GBP/USD Price Forecast: Holds To Gains On Mixed US Data

Photo by Colin Watts on Unsplash

- GBP/USD remains above 1.3100, with RSI showing buyers in control and eyeing 1.3200 resistance.

- Clearing 1.3179 would open the door to challenge the March 2022 high of 1.3298, with further upside to 1.3437.

- A pullback below 1.3150 could lead to testing key support at 1.3100 and 1.3044, with the 50-DMA at 1.2914.

The GBP/USD aims up during the North American session, after jobs data from the United States (US) was mixed, while business activity expanded. Despite this, the pair clings to its gains and trades at 1.3166 above its opening price by 0.15% at the time of writing.

GBP/USD Price Forecast: Technical outlook

The GBP/USD has remained above the 1.3100 figure but has been capped on the upside so far as traders await the release of August’s Nonfarm Payrolls on Friday. The Relative Strength Index (RSI) shows that buyers are in charge and could sponsor a leg-up towards 1.3200.

If GBP/USD resumes to the upside and clears 1.3179, a move to 1.3200 will be made on the cards. A breach of the latter and will expose the March 23, 2022, peak at 1.3298 before challenging the March 1, 2022, cycle high at 1.3437.

Conversely, if sellers step in and push GBP/USD below 1.3150, look for a pullback to 1.3100. Despite this, bears must clear the September 3 low of 1.3087 if they remain hopeful of lower exchange rates. The next key support levels would be July 17, high at 1.3044, followed by the 1.3000 figure and the 50-day moving average (DMA) at 1.2914.

GBP/USD Price Action – Daily Chart

British Pound PRICE Today

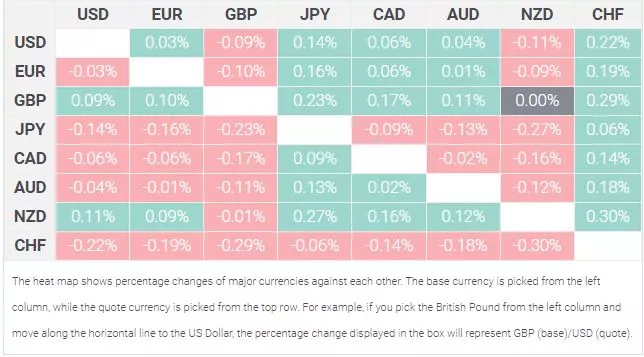

The table below shows the percentage change of British Pound (GBP) against listed major currencies today. British Pound was the strongest against the Swiss Franc.

More By This Author:

Gold Price Ticks Higher On Soft US JOLTS DataGBP/USD Price Forecast: Rises As US Data Fuels Rate Cut Speculation

Gold Slides Below $2,500 Ahead Of Busy US Economic Docket

Disclaimer: Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only ...

more