Tuesday, July 15, 2025 9:00 AM EST

- Instrument: GBP/USD

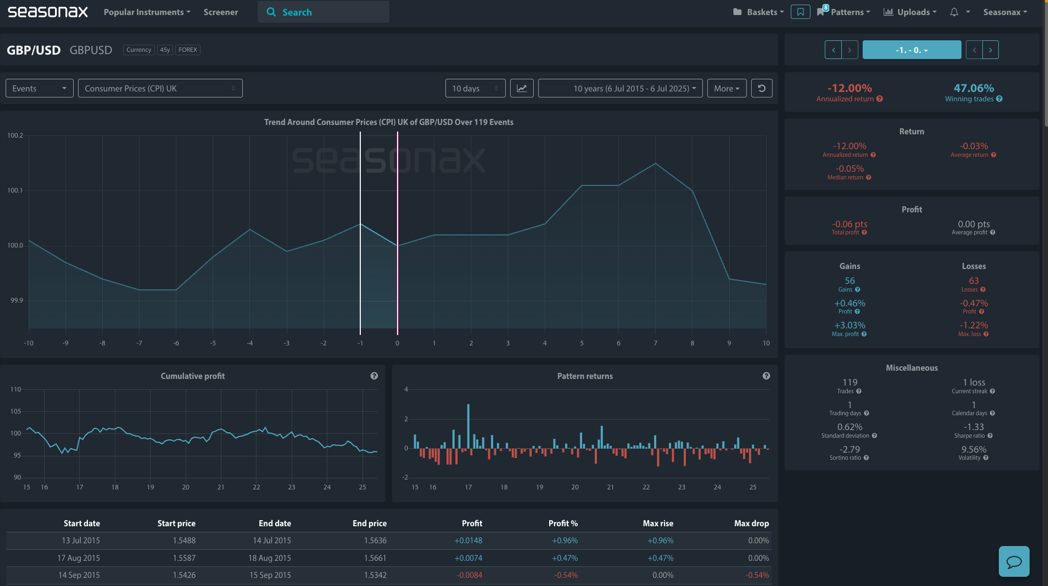

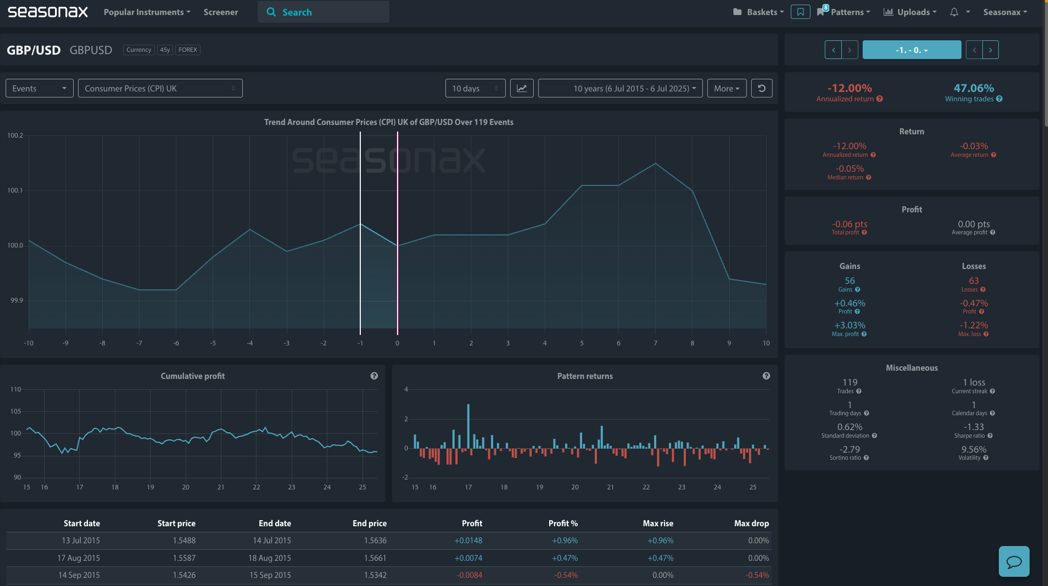

- Event-Based Seasonality: UK CPI

- Timeframe: 1-day window on CPI day

- Average Pattern Move: –0.03%

- Winning Percentage: 47.06%

You may not realize it, but UK CPI prints have historically triggered mild but consistent downside pressure in GBP/USD, with a notable tendency for sharper drops when inflation surprises to the downside. Based on 119 events over the past decade, the chart below shows that, GBP/USD has posted a –0.03% average return the day after CPI, with a 47% win rate and an annualized return of –12.00%.

