GBP/USD Looking To Snap Two-Day Losing Streak

GBP/USD Fundamental Backdrop

GBP/USD is on course to snap a two-day losing streak thanks to a weaker dollar index and a broader risk-on sentiment. The European session saw a modest recovery for the greenback pushing the pair down 60-odd pips to trade sub 1.22000 as we approach the US session.

British Pound gains to start the week come as a bit of a surprise given the contrasting central bank messages last week. The US Federal Reserve being relatively hawkish while the Bank of England revealed a vote split, with two members voting for no rate hike. The news saw Sterling retreat from its 6-month against the greenback keeping the GBP down around 10% YTD against the US dollar. The hawkish outlook by the Fed should keep dollar bulls in play adding further downside pressure on GBP/USD.

Meanwhile, this morning the UK Treasury confirmed that the next budget will be delivered on March 15, 2023. Chancellor Hunt has requested the Office for Budget Responsibility (OBR) to “prepare an economic and fiscal forecast which will be presented alongside the Spring Budget on 15 March 2023.”

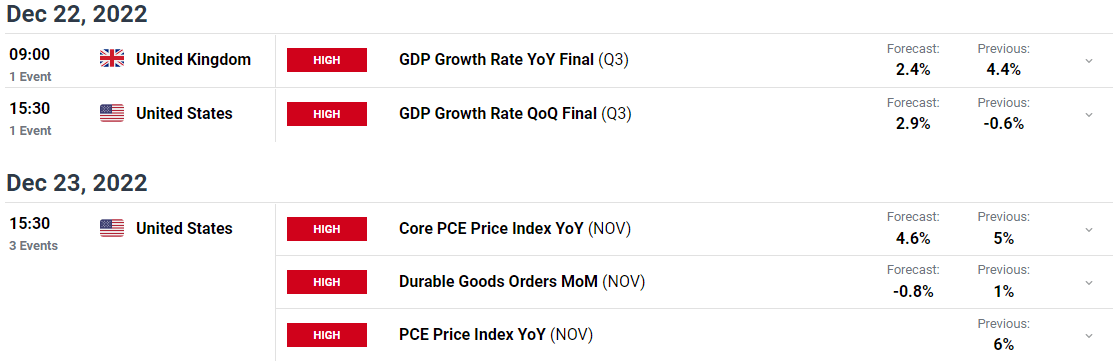

The economic calendar is rather bereft of any significant market moving data in the early part of the week with GBP/USD likely to be driven by the US dollar index until UK GDP is released on Thursday. On the US front the Core PCE data release on Friday could prove to be a further catalyst for the pair as it remains the Fed’s preferred gauge for inflation.

For all market-moving economic releases and events, see the DailyFX Calendar

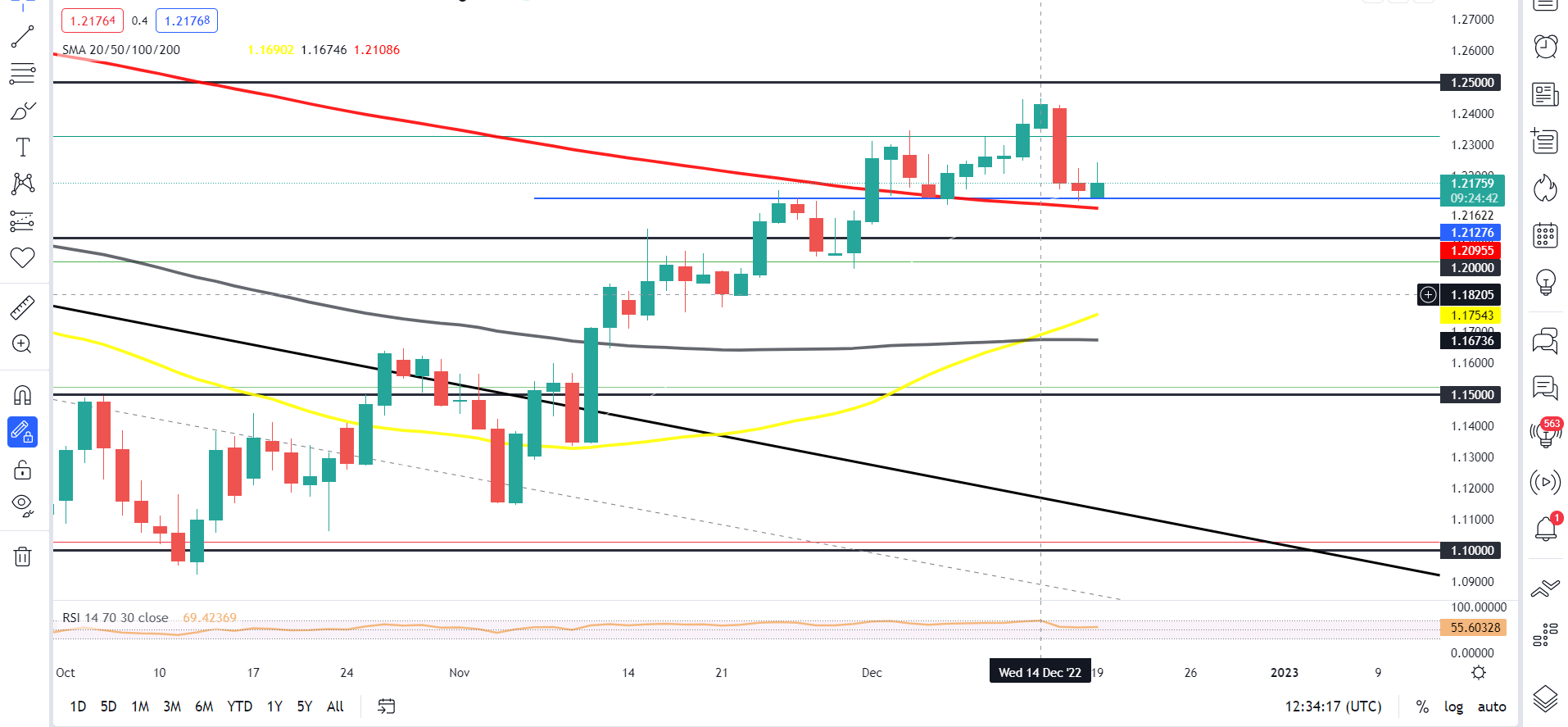

From a technical perspective, GBP/USD is in a bullish trend as long as price remains above the 1.21270 handle (Dec 7 swing low) and the 200-day MA. A daily candle close below here could open up further losses for GBP/USD down toward the 1.2000 and potentially lower. The 200-day MA currently resting around the 1.21000 could serve as a significant stumbling block for further downside. Supporting an upside narrative is the completion of the golden cross pattern, a sign that upward momentum could continue.

GBP/USD Daily Chart – December 19, 2022

(Click on image to enlarge)

Source: TradingView

More By This Author:

AUD/USD Forecast: Downside Potential For Aussie Despite China Policy SupportEuro Firms on US Dollar Weakness as Fed Hawks Undermine Equities. Has EUR/USD Peaked?

Dollar Outlook Still Carries Important Event Risk and Technical Pressure

Disclosure: See the full disclosure for DailyFX here.