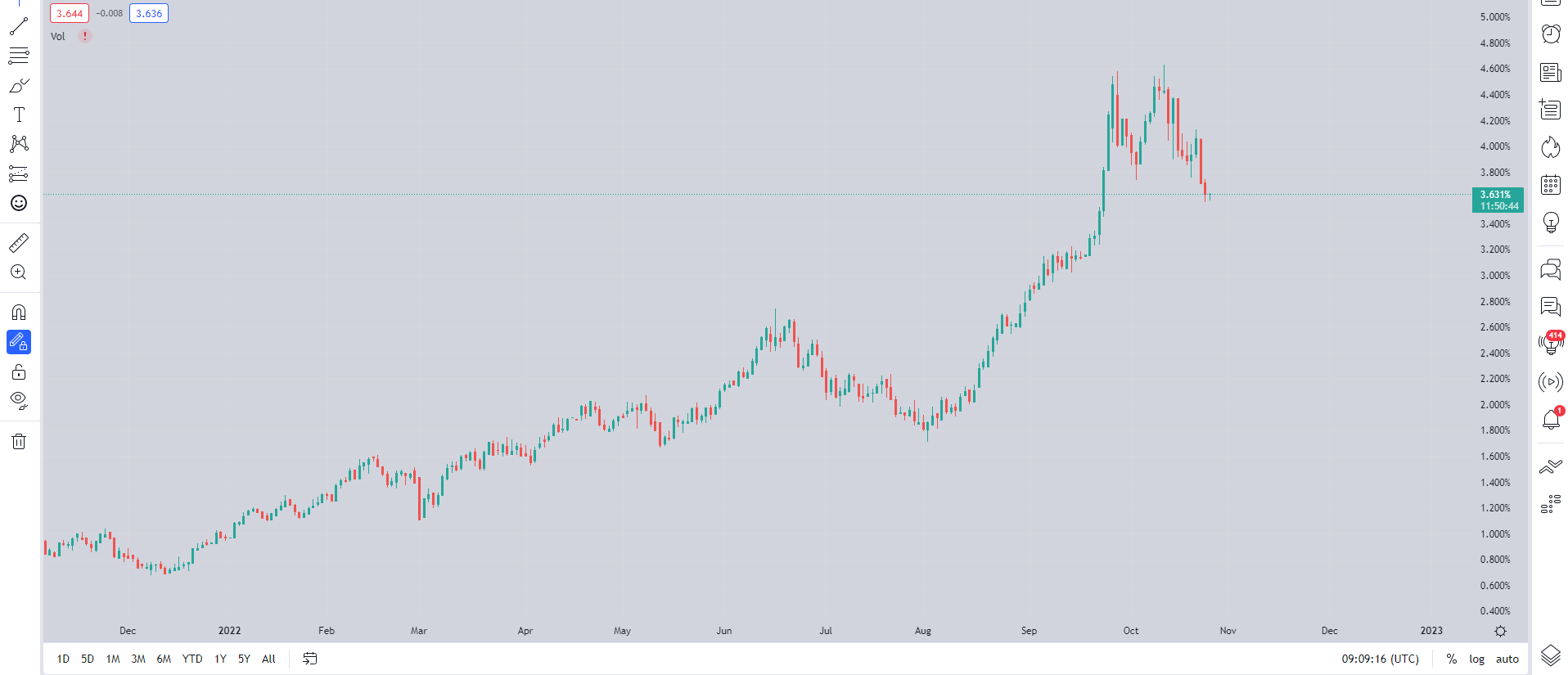

PM Sunak in his first address confirmed that he is likely to stick by the 2019 manifesto set out by the Tory party while stating that economic stability will be at the heart of the agenda. In a further positive for market stability, Jeremy Hunt will remain as Chancellor of the Exchequer with UK lawmaker Dominic Raab appointed as Deputy PM and Justice Secretary. Given the decline seen in the 10-Year Gilt yield, it seems markets have responded positively to the Prime Minister’s first moves as bigger challenges lie ahead.

UK Government Bonds 10Y Yield, Daily Chart- October 26, 2022

(Click on image to enlarge)

Source: TradingView

Chancellor Hunt meanwhile confirmed that he had a conversation with Bank of England (BoE) Governor Andrew Bailey. The Chancellor reiterated his commitment to the central bank's independence and inflation targeting while agreeing on the need to work together to restore confidence and credibility. A welcome step has given the disconnect between the Government and the BoE following the ‘Trussonomics’ budget.

Later in the day, we have a host of medium-rated data out of the US with new home sales numbers of particular interest. Estimates are pointing to a significantly lower print with a miss likely to keep the GBP bid ahead of tomorrow’s US GDP numbers.

For all market-moving economic releases and events, see the DailyFX Calendar

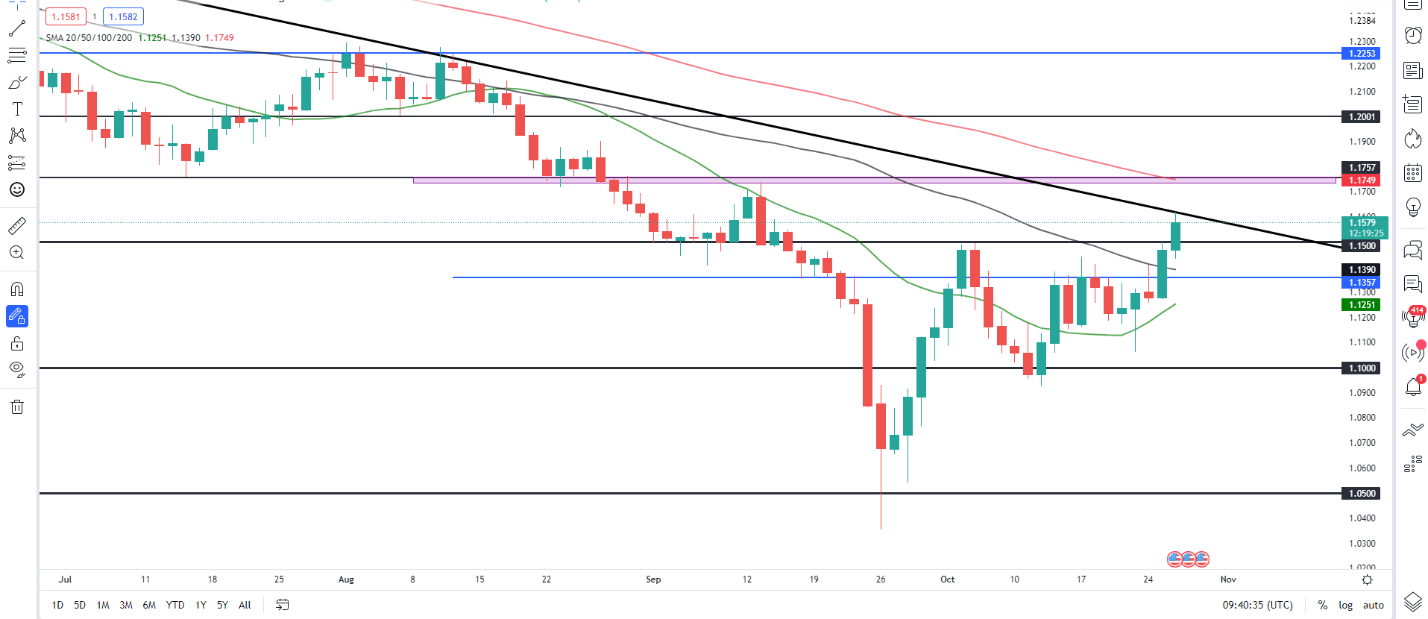

GBP/USD Daily Chart – October 26, 2022

(Click on image to enlarge)

Source: TradingView

From a technical perspective, the pair has smashed through the 1.15 psychological level as the price tests trendline resistance around the 1.16 area. A break higher here should lead price toward the 1.1750 area which lines up with the 100-SMA. Cable does need a daily candle close above the 1.15 level to ensure further upside potential.

Alternatively, a break and candle close below 1.15 could see the pair drop lower toward support areas around 1.14 or lower around 1.1250 which lines up with the 50 and 20-SMA respectively.

Key intraday levels that are worth watching:

Support Areas

- 1.1500

- 1.1400

- 1.1250

Resistance Areas

- 1.1600

- 1.1750

- 1.2000

More By This Author:

Euro Price Forecast: Descending Channel Breakout Potential For EUR/USDS&P 500 Futures Turn Lower After Microsoft and Alphabet Post Mixed Earnings. Now What?

S&P 500, Nasdaq, Dow Jones Forecast Into Earnings

Disclosure: See the full disclosure for DailyFX here.