GBP/USD Forecast: Hard-Brexit Speculation Leads Ahead Of May's Speech

The GBP/USD pair gapped lower at the weekly opening, roughly 200 pips below Friday's close, and traded as low as 1.1986 during the Asian session, before regaining the 1.2000 level early Europe. Nevertheless, the strong bearish pressure persists, and the pair is far from filling the gap, as news released over the weekend, suggest Tuesday's Theresa May speech will be lean towards a "hard-Brexit."

GBPUSD from Tip TV Productions on Vimeo.

The logic behind the speculative headlines says that the UK should leave to EU Single Market to secure free-trade deals with other countries across the world, and regain full control of the kingdom's borders. Although its mere speculation, it was enough to take the Pound sharply lower at the opening.

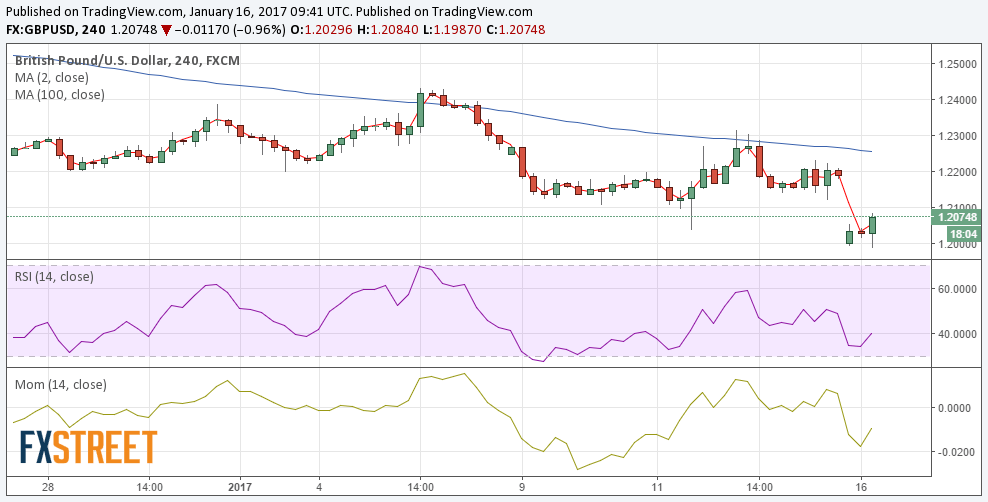

After the initial decline, the GBP/USD pair is recovering some ground early London, having reached a high for the session at 1.2083. Friday's close was set at 1.2163. From a technical point of view, the 4 hours chart shows that the price remains far below a bearish 20 SMA, in the 1.2160 region, whilst technical indicators are holding near oversold readings, trying to correct higher, but with quite limited upward strength. Additionally, selling on spikes continues to be an interest trade, in spite of the gap.

The pair needs to recover above 1.2120 to advance up to the 1.2160 region, where strong selling interest will likely resurge and prevent it from advancing further. The immediate support comes at 1.2045, with a break below it indicating a slide towards 1.2000 first, and further, towards the mentioned daily low of 1.1986.