GBP/USD Regains Footing, But Underlying Doubts Persist

Photo by Nicholas Cappello on Unsplash

The GBP/USD pair is edging higher, trading around 1.3239, following a pause in its five-day rally. While the pair has returned to positive territory, investor focus has shifted to the underlying health of the UK economy and the credibility of the newly announced budget measures.

The fundamental headwinds for sterling remain significant. Weak growth prospects, stubbornly low productivity, and persistent inflationary pressures continue to cap the currency's long-term potential.

The UK government bond market experienced a short-lived rally after Chancellor Rachel Reeves unveiled a larger-than-expected fiscal reserve and reaffirmed her commitment to strict spending control. Thirty-year gilt yields initially fell by over 10 basis points but subsequently pared these losses.

A key concern for investors is the government's fiscal trajectory. By postponing most of its proposed tax measures until after 2029 – beyond the current parliamentary cycle – the government has raised questions about its fiscal credibility. This long-dated approach leaves the pound vulnerable to future weakness, as the necessary budgetary tightening remains a distant and uncertain prospect.

Technical Analysis: GBP/USD

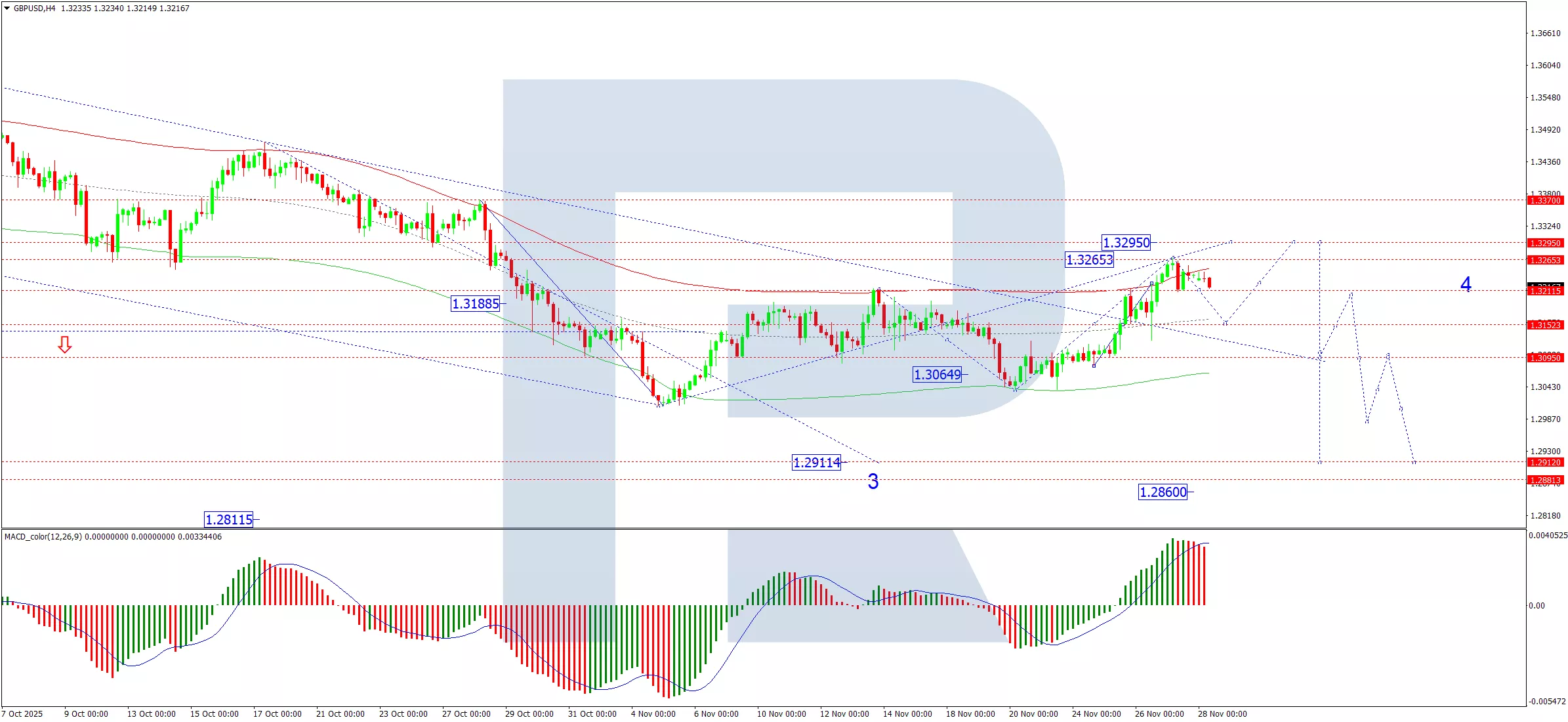

H4 Chart:

(Click on image to enlarge)

On the H4 chart, GBP/USD has completed a growth wave to 1.3265 and is now likely to form a consolidation range below this peak. A decisive decline and break below the 1.3210 support would trigger a corrective move towards 1.3152. Following the completion of this correction, we would anticipate the formation of a new growth structure, initially targeting a return to 1.3215. A sustained break above this level would then open the path for a more significant advance towards 1.3295. The MACD indicator supports this view of an impending pullback. Its signal line is at elevated levels above zero and has diverged bearishly from its histogram, suggesting the recent upward momentum is waning.