While the aggregate move may appear small, some individual prints have triggered outsized losses, particularly when the data undershot market expectations.

Noteworthy drops post-CPI:

- 16 Aug 2022: –0.38%

- 18 Jul 2023: –0.74%

- 14 Feb 2023: –1.18%

- 18 May 2022: –1.22%

- 18 Jul 2016: –1.09%

Each of these cases occurred during moments of heightened uncertainty or policy transition, a familiar backdrop once again in 2025.

Bailey Is Giving Traders a Reason

BoE Governor Andrew Bailey’s latest comments only add fuel to the short-GBP/USD narrative:

“We see signs of softening in the economy and labor market… the direction of rates remains downward.”

“There will be no sustained growth without stable and low inflation… businesses are putting off investment decisions.”

Translation? The BoE is guiding toward a cutting cycle, and traders may simply be waiting for one weak CPI print to pounce.

If inflation misses, the market may accelerate rate cut expectations, push front-end yields lower, and pressure sterling. Given the seasonally soft CPI reaction trend, this could be the excuse traders need.

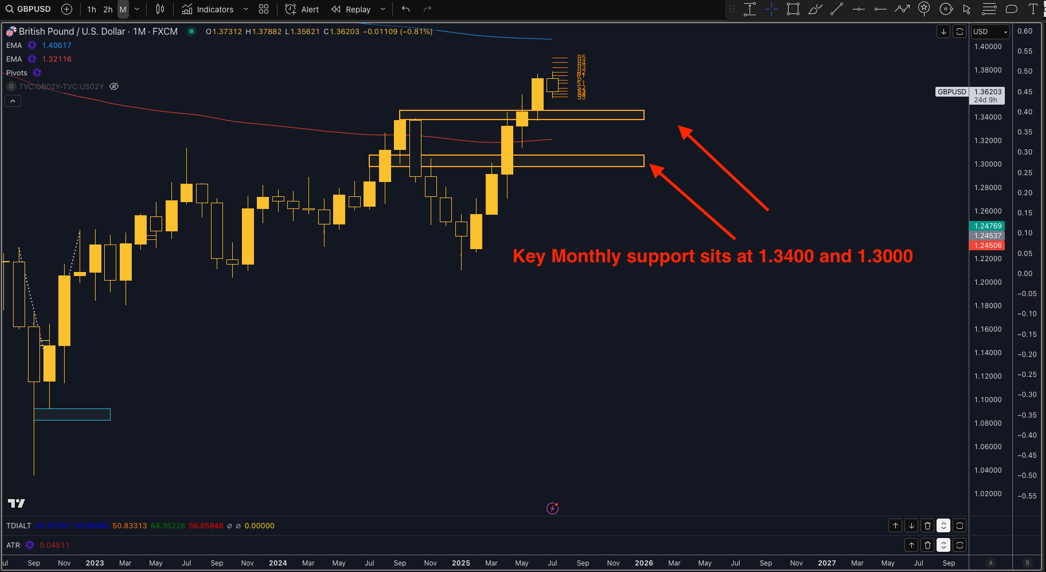

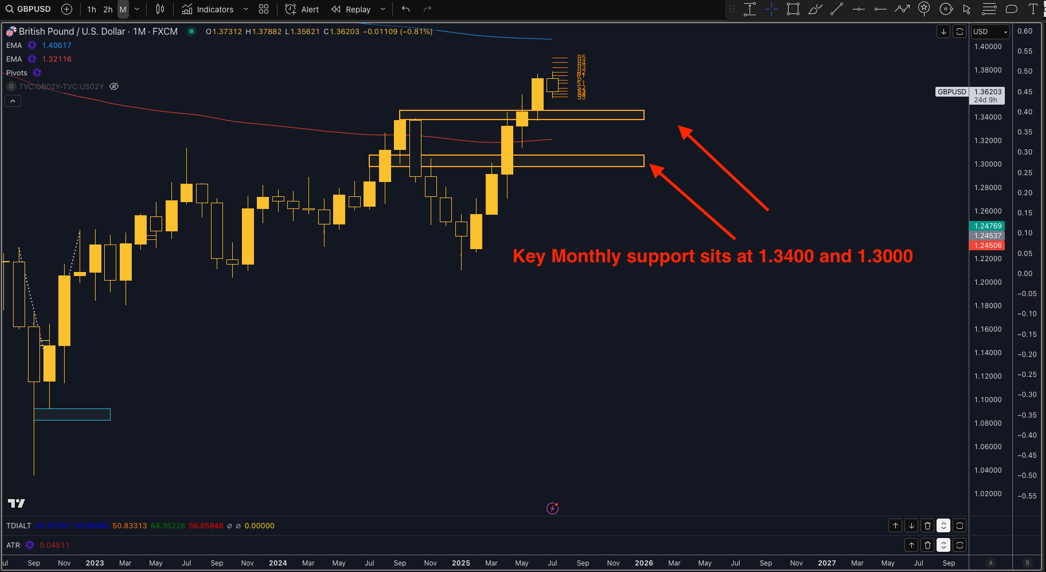

Technical Outlook

Key monthly support sits at 1.3400 and 1.3000 and offer major targets for any serious sell pressure that may emerge in the GBPUSD

(Click on image to enlarge)

Trade Risks:

- A hotter-than-expected CPI print could delay the BoE easing cycle and trigger short-covering.

Video Length: 00:02:03

More By This Author:

H2O America: Will Seasonal Strength Break The Downtrend?

Oracle: Buy the Dip on Seasonal Weakness?

Crédit Agricole: Riding Europe’s Resurgence Into A Seasonal Sweet Spot?

Disclaimer: Past results and past seasonal patterns are no indication of future performance, in particular, future market trends. seasonax GmbH neither recommends nor approves of any particular ...

more

