GBP/USD Price Tumbles From 1.3750, Evergrande Uncertainty Hovers

During Friday’s Asian session, the GBP/USD price stabilized after a sharp rise during the previous session.

In response to optimism about the Bank of England (BOE)’s an unexpectedly hawkish stance on Super Thursday, the pair jumped more than 150 pips from the monthly low of around 1.3600.

The GBP/USD pair opened lower on Friday but recovered quickly to hit a 1.3736 intraday high before losing momentum.

Following the Bank of England’s (BOE) monetary policy announcement on Thursday, which kept rates unchanged at 0.1% but warned of higher inflation, the British pound strengthened against the dollar and the euro. Two members of the Monetary Policy Committee (MPC), Dave Ramsden and Michael Saunders voted to end the pandemic-era incentives as soon as possible.

Despite signs that the economy as a whole is slowing, European markets bounced back for the third day in a row yesterday, ignoring concerns about the Chinese property market earlier in the week.

The FTSE100 did its best to follow its partisan role by slipping from its intraday highs and finishing in negative territory, which may be partly attributed to the strength of the pound and gold. Although it appeared unlikely on Monday, as investors withdrew from Evergrande’s bankruptcy, Europe and the US markets have rebounded this week.

Gains in the stock market occurred despite a sharp rise in yields, which caused US 10-year bonds to hit a three-month high and UK 10-year bonds to hit almost their highest in more than two years.

As the US Evergrande payment deadline passed without an update of when or if it would happen, the Asian markets were mixed this morning. The S&P500, Nasdaq, and Dow both closed above their 50-day moving averages today. A grace period of at least 30 days will begin before a default is declared, with Chinese authorities asking the company to avoid default. Meanwhile, bond payments must continue during this period.

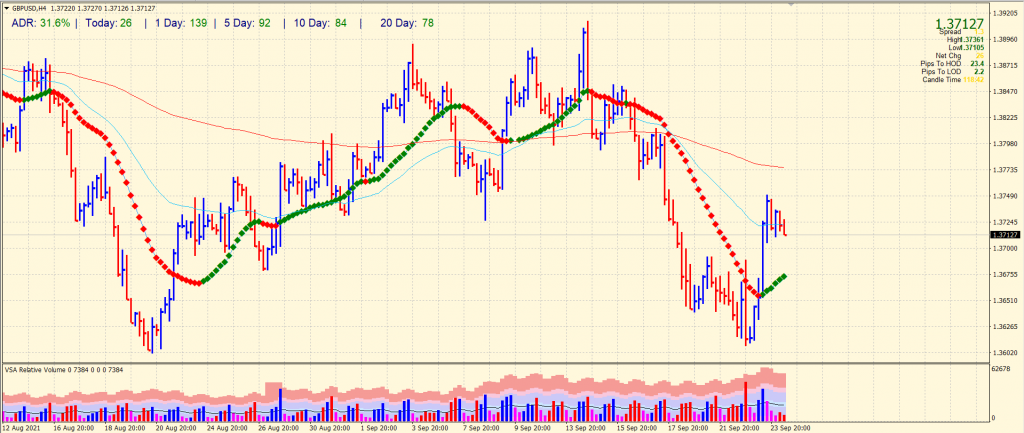

GBP/USD Price Technical Analysis: Consolidating Gains Above 1.3700

The GBP/USD surrendered some gains from yesterday’s multi-week top at 1.3750. However, the price is still in the positive territory. The price is now consolidating while the volume is drying. It shows a sign of bullish continuation. The bulls may look at 1.3750 ahead of the 1.3800 handle.

On the flip side, the pair may find support at 1.3700 followed by 1.3660 and then 1.3600.

Disclaimer: Foreign exchange (Forex) trading carries a high level of risk and may not be suitable for all investors. The risk grows as the leverage is higher. Investment objectives, risk ...

more