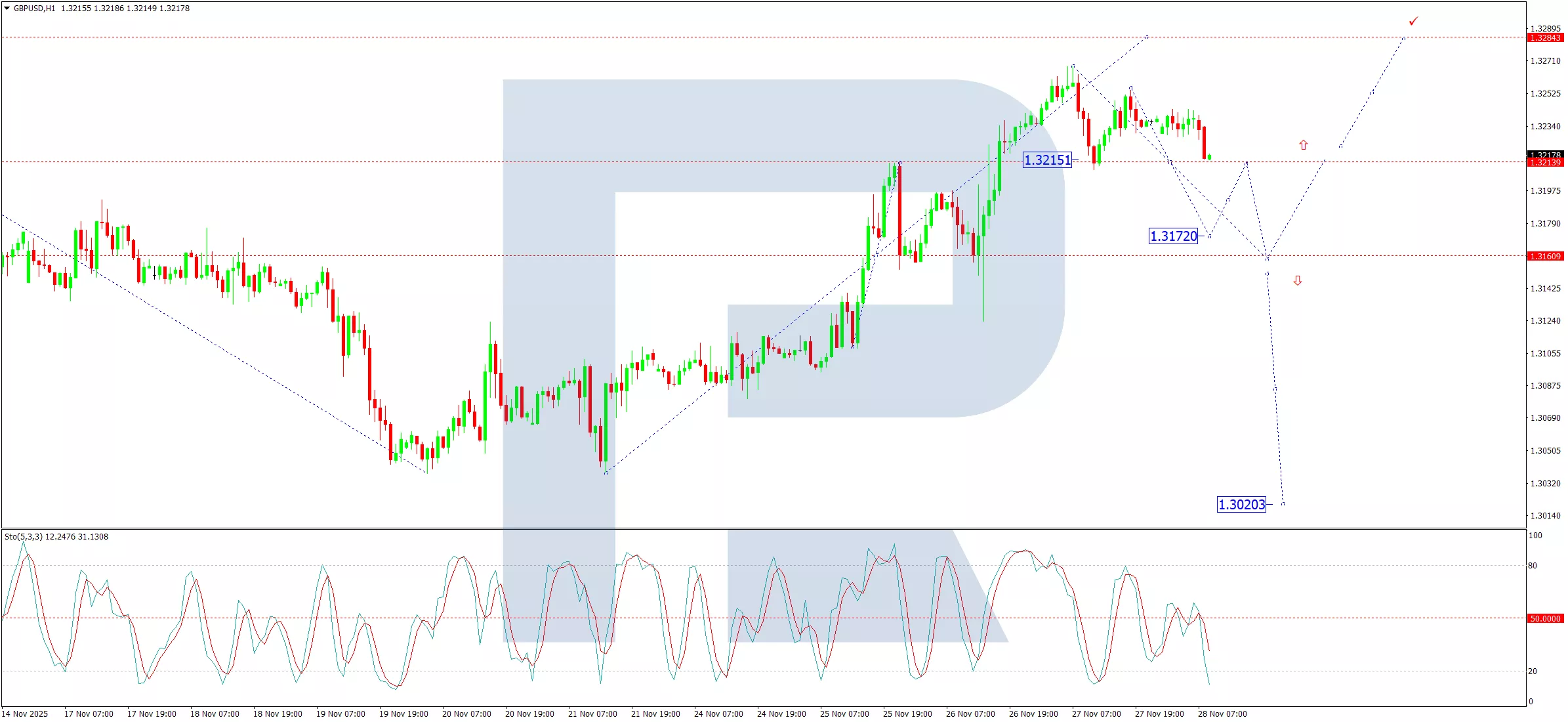

H1 Chart:

(Click on image to enlarge)

On the H1 chart, the pair formed a downward impulse to 1.3210, followed by a rebound to 1.3254. These two levels now define the boundaries of a consolidation range. We expect a downward breakout from this range, triggering a decline towards the 1.3160 target. This near-term bearish bias is confirmed by the Stochastic oscillator. Its signal line is below 50 and is trending downward towards 20, indicating that short-term selling momentum is building.

Conclusion

While GBP/USD is managing to hold onto recent gains, the rally appears to be on shaky ground. Fundamental doubts about the UK's fiscal and economic outlook are colliding with technical signals that suggest a near-term correction is likely. The key level to watch is 1.3210; a break below this support would signal a deeper pullback towards 1.3160, potentially offering a more attractive level from which to reassess the long-term directional bias. For any sustained bullish move to develop, a decisive break above 1.3295 would be required.

More By This Author:

USD/JPY Extends Decline As Yen Recovers On Intervention Fears

GBP/USD Rises As Markets Await Crucial UK Budget

Yen Under Sustained Pressure, Igniting Intervention Fears

Disclaimer: Any forecasts contained herein are based on the author's particular opinion. This analysis may not be treated as trading advice. RoboForex bears no responsibility for ...

more