GBP/USD Price Forecast: Drops Below 1.3100 As Fed Large Rate Cut Odds Wane

Photo by Colin Watts on Unsplash

- GBP/USD downtrend intensifies, with momentum signaling further downside as RSI nears a break below neutral.

- Key support at 1.3044 could trigger deeper losses, with the 50-DMA at 1.2933 and the 1.2900 mark as critical levels.

- Buyers must reclaim 1.3239 for a bullish continuation and to regain upward momentum.

The GBP/USD begins the North American session down by over 0.30% on Monday as traders trim the chances of a 50-basis point Fed interest rate cut in ten days. At the time of writing, the pair trades at 1.3075 after reaching a high of 1.3143.

GBP/USD Price Forecast: Technical outlook

The GBP/USD has fallen below the 1.3100 mark, though the uptrend remains intact unless sellers grab the pair below the July 17 high of 1.3044, which could open the door for a deeper pullback.

Momentum suggests further downside. The Relative Strength Index (RSI) is about to punch below its neutral line, which could spark a sell-off. Therefore, in the short term, the path of least resistance is tilted to the downside.

The first support for GBP/USD would be the July 17 peak turned support, followed by the 1.3000 figure. Further losses are seen beneath that level, with the 50-day moving average (DMA) emerging as the potential line of defense for buyers at 1.2933, ahead of 1.2900.

For a bullish continuation, GBP/USD buyers must reclaim last week’s peak at 1.3239.

GBP/USD Price Action – Daily Chart

British Pound PRICE Today

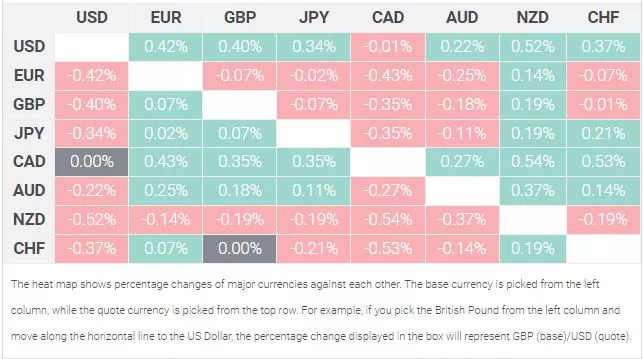

The table below shows the percentage change of British Pound (GBP) against listed major currencies today. British Pound was the strongest against the New Zealand Dollar.

More By This Author:

USD/JPY Price Forecast: Downtrend Resumed, Boosted By US Yields FallingGold Price Fell And Ended The Week Below $2,500 Ahead Of US Inflation Data

GBP/USD Price Forecast: Holds Steady As US Data Leaves Fed Rate Cut Uncertainty

Disclaimer: Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only ...

more