Disclaimer: Past results and past seasonal patterns are no indication of future performance, in particular, future market trends. seasonax GmbH neither recommends nor approves of any particular financial instrument, group of securities, segment of industry, analysis interval or any particular idea, approach, strategy or attitude nor provides consulting nor brokerage nor asset management services. seasonax GmbH hereby excludes any explicit or implied trading recommendation, in particular, any promise, implication or guarantee that profits are earned and losses excluded, provided, however, that in case of doubt, these terms shall be interpreted in abroad sense. Any information provided by seasonax GmbH or on this website or any other kind of data media shall not be construed as any kind of guarantee, warranty or representation, in particular as set forth in a prospectus. Any user is solely responsible for the results or the trading strategy that is created, developed or applied. Indicators, trading strategies and functions provided by seasonax GmbH or on this website or any other kind of data media may contain logical or other errors leading to unexpected results, faulty trading signals and/or substantial losses. seasonax GmbH neither warrants nor guarantees the accuracy, completeness, quality, adequacy or content of the information provided by it or on this website or any other kind of data media. Any user is obligated to comply with any applicable capital market rules of the applicable jurisdiction. All published content and images on this website or any other kind of data media are protected by copyright. Any duplication, processing, distribution or any form of utilisation beyond the scope of copyright law shall require the prior written consent of the author or authors in question. Futures and forex trading contains substantial risk and is not for every investor. An investor could potentially lose all or more than the initial investment. Risk capital is money that can be lost without jeopardizing ones’ financial security or lifestyle. Only risk capital should be used for trading and only those with sufficient risk capital should consider trading. Past performance is not necessarily indicative of future results. Testimonials appearing on this website may not be representative of other clients or customers and is not a guarantee of future performance or success.

less

How did you like this article? Let us know so we can better customize your reading experience.