GBP/USD Jumps Above 1.3540 As UK Retail Sales, PMIs Surprise Higher

- GBP/USD surges as UK Retail Sales beat forecasts, signaling resilient consumer demand.

- Strong Services and Composite PMIs reinforce growth momentum and support a less dovish BoE outlook.

- Dollar trims losses on firmer US sentiment, but Sterling momentum remains dominant.

GBP/USD surges during the North American session over 0.31% on stronger than expected Retail Sales and PMI data, even though the Greenback trimmed losses on an upbeat Consumer Sentiment report. The pair trades at 1.3542 after bouncing off daily lows of 1.3482.

Sterling rallies on strong UK data, trimming Bank of England easing expectations

In the UK, Retail Sales data sponsored a leg-up in the GBP/USD pair, which cleared the 1.3500 figure, but it remains shy of clearing the latest cycle high, which could pave the way towards 1.3600. In December, Retail Sales rose 0.4% MoM, exceeding estimates for a 0.1% decline. Annually based, sales increased from 1.8% to 2.5%, above forecasts for 1% growth.

Business activity in the UK improved according to S&P Global. The Services and Composite PMIs fared better than the November print, with services rising from 51.4 to 54.3, and composite rising from 51.4 to 53.9.

Bank of England Governor Green said, “forward indicators for wage growth are even more concerning than inflation expectations.” The BoE is expected to hold rates in February, and it seems that traders are trimming their odds for rate cuts. A day ago, money markets implied 45 basis points of easing towards the end of 2026. As of writing, they expect at least 39 basis points.

Across the pond, the University of Michigan Consumer Sentiment final reading for January rose to a five-month high to 56.4 up from 54 in the preliminary reading, above forecasts of 54. Joanne Hsu, director of the survey, said that despite the improvement, “consumers continued to report pressures on their purchasing power stemming from high prices and the propsect of weakening labor markets.”

The survey revealed that American households see a dip on inflation expectations for 1-year from 4.2% to 4% and for a five-year period at 3.3% down from 3.5%.

Other data showed tnat business activity improved slightly in January, reported S&P Global. Composite PMI edged up to 52.8 from 52.7. Chris Williamson, chief business economist at S&P Global Market Intelligence, said in a statement “A worryingly subdued rate of new business growth across both manufacturing and services adds further to signs that first-quarter growth could disappoint.”

Next week, traders will eye the Federal Reserve monetary policy meeting and the Fed Chair Jerome Powell press conference.

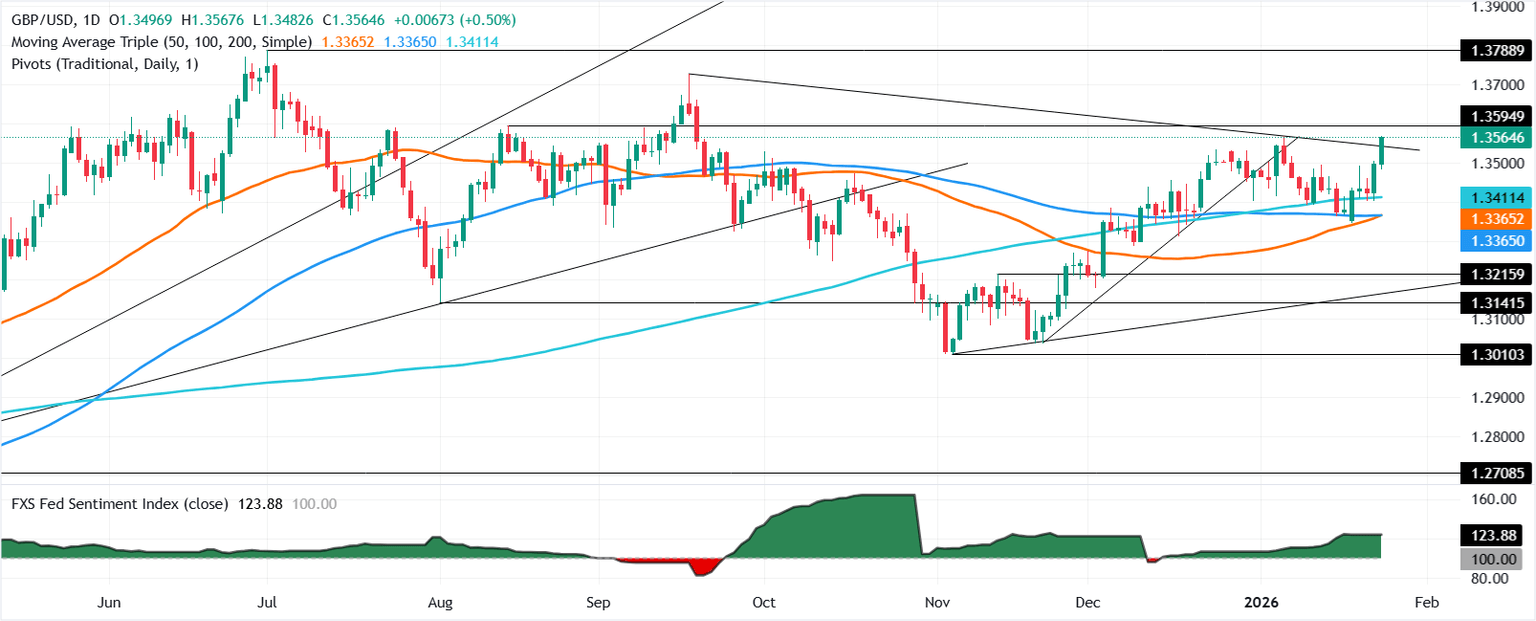

GBP/USD Price Forecast: Technical Outlook

The GBP/USD has broken a downslope trendline, which clears the path to challenge 1.3600. A decisive break above that level, could shift the trend upward and open the door for further gains. The next key resistance level would be the July 1 swing high at 1.3788 ahead of 1.3800.

Conversely, if GBP/USD retreats below 1.3500, the first support would be the 20-day SMA at 1.3452, followed by the 200-day SMA at 1.3406.

GBP/USD Daily Chart

More By This Author:

EUR/USD Rallies Above 1.1740 As Trump Drops Tariff Threats, Dollar SlipsEUR/USD Slips As Trump Drops Tariff Threats, Lifts The U.S. Dollar

Gold Holds Firm Near $4,770 As Trump Softens Greenland Stance