GBPUSD: Sell Trade Hits Targets

Image Source: Pexels

On October 4 2023 I posted on social media @AidanFX ”Sold GBPUSD at 1.21684 Stop Loss at 1.21784 Target at 1.21384.”

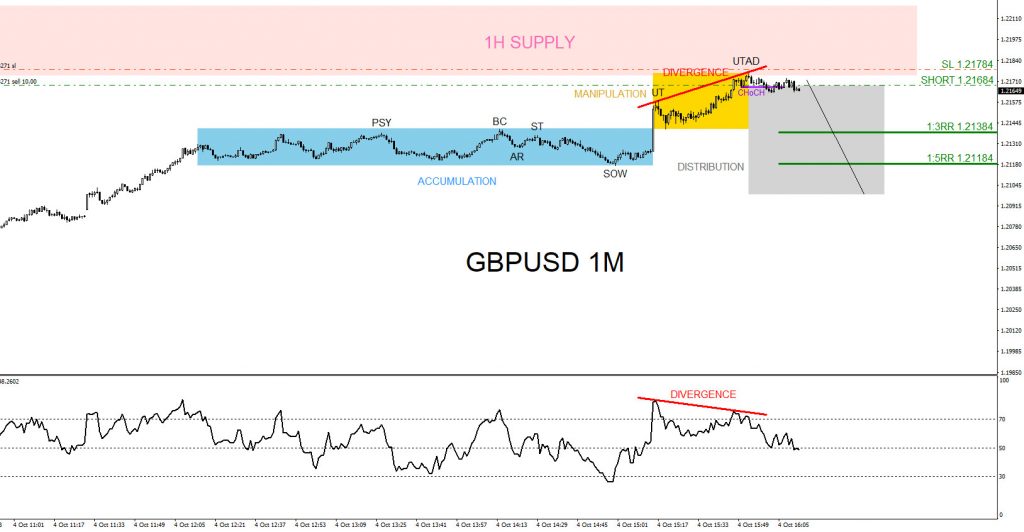

SELL Trade Setup

1. Price entered the 1-hour supply zone area signalling a reversal move lower. (Pink)

2. Bearish Wyckoff distribution schematic pattern (Black Labels) terminating in the supply zone signalling a reversal lower.

3. Price forms a bearish divergence pattern in the supply adding more confidence the pair will move lower.

4. Price breaks below internal structure higher low (Purple Line/ChoCh-Change of Character) signalling bullish weakness and a bearish market shift. SELL was triggered.

GBPUSD 1 Minute Chart October 4 2023

(Click on image to enlarge)

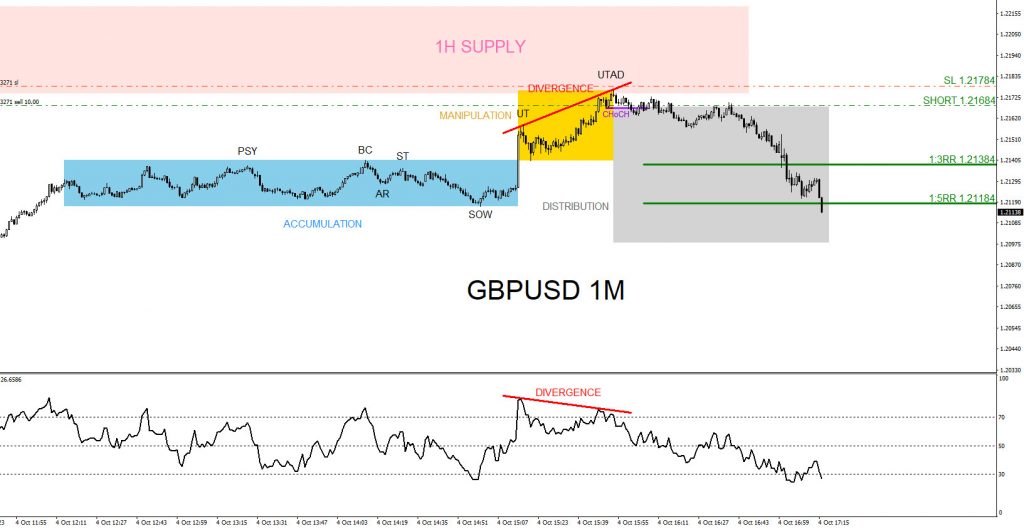

(Click on image to enlarge)

Sell trade entered at 1.21684 with a 10 pip Stop Loss at 1.21784 and on October 4 2023, about 1 hour after entry, GBPUSD moved lower to the proposed 1:3 Risk/Reward target (1.21384) and extended even lower to hit the 1:5 Risk/Reward target where the trade was closed at 1.21184 for +50 pips. (+5% gain risking 1% on every trade)

A trader should always have multiple strategies all lined up before entering a trade. Never trade off one simple strategy. When multiple strategies all line up it allows a trader to see a clearer trade setup. If you followed me on social media you too could have caught the GBPUSD move lower. We at EWF never say we are always right. No market service provider can forecast markets with 100% accuracy. The only thing we at EWF 100%, is that we are RIGHT more than we are WRONG.

Of course, like any strategy/technique, there will be times when the strategy/technique fails so proper money/risk management should always be used on every trade. Hope you enjoyed this article and follow me on social media for updates and questions> @AidanFX

More By This Author:

Nvidia Returning From The Elliott Wave Blue Box AreaGold Miners Approaching Support Zone

Gold Bearish Sequence Favors More Downside

Disclaimer: Futures, options, and over the counter foreign exchange products may involve substantial risk and may not be suitable for all investors. Leverage can work against you as well as for ...